Answered step by step

Verified Expert Solution

Question

1 Approved Answer

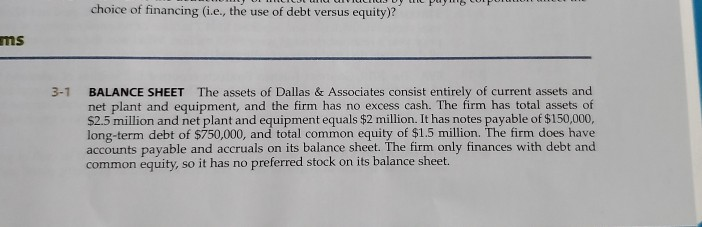

Problems choice of financing (i.e., the use of debt versus equity)? ms 3-1 BALANCE SHEET The assets of Dallas & Associates consist entirely of current

Problems

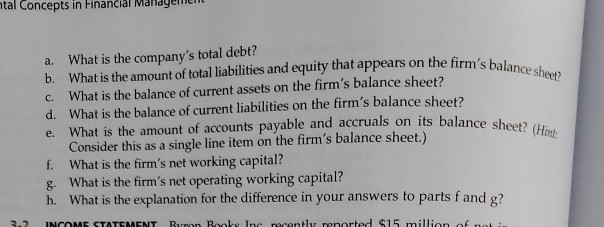

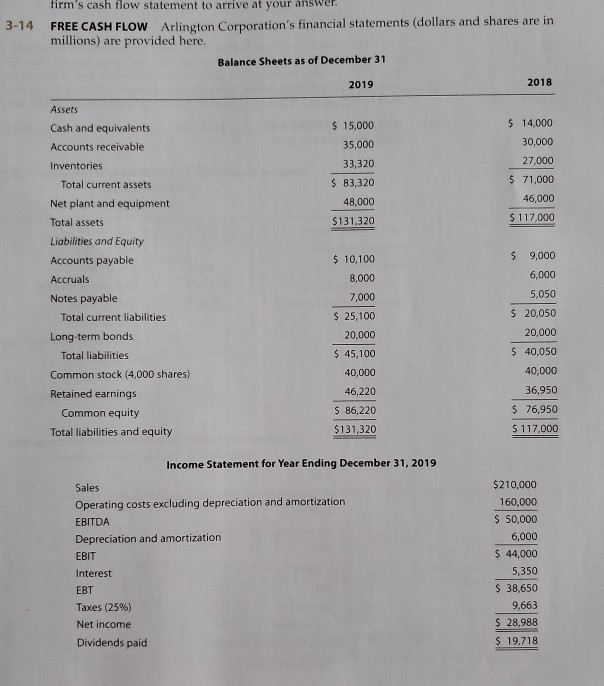

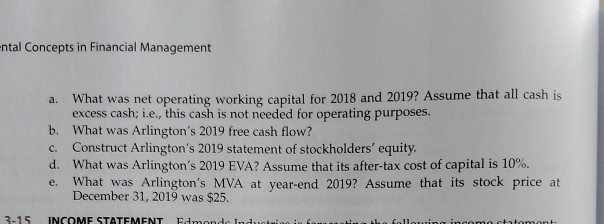

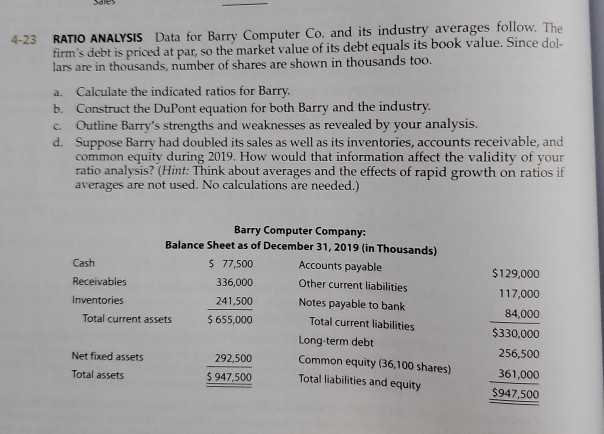

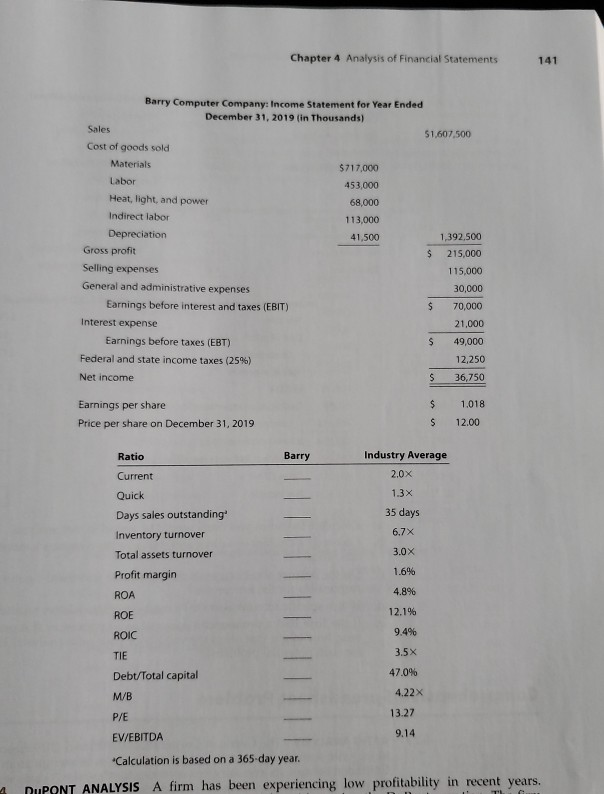

choice of financing (i.e., the use of debt versus equity)? ms 3-1 BALANCE SHEET The assets of Dallas & Associates consist entirely of current assets and net plant and equipment, and the firm has no excess cash. The firm has total assets of $2.5 million and net plant and equipment equals $2 million. It has notes payable of $150,000, long-term debt of $750,000, and total common equity of $1.5 million. The firm does have accounts payable and accruals on its balance sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. b. What is the amount of total liabilities and equity that appears on the firm's balance sheet? What is the amount of accounts payable and accruals on its balance sheet? (Hint: ntal Concepts in Financial a. What is the company's total debt? What is the balance of current assets on the firm's balance sheet? d. What is the balance of current liabilities on the firm's balance sheet? C. e. Consider this as a single line item on the firm's balance sheet.) f. What is the firm's net working capital? What is the firm's net operating working capital? h. What is the explanation for the difference in your answers to parts fand g? 8 3.2 INCOME STATEMENT Bern Bole In recently noorted $15 million 3-14 firm's cash flow statement to arrive at your answer. FREE CASH FLOW Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 2019 2018 Assets Cash and equivalents Accounts receivable $ 15,000 35,000 33,320 $ 83,320 48,000 $ 14,000 30,000 27,000 $ 71,000 46,000 $ 117,000 $131,320 Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities $ 10,100 8,000 7,000 $ 9,000 6,000 5,050 $ 25,100 $ 20,050 Long-term bonds Total liabilities 20,000 $ 45,100 40,000 20,000 $ 40,050 40,000 36,950 Common stock (4,000 shares) Retained earnings Common equity Total liabilities and equity 46,220 S 86,220 $131,320 $ 76,950 $ 117,000 Income Statement for Year Ending December 31, 2019 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization EBIT $210,000 160,000 $ 50,000 6,000 $ 44,000 5,350 $ 38,650 9,663 $ 28,988 $ 19,718 Interest EBT Taxes (25%) Net income Dividends paid -ntal Concepts in Financial Management a. What was net operating working capital for 2018 and 2019? Assume that all cash is excess cash; i.e., this cash is not needed for operating purposes. b. What was Arlington's 2019 free cash flow? Construct Arlington's 2019 statement of stockholders' equity. d. What was Arlington's 2019 EVA? Assume that its after-tax cost of capital is 10%. What was Arlington's MVA at year-end 2019? Assume that its stock price at December 31, 2019 was $25. C. e. 3-15 INCOME STATEMENT Edonde 1 incon tatamant 4-23 a. RATIO ANALYSIS Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dol- lars are in thousands, number of shares are shown in thousands too. Calculate the indicated ratios for Barry. b. Construct the DuPont equation for both Barry and the industry. Outline Barry's strengths and weaknesses as revealed by your analysis. d. Suppose Barry had doubled its sales as well as its inventories, accounts receivable, and common equity during 2019. How would that information affect the validity of your ratio analysis? (Hint: Think about averages and the effects of rapid growth on ratios if averages are not used. No calculations are needed.) c Barry Computer Company: Balance Sheet as of December 31, 2019 (in Thousands) Cash $ 77,500 Accounts payable Receivables 336,000 Other current liabilities Inventories 241,500 Notes payable to bank Total current assets $ 655,000 Total current liabilities Long-term debt Net fixed assets 292,500 Common equity (36,100 shares) Total assets $ 947,500 Total liabilities and equity $129,000 117,000 84,000 $330,000 256,500 361,000 $947,500 Chapter 4 Analysis of Financial Statements 141 Barry Computer Company: Income Statement for Year Ended December 31, 2019 in Thousands) Sales $1,607,500 Cost of goods sold Materials $717,000 Labor 453,000 Heat, light, and power 68,000 Indirect labor 113,000 Depreciation 41,500 1,392.500 Gross profit $ 215,000 Selling expenses 115,000 General and administrative expenses 30,000 Earnings before interest and taxes (EBIT) $ 70,000 Interest expense 21,000 Earnings before taxes (EBT) $ 49,000 Federal and state income taxes (25%) 12,250 Net income S 36,750 $ Earnings per share Price per share on December 31, 2019 1.018 12.00 $ Ratio Barry Industry Average 2.0X 1.3x Current Quick Days sales outstanding Inventory turnover Total assets turnover 35 days 6.7x 3.0x Profit margin 1.6% ROA 4.8% ROE 12.1% ROIC 9.4% TIE 3.5X Debt/Total capital 47.0% 4.22X M/B P/E 13.27 EV/EBITDA 9.14 Calculation is based on a 365-day year. 1 RUPONT ANALYSIS A firm has been experiencing low profitability in recent years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started