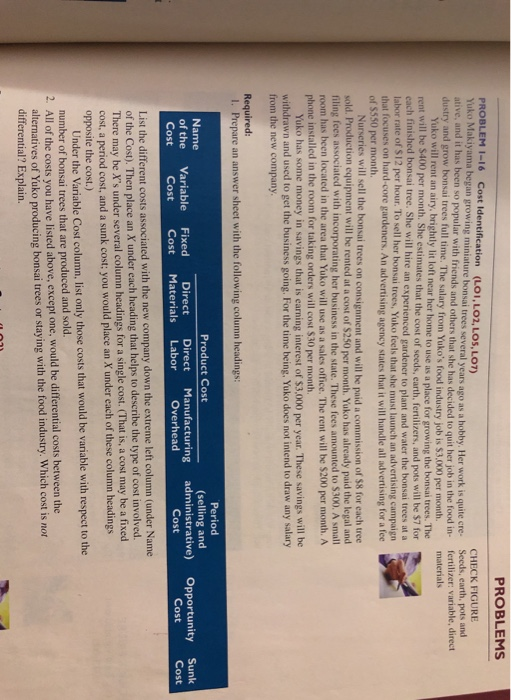

PROBLEMS CHECK FIGURE Seeds, earth, pots and fertilizer: variable, direct materials PROBLEM I-16 Cost Identification (LOI, LO2, LO5, LOT) Yuko Makiyama began growing miniature bonsaitrees several years ago as a hobby. Her work is quite cre ative, and it has been so popular with friends and others that she has decided to quit her job in the food in dustry and grow bonsai trees full time. The salary from Yuko's food industry job is $3.000 per month. Yuko will rent an airy, brightly lit loft near her home to use as a place for growing the bonsaltrees. The rent will be $400 per month. She estimates that the cost of seeds, earth. fertilizers, and pots will be $7 for cach finished bonsai tree. She will hire an experienced gardener to plant and water the bonsai Trees at a labor rate of S12 per hour. To sell her bonsai trees, Yuko feels that she must launch an advertising campaign that focuses on hard-core gardeners. An advertising agency states that it will handle all advertising for a fee of $550 per month Nurseries will sell the bonsai trees on consignment and will be paid a commission of $8 for each tree sold. Production equipment will be rented at a cost of $250 per month. Yuko has already paid the legal and filing fees associated with incorporating her business in the state. These fees amounted to $300. A small room has been located in the area that Yuko will use as a sales office. The rent will be $200 per month. A phone installed in the room for taking orders will cost $30 per month Yuko has some money in savings that is earning interest of $3.000 per year. These savings will be withdrawn and used to get the business going. For the time being. Yuko does not intend to draw any salary from the new company Required: 1. Prepare an answer sheet with the following column headings: Name Period (selling and administrative) Cost Product Cost Direct Manufacturing Labor Overhead Opportunity 'Cost Sunk Cost of the Cost Variable Cost Fixed Cost Direct Materials rect List the different costs associated with the new company down the extreme left column (under Name of the Cost). Then place an X under each heading that helps to describe the type of cost involved. There may he X's under several column headings for a single cost. That is, a cost may be a fixed cost, a period cost, and a sunk cost you would place an X under each of these column headings opposite the cost.) Under the Variable Cost column, list only those costs that would be variable with respect to the number of bonsai trees that are produced and sold. 2. All of the costs you have listed above, except one, would be differential costs between the alternatives of Yuko producing bonsai trees or staying with the food industry. Which cost is no PROBLEMS PROBLEM 1-16 Cost Identification (LOI, LOL, LOS, LOT) CHECK FIGURE Yuko Makiyama began growing miniature bonsai trees several years ago as a hobby. Her work is quite cre- Seeds. car. ative, and it has been so popular with Trends and others that she has decided to quit her job in the food in fertilizer: variable, direct dustry and grow bonsai trees full time. The salary from Yuko's food industry job is $3.000 per month materials Yuko will rentan airy, brightly lit loft near her home to use is a place for growing the bonsai trees. The rent will be $400 per month. She estimates that the cost of seeds, earth, fertilizers, and pots will be $7 for each finished bonsai tree. She will hire an experienced gardener to plant and water the bonsai trees at a labor rate of siz per hour. To sell her bonsai trees, Yuko feels that she must launch an advertising campaign that focuses on hard-core gardeners. An advertising agency states that it will handle all advertising for a fee of 5550 per month Nurseries will sell the bonsai trees on consignment and will be paid a commission of 58 for each tree sold. Production equipment will be rented at a cost of $250 per month. Yuko has already paid the legal and filing fees associated with incorporating her business in the state. These fees amounted to $300. A small room has been located in the area that Yuko will use as a sales office. The rent will be $200 per month. A phone installed in the room for taking orders will cost $30 per month Yuko has some money in savings that is earning interest of $3,000 per year. These savings will be withdrawn and used to get the business going. For the time being, Yuko does not intend to draw any salary from the new company. Required: 1. Prepare an answer sheet with the following column headings: Name of the Cost Period (selling and administrative) Cost Sunk Variable Cost Product Cost Direct Manufacturing Labor Overhead Fixed Cost Direct Materials Opportunity Cost Cost List the different costs associated with the new company down the extreme left column (under Name of the Cost). Then place an X under each heading that helps to describe the type of cost involved. There may be X's under several column headings for a single cost. (That is, a cost may be a fixed cost, a period cost, and a sunk cost: you would place an X under each of these column headings opposite the cost.) Under the Variable Cost column, list only those costs that would be variable with respect to the number of bonsai trees that are produced and sold. 2. All of the costs you have listed above, except one, would be differential costs between the alternatives of Yuko producing bonsai trees or staying with the food industry. Which cost is not differential? Explain