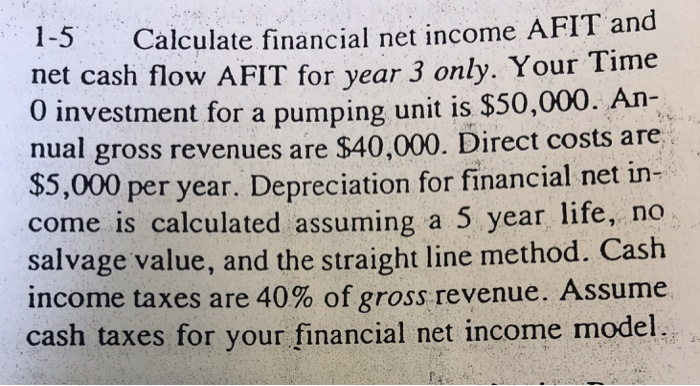

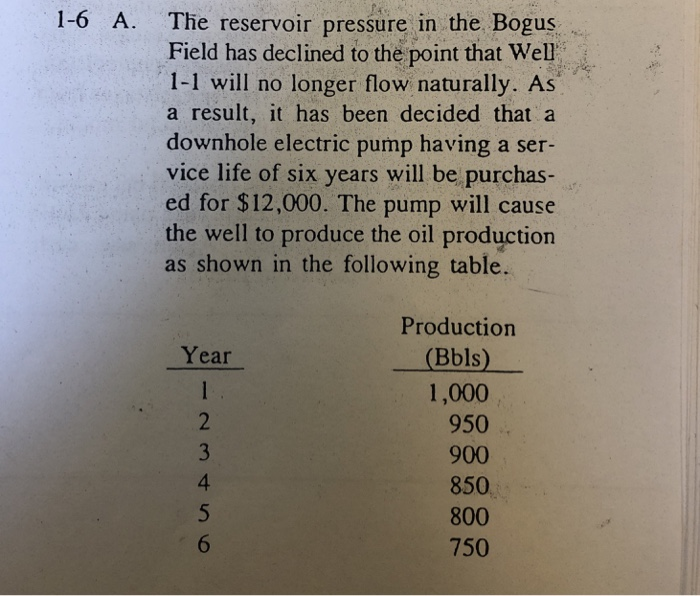

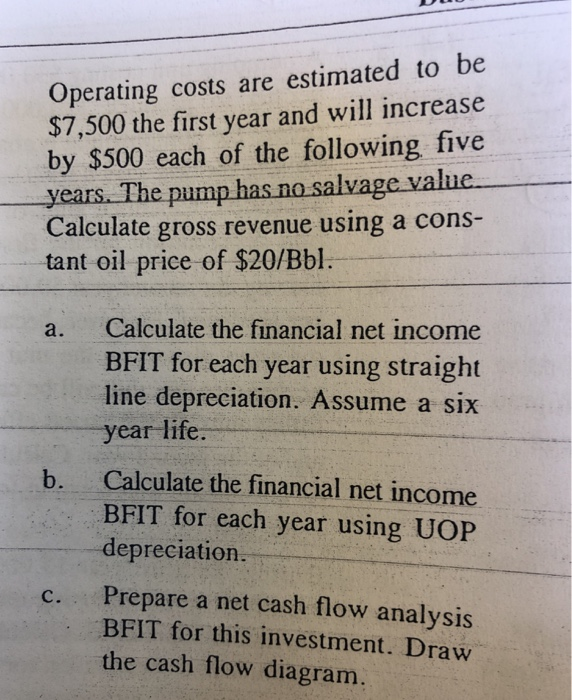

PROBLEMS ield transfer pump having a useful $1,500 in the -1 life of five years is purchased for ump will generate an incrementa rst year. However the revenue will decrease per year in each of the.nexL four years. the next four years. Operating costs will be $500 in the first year but will increase S100 per year in each of the following four years b. a. Calculate financial net income before income taxes for each year using straight line depreciation (no salvage value) b. Prepare a net cash flow analysis for this investment. Draw the cash flow diagram 1-3 Calculate NCF using the cash flow model for an oil property evaluation for the following case Time Period: 1 year Gross Production: 50,000 bbl Shrinkage: 5% Sales price of oil: $30/bbl Net Revenue Interest: 0.80 Your share of state and local taxes: $90,000 year: $100,000 tax: $200,000 Your share of investments during the Your share of windfall profits Your share of operating costs: $25,000 Your share of federal income taxes: $200,000 1-14 A pumping unit costing $30,000 is ex- pected to produce 120,000 barrels before the pumping unit is abandoned During the first year 40,000 barrels are produced. Calculate units-of produc- tion depreciation for the first year. a. b. During the second year 50,000 barrels are produced. However, because of an overload placed on the unit it is ex pected that the unit will be capable of lifting only 10,000 barrels effective the end of the second year. Calculate units of-production depreciation for the se- cond year. c. During the third year 15,000 barrels are lifted by the pumping unit before the unit is abandoned. Calculate units of production depreciation for the pum- ping unit for the third year. 1-5 Calculate financial net income AFIT and net cash flow AFIT for year 3 only. Your Time 0 investment for a pumping unit is $50,000. An- nual gross revenues are $40,000. Direct costs are $5,000 per year come is calculated assuming a 5 year life, no salvage value, and the straight line method. Cash ncome taxes are 40% of gross revenue. Assume cash taxes for your financial net income model . Depreciation for financial net in- 1-6 A. Tie reservoir pressure in the Bogus Field has declined to the point that Well 1-1 will no longer flow naturally. As a result, it has been decided that a downhole electric pump having a ser- vice life of six years will be purchas ed for $12,000. The pump will cause the well to produce the oil production as shown in the following table. Productiorn Year Bbl 1,000 950 900 850 800 750 4 6 Operating costs are estimated to be $7,500 the first year and will increase by $500 each of the following five years Calculate gross revenue using a cons- tant oil price of $20/Bbl le Calculate the financial net income BFIT for each year using straight line depreciation. Assume a six year life Calculate the financial net income BFIT for each year using UOP depreciation a. b. c. Prepare a net cash flow analysis BFIT for this investment. Draw the cash flow diagram