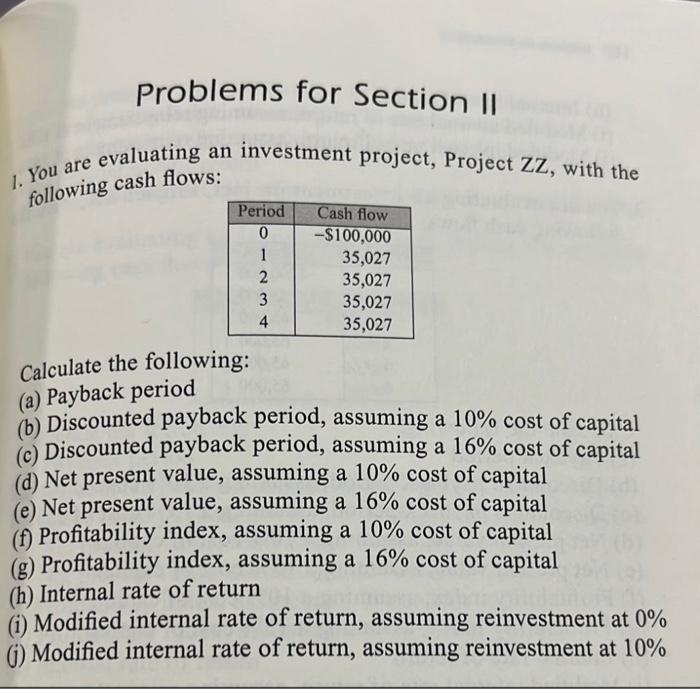

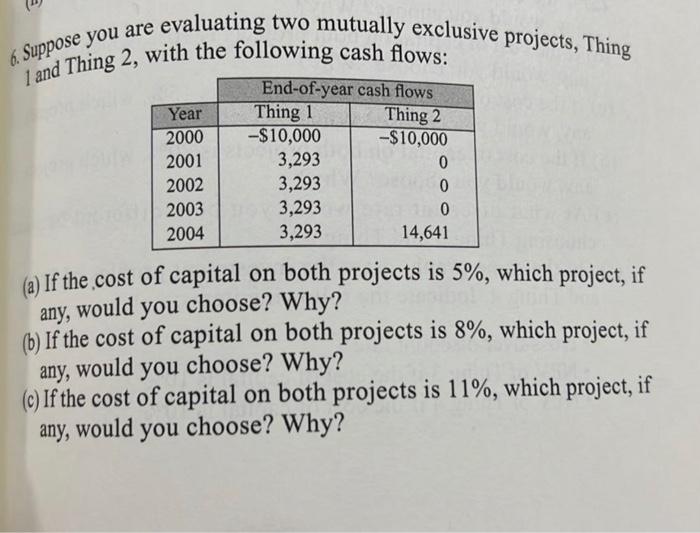

Problems for Section II 1. You are evaluating an investment project, Project ZZ, with the following cash flows: Calculate the following: (a) Payback period (b) Discounted payback period, assuming a 10% cost of capital (c) Discounted payback period, assuming a 16% cost of capital (d) Net present value, assuming a 10% cost of capital (e) Net present value, assuming a 16% cost of capital (f) Profitability index, assuming a 10% cost of capital (g) Profitability index, assuming a 16% cost of capital (h) Internal rate of return (i) Modified internal rate of return, assuming reinvestment at 0% (j) Modified internal rate of return, assuming reinvestment at 10% 6. Suppose you are evaluating two mutually exclusive projects, Thing 1 and Thing 2, with the following cash flows: (a) If the cost of capital on both projects is 5%, which project, if any, would you choose? Why? (b) If the cost of capital on both projects is 8%, which project, if any, would you choose? Why? (c) If the cost of capital on both projects is 11%, which project, if any, would you choose? Why? 120 Problems for Section II (d) If the cost of capital on both projects is 14%, which project, if any, would you choose? Why? (e) At what discount rate would you be indifferent between choosing Thing 1 and Thing 2 ? (f) On the same graph, draw the investment profiles of Thing 1 and Thing 2. Indicate the following items: - cross-over discount rate - NPV of Thing 1 if the cost of capital is 5% - NPV of Thing 2 if cost of capital is 5% - IRR of Thing 1 - IRR of Thing 2 Problems for Section II 1. You are evaluating an investment project, Project ZZ, with the following cash flows: Calculate the following: (a) Payback period (b) Discounted payback period, assuming a 10% cost of capital (c) Discounted payback period, assuming a 16% cost of capital (d) Net present value, assuming a 10% cost of capital (e) Net present value, assuming a 16% cost of capital (f) Profitability index, assuming a 10% cost of capital (g) Profitability index, assuming a 16% cost of capital (h) Internal rate of return (i) Modified internal rate of return, assuming reinvestment at 0% (j) Modified internal rate of return, assuming reinvestment at 10% 6. Suppose you are evaluating two mutually exclusive projects, Thing 1 and Thing 2, with the following cash flows: (a) If the cost of capital on both projects is 5%, which project, if any, would you choose? Why? (b) If the cost of capital on both projects is 8%, which project, if any, would you choose? Why? (c) If the cost of capital on both projects is 11%, which project, if any, would you choose? Why? 120 Problems for Section II (d) If the cost of capital on both projects is 14%, which project, if any, would you choose? Why? (e) At what discount rate would you be indifferent between choosing Thing 1 and Thing 2 ? (f) On the same graph, draw the investment profiles of Thing 1 and Thing 2. Indicate the following items: - cross-over discount rate - NPV of Thing 1 if the cost of capital is 5% - NPV of Thing 2 if cost of capital is 5% - IRR of Thing 1 - IRR of Thing 2