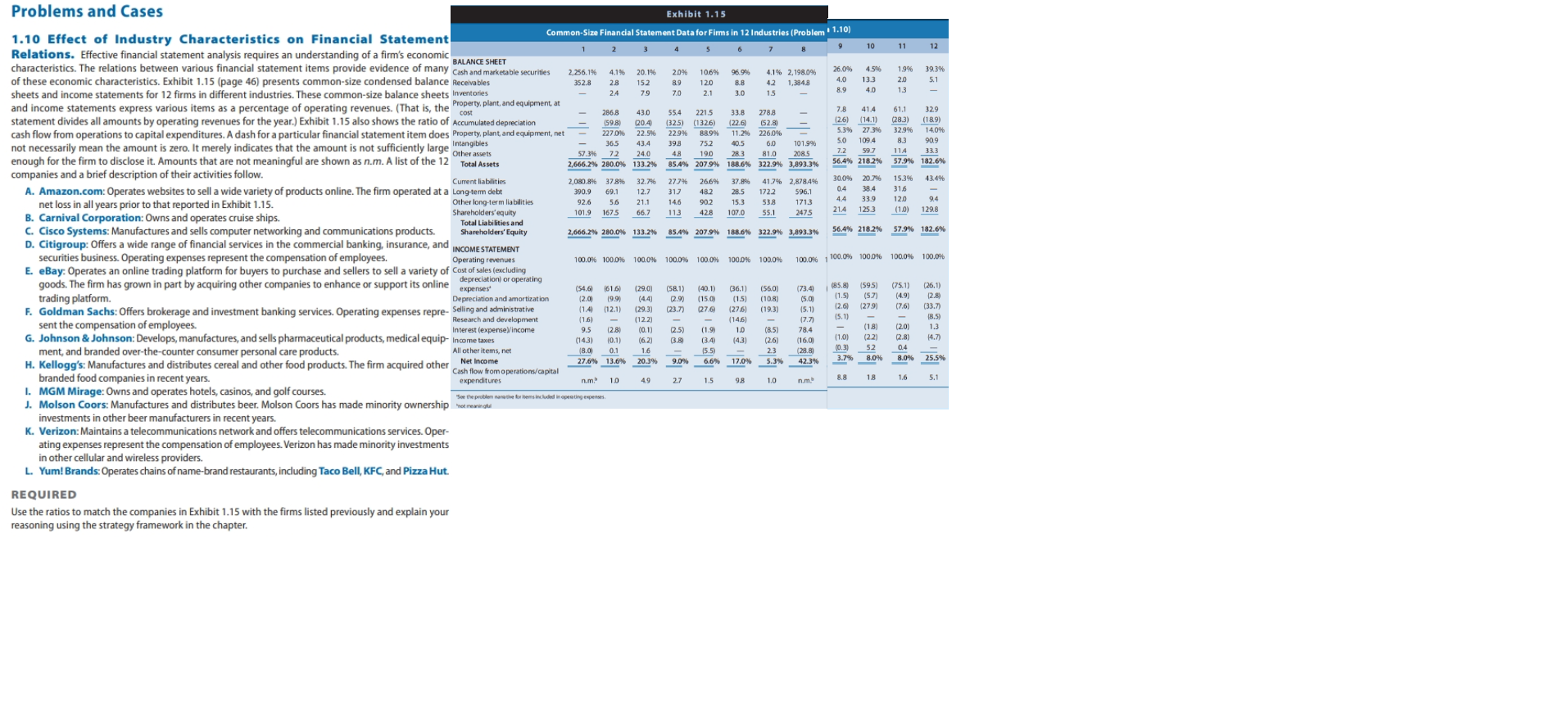

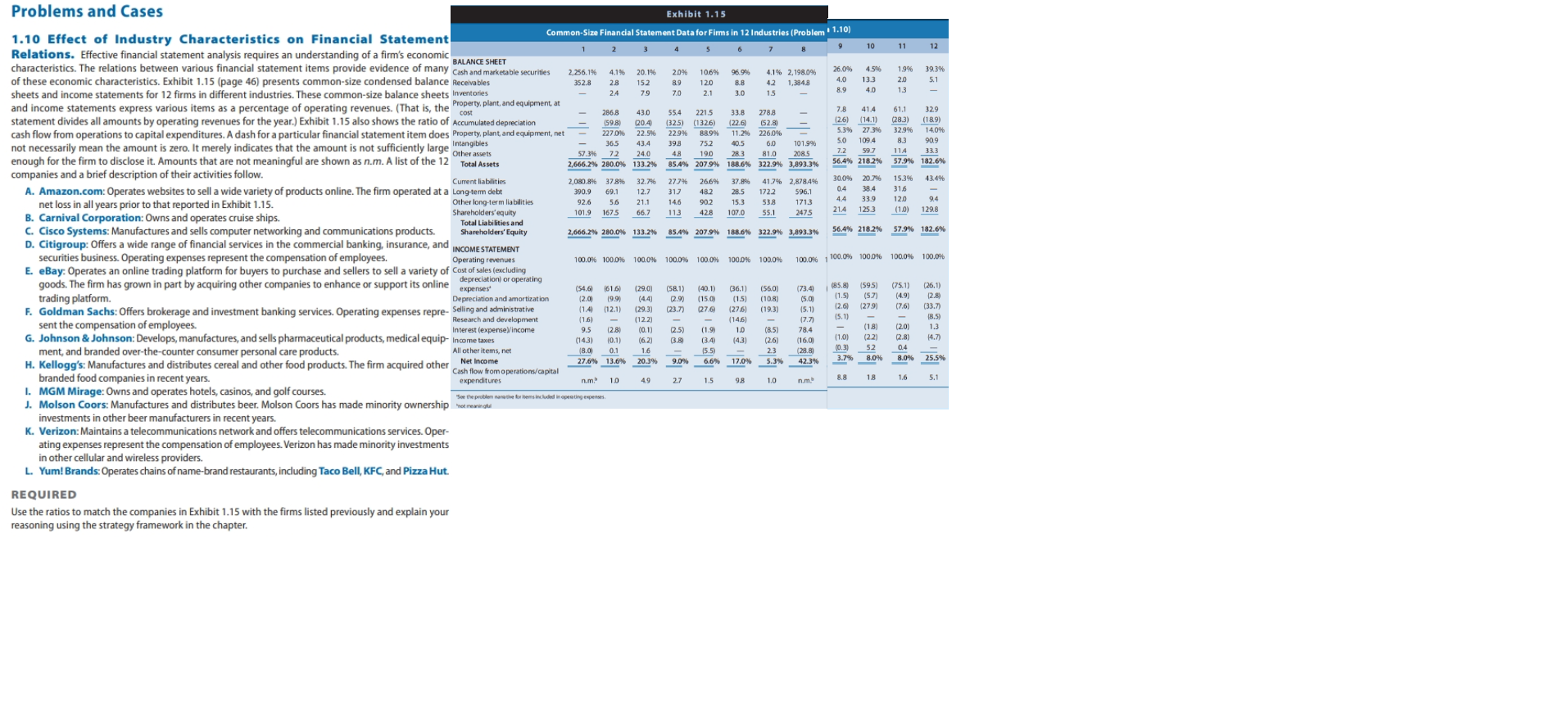

Problems and Cases 1.10 Effect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firm's economin characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.15 (page 46) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheet: and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.15 also shows the ratio 0 cash flow from operations to capital expenditures. A dash for a particular financial statement item doe: not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large enough for the firm to disclose it. Amounts that are not meaningful are shown as n.m. A list of the 12 companies and a brief description of their activities follow. A. Amazon.com: Operates websites to sell a wide variety of products online. The firm operated at a net loss in all years prior to that reported in Exhibit 1.15. B. Carnival Corporation: Owns and operates cruise ships. C. Cisco Systems: Manufactures and sells computer networking and communications products. D. Citigroup: Offers a wide range of financial services in the commercial banking, insurance, anc securities business. Operating expenses represent the compensation of employees. E. eBay: Operates an online trading platform for buyers to purchase and sellers to sell a variety o goods. The firm has grown in part by acquiring other companies to enhance or support its online trading platform. F. Goldman Sachs: Offers brokerage and investment banking services. Operating expenses repre sent the compensation of employees. G. Johnson \& Johnson: Develops, manufactures, and sells pharmaceutical products, medical equip ment, and branded over-the-counter consumer personal care products. H. Kellogg's: Manufactures and distributes cereal and other food products. The firm acquired otheI branded food companies in recent years. I. MGM Mirage: Owns and operates hotels, casinos, and golf courses. J. Molson Coors: Manufactures and distributes beer. Molson Coors has made minority ownershi; investments in other beer manufacturers in recent years. K. Verizon: Maintains a telecommunications network and offers telecommunications services. Operating expenses represent the compensation of employees. Verizon has made minority investments in other cellular and wireless providers. L. Yum! Brands: Operates chains of name-brand restaurants, including Taco Bell, KFC, and Pizza Hut. REQUIRED Use the ratios to match the companies in Exhibit 1.15 with the firms listed previously and explain your reasoning using the strategy framework in the chapter