Answered step by step

Verified Expert Solution

Question

1 Approved Answer

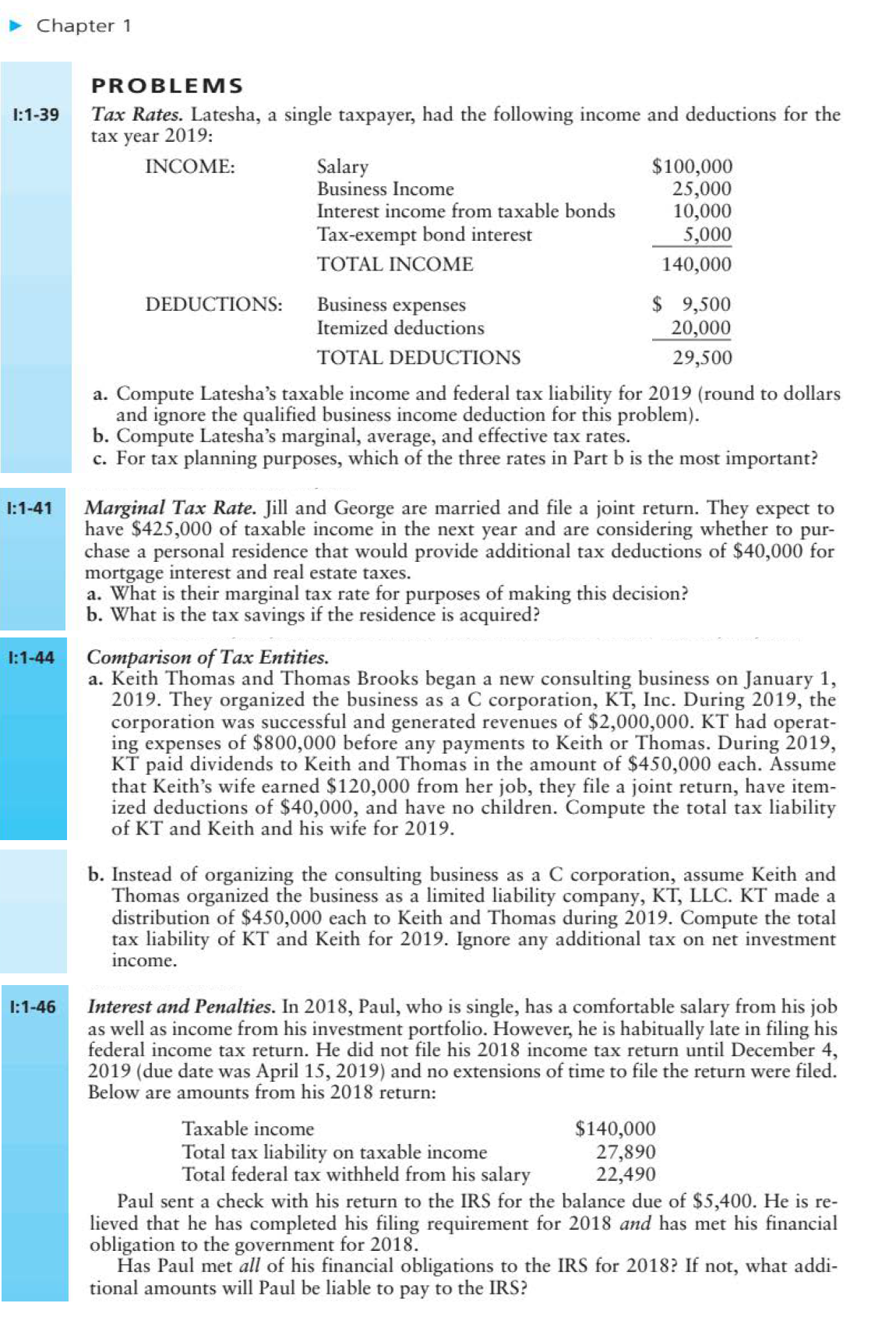

PROBLEMS I: 1 - 3 9 Tax Rates. Latesha, a single taxpayer, had the following income and deductions for the tax year 2 0 1

PROBLEMS

I:

Tax Rates. Latesha, a single taxpayer, had the following income and deductions for the

tax year :

a Compute Latesha's taxable income and federal tax liability for round to dollars

and ignore the qualified business income deduction for this problem

b Compute Latesha's marginal, average, and effective tax rates.

c For tax planning purposes, which of the three rates in Part b is the most important?

Marginal Tax Rate. Jill and George are married and file a joint return. They expect to

have $ of taxable income in the next year and are considering whether to pur

chase a personal residence that would provide additional tax deductions of $ for

mortgage interest and real estate taxes.

a What is their marginal tax rate for purposes of making this decision?

b What is the tax savings if the residence is acquired?

Comparison of Tax Entities.

a Keith Thomas and Thomas Brooks began a new consulting business on January

They organized the business as a C corporation, KT Inc. During the

corporation was successful and generated revenues of $ KT had operat

ing expenses of $ before any payments to Keith or Thomas. During

KT paid dividends to Keith and Thomas in the amount of $ each. Assume

that Keith's wife earned $ from her job, they file a joint return, have item

ized deductions of $ and have no children. Compute the total tax liability

of KT and Keith and his wife for

b Instead of organizing the consulting business as a C corporation, assume Keith and

Thomas organized the business as a limited liability company, KT LLC KT made a

distribution of $ each to Keith and Thomas during Compute the total

tax liability of KT and Keith for Ignore any additional tax on net investment

income.

Interest and Penalties. In Paul, who is single, has a comfortable salary from his job

as well as income from his investment portfolio. However, he is habitually late in filing his

federal income tax return. He did not file his income tax return until December

due date was April and no extensions of time to file the return were filed.

Below are amounts from his return:

Paul sent a check with his return to the IRS for the balance due of $ He is re

lieved that he has completed his filing requirement for and has met his financial

obligation to the government for

Has Paul met all of his financial obligations to the IRS for If not, what addi

tional amounts will Paul be liable to pay to the IRS?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started