Answered step by step

Verified Expert Solution

Question

1 Approved Answer

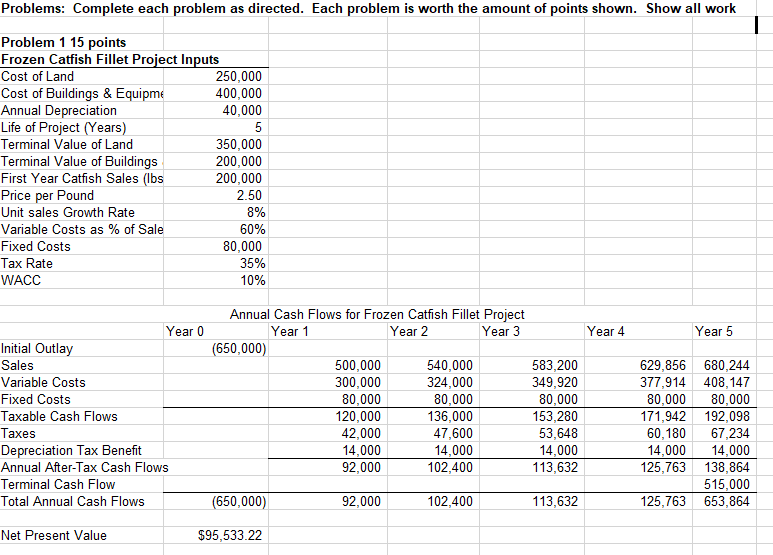

Problems: Complete each problem as directed. Each problem is worth the amount of points shown. Show all work Problem 1 15 points Frozen Catfish

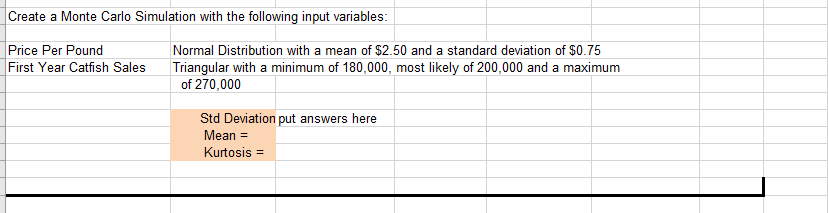

Problems: Complete each problem as directed. Each problem is worth the amount of points shown. Show all work Problem 1 15 points Frozen Catfish Fillet Project Inputs Cost of Land Cost of Buildings & Equipme Annual Depreciation Life of Project (Years) Terminal Value of Land Terminal Value of Buildings First Year Catfish Sales (lbs) Price per Pound Unit sales Growth Rate Variable Costs as % of Sale Fixed Costs Tax Rate WACC Initial Outlay Sales Variable Costs Fixed Costs Taxable Cash Flows Taxes Year 0 Depreciation Tax Benefit Annual After-Tax Cash Flows Terminal Cash Flow Total Annual Cash Flows Net Present Value 250,000 400,000 40,000 5 350,000 200,000 200,000 2.50 8% 60% 80,000 35% 10% Annual Cash Flows for Frozen Catfish Fillet Project Year 1 Year 2 Year 3 (650,000) (650,000) $95,533.22 500,000 300,000 80,000 120,000 42,000 14,000 92,000 92,000 540,000 324,000 80,000 136,000 47,600 14,000 102,400 102,400 583,200 349,920 80,000 153,280 53,648 14,000 113,632 113,632 Year 4 Year 5 629,856 680,244 377,914 408,147 80,000 80,000 171,942 192,098 60,180 67,234 14,000 14,000 125,763 138,864 515,000 125,763 653,864 Create a Monte Carlo Simulation with the following input variables: Price Per Pound First Year Catfish Sales Normal Distribution with a mean of $2.50 and a standard deviation of $0.75 Triangular with a minimum of 180,000, most likely of 200,000 and a maximum of 270,000 Std Deviation put answers here Mean = Kurtosis =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV we need to discount the annual cash flows to their present va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started