Answered step by step

Verified Expert Solution

Question

1 Approved Answer

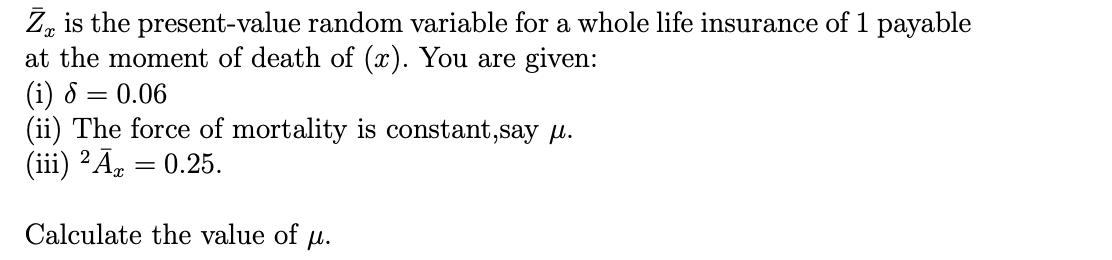

Z is the present-value random variable for a whole life insurance of 1 payable at the moment of death of (x). You are given:

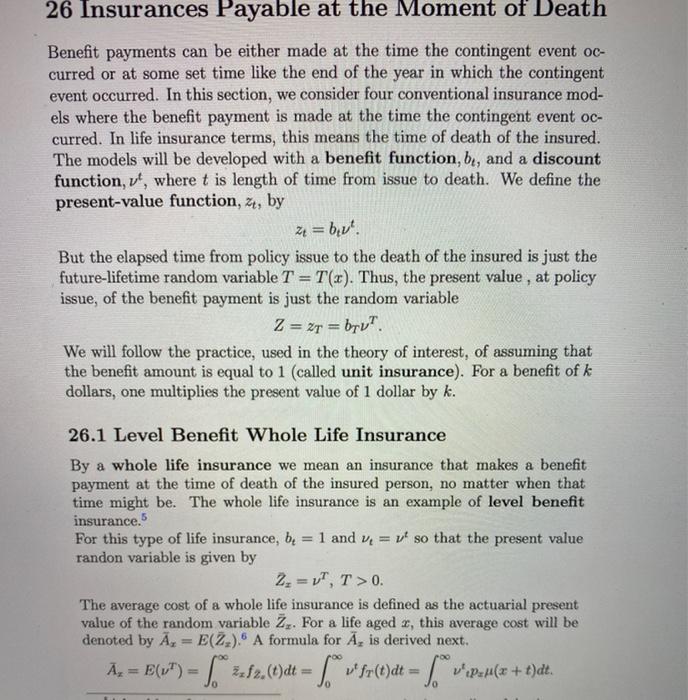

Z is the present-value random variable for a whole life insurance of 1 payable at the moment of death of (x). You are given: (i) 8 (ii) The force of mortality is constant,say . (iii) = 0.25. 2 Calculate the value of u. = 0.06 26 Insurances Payable at the Moment of Death Benefit payments can be either made at the time the contingent event oc- curred or at some set time like the end of the year in which the contingent event occurred. In this section, we consider four conventional insurance mod- els where the benefit payment is made at the time the contingent event oc- curred. In life insurance terms, this means the time of death of the insured. The models will be developed with a benefit function, be, and a discount function, t, where t is length of time from issue to death. We define the present-value function, z, by z = bv. But the elapsed time from policy issue to the death of the insured is just the future-lifetime random variable T = T(x). Thus, the present value, at policy issue, of the benefit payment is just the random variable Z = 2T = brv". We will follow the practice, used in the theory of interest, of assuming that the benefit amount is equal to 1 (called unit insurance). For a benefit of k dollars, one multiplies the present value of 1 dollar by k. 26.1 Level Benefit Whole Life Insurance By a whole life insurance we mean an insurance that makes a benefit payment at the time of death of the insured person, no matter when that time might be. The whole life insurance is an example of level benefit insurance.5 For this type of life insurance, b, = 1 and = so that the present value randon variable is given by 2=UT, T> 0. The average cost of a whole life insurance is defined as the actuarial present value of the random variable Zz. For a life aged 2, this average cost will be denoted by A = E(Z). A formula for , is derived next. A = E(v)=2f2. (t)dt = v fr(t)dt = v=n(x + 1)dt.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

For a continuously increasing whole life insurance on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started