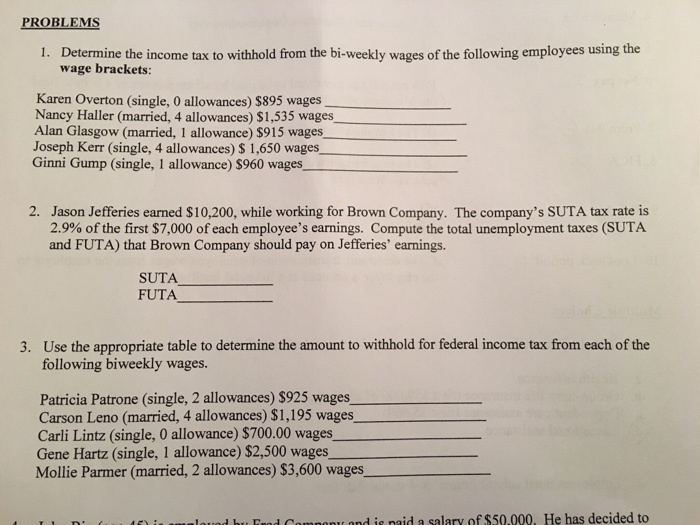

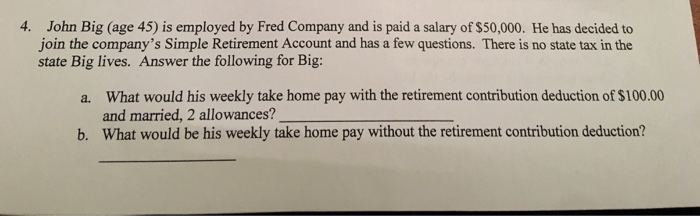

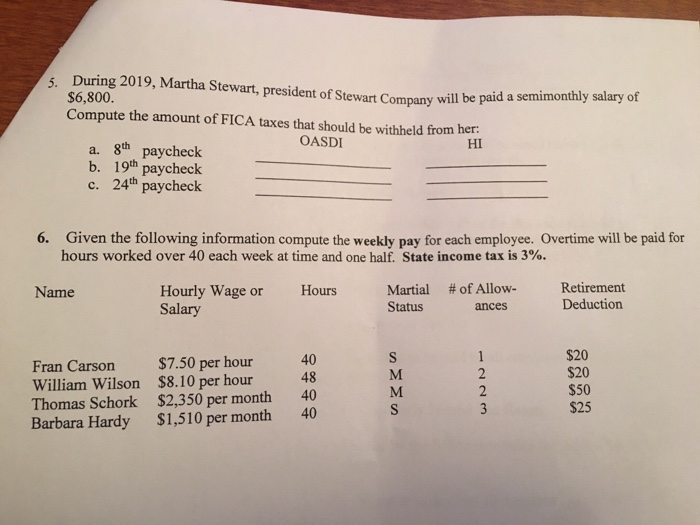

PROBLEMS Determine the income tax to withhold from the bi-weekly wages of the following employees using the 1. wage brackets: Karen Overton (single, 0 allowances) $895 wages Nancy Haller (married, 4 allowances) $1,535 wages Alan Glasgow (married, 1 allowance) $915 wages Joseph Kerr (single, 4 allowances) $ 1,650 wages Ginni Gump (single, 1 allowance) $960 wages 2. Jason Jefferies earned $10,200, while working for Brown Company. The company's SUTA tax rate is 2.9% of the first $7,000 of each employee's earnings. Compute the total unemployment taxes (SUTA and FUTA) that Brown Company should pay on Jefferies' earnings. SUTA FUTA Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages. 3. Patricia Patrone (single, 2 allowances) $925 wages Carson Leno (married, 4 allowances) $1,195 wages Carli Lintz (single, 0 allowance) $700.00 wages Gene Hartz (single, 1 allowance) $2,500 wages Mollie Parmer (married, 2 allowances) $3,600 wages Compony ond is naid a salary of $50.000, He has decided to 4. John Big (age 45) is employed by Fred Company and is paid a salary of $50,000. He has decided to join the company's Simple Retirement Account and has a few questions. There is no state tax in the state Big lives. Answer the following for Big: What would his weekly take home pay with the retirement contribution deduction of $100.00 and married, 2 allowances? What would be his weekly take home pay without the retirement contribution deduction? a. b. During 2019, Martha Stewart, president of Stewart Company will $6,800. Compute the amount of FICA taxes that should be withheld from her be paid a semimonthly salary of OASDI HI a. 8th paycheck b. 19th paycheck c. 24th paycheck 6. Given the following information compute the weekly pay for each employee. Overtime will be paid for hours worked over 40 each week at time and one half. State income tax is 3%. Retirement Deduction Martial #ofAllow_ Status Hourly Wage or Salary Hours Name ances $20 $20 $50 $25 40 48 $7.50 per hour $8.10 per hour $2,350 per month $1,510 per month Fran Carson William Wilson Thomas Schork Barbara Hardy 40 40 PROBLEMS Determine the income tax to withhold from the bi-weekly wages of the following employees using the 1. wage brackets: Karen Overton (single, 0 allowances) $895 wages Nancy Haller (married, 4 allowances) $1,535 wages Alan Glasgow (married, 1 allowance) $915 wages Joseph Kerr (single, 4 allowances) $ 1,650 wages Ginni Gump (single, 1 allowance) $960 wages 2. Jason Jefferies earned $10,200, while working for Brown Company. The company's SUTA tax rate is 2.9% of the first $7,000 of each employee's earnings. Compute the total unemployment taxes (SUTA and FUTA) that Brown Company should pay on Jefferies' earnings. SUTA FUTA Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages. 3. Patricia Patrone (single, 2 allowances) $925 wages Carson Leno (married, 4 allowances) $1,195 wages Carli Lintz (single, 0 allowance) $700.00 wages Gene Hartz (single, 1 allowance) $2,500 wages Mollie Parmer (married, 2 allowances) $3,600 wages Compony ond is naid a salary of $50.000, He has decided to 4. John Big (age 45) is employed by Fred Company and is paid a salary of $50,000. He has decided to join the company's Simple Retirement Account and has a few questions. There is no state tax in the state Big lives. Answer the following for Big: What would his weekly take home pay with the retirement contribution deduction of $100.00 and married, 2 allowances? What would be his weekly take home pay without the retirement contribution deduction? a. b. During 2019, Martha Stewart, president of Stewart Company will $6,800. Compute the amount of FICA taxes that should be withheld from her be paid a semimonthly salary of OASDI HI a. 8th paycheck b. 19th paycheck c. 24th paycheck 6. Given the following information compute the weekly pay for each employee. Overtime will be paid for hours worked over 40 each week at time and one half. State income tax is 3%. Retirement Deduction Martial #ofAllow_ Status Hourly Wage or Salary Hours Name ances $20 $20 $50 $25 40 48 $7.50 per hour $8.10 per hour $2,350 per month $1,510 per month Fran Carson William Wilson Thomas Schork Barbara Hardy 40 40