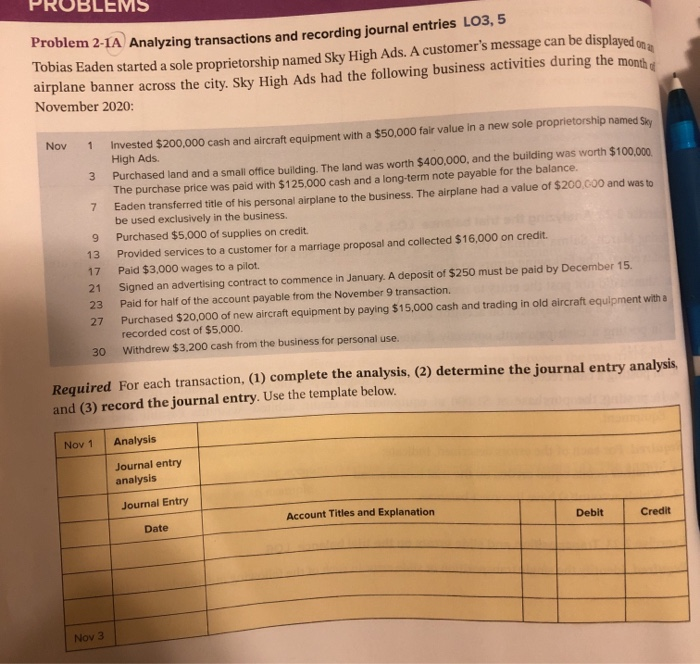

PROBLEMS em 2-LA Analyzing transactions and recording journal entries L03,5 Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on airplane banner across the city. Sky High Ads had the following business activities during the month November 2020: Nov 1 3 7 9 13 17 21 23 27 Invested $200,000 cash and aircraft equipment with a $50,000 fair value in a new sole proprietorship named Sky High Ads. Purchased land and a small office building. The land was worth $400,000, and the building was worth $100.000 The purchase price was paid with $125,000 cash and a long-term note payable for the balance. Eaden transferred title of his personal airplane to the business. The airplane had a value of $200.000 and was to be used exclusively in the business. Purchased $5,000 of supplies on credit. Provided services to a customer for a marriage proposal and collected $16,000 on credit. Paid $3,000 wages to a pilot. Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. Paid for half of the account payable from the November 9 transaction Purchased $20,000 of new aircraft equipment by paying $15,000 cash and trading in old aircraft equipment with a recorded cost of $5.000. Withdrew $3,200 cash from the business for personal use. 30 Required for each transaction, (1) complete the analysis, (2) determine the journal entry analysis. and (3) record the journal entry. Use the template below. Nov 1 Analysis Journal entry analysis Journal Entry Account Titles and Explanation Debit Credit Date Nov 3 PROBLEMS em 2-LA Analyzing transactions and recording journal entries L03,5 Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on airplane banner across the city. Sky High Ads had the following business activities during the month November 2020: Nov 1 3 7 9 13 17 21 23 27 Invested $200,000 cash and aircraft equipment with a $50,000 fair value in a new sole proprietorship named Sky High Ads. Purchased land and a small office building. The land was worth $400,000, and the building was worth $100.000 The purchase price was paid with $125,000 cash and a long-term note payable for the balance. Eaden transferred title of his personal airplane to the business. The airplane had a value of $200.000 and was to be used exclusively in the business. Purchased $5,000 of supplies on credit. Provided services to a customer for a marriage proposal and collected $16,000 on credit. Paid $3,000 wages to a pilot. Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. Paid for half of the account payable from the November 9 transaction Purchased $20,000 of new aircraft equipment by paying $15,000 cash and trading in old aircraft equipment with a recorded cost of $5.000. Withdrew $3,200 cash from the business for personal use. 30 Required for each transaction, (1) complete the analysis, (2) determine the journal entry analysis. and (3) record the journal entry. Use the template below. Nov 1 Analysis Journal entry analysis Journal Entry Account Titles and Explanation Debit Credit Date Nov 3