Question

Process analysis involves adjusting the capacities and balance among different parts of the process to maximize output or minimize the costs with available resources. Our

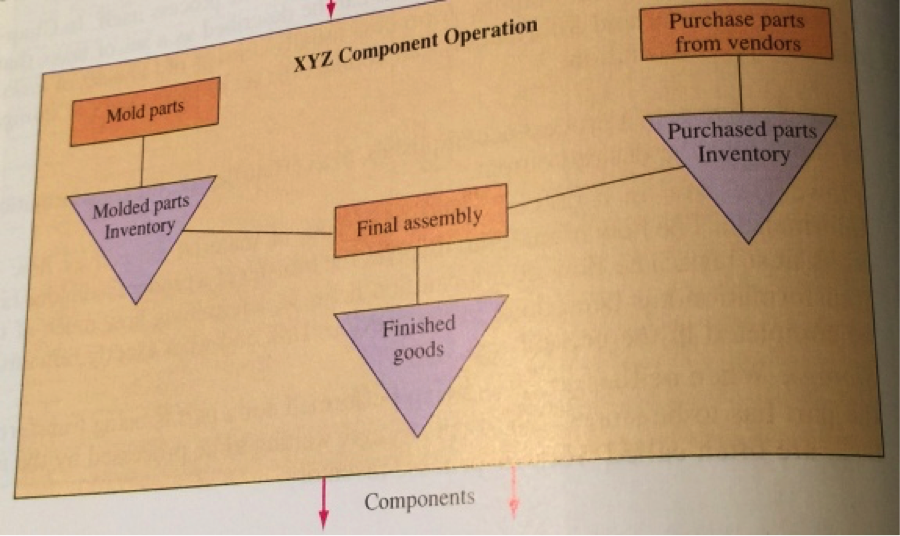

Process analysis involves adjusting the capacities and balance among different parts of the process to maximize output or minimize the costs with available resources. Our company supplies a component to several large auto manufacturers. This component is assembled in a shop by 15 workers working an eight-hour shift on an assembly line that moves at the rate of 150 components per hour (i.e. output rate of the final assembly process; see flow diagram below). The workers receive their pay in the form of a group incentive amounting to 30 cents per completed good part. This wage is distributed equally among the workers. Management believes that it can hire 15 more workers for a second shift if necessary.

Parts for the final assembly come from two sources. The molding department makes one very critical part and the rest come from outside suppliers. There are 11 machines capable of molding the one part done in-house; but historically, one machine is being overhauled or repaired at any given time. Each machine requires a full-time operator. The machines could each produce 25 parts per hour, and the workers are paid on an individual piece rate of 20 cents per good part. The workers will work overtime at a 50 percent increase in rate, or for 30 cents per good part. The workforce for molding is flexible; currently, only six workers are on this job. Four more are available from a labour pool within the company. The raw materials for each part molded cost 10 cents per part; a detailed analysis by the accounting department has concluded that 2 cents of electricity is used in making each part. The parts purchased from the outside cost 30 cents for each component produced.

The entire operation is located in a rented building costing $100 per week. Supervision, maintenance, and clerical employees receive $1,000 per week. The accounting department charges depreciation for equipment against this operation at $50 per week.

The accompanying process flow diagram describes the process. The tasks have been shown as rectangles and the storage of good (inventories) as triangles.

A) Determine the capacity (number of components produced per week) of the entire process (i.e. molding process and assembly process). Are the capacities of all the processes balanced?

B) If the molding process were to use 10 machines instead of 6, and no changes were to be made in the final assembly task, what is the capacity of the entire process?

C) If our company went to a second shift of eight more hours on the assembly task, what would be the new capacity of the assembly process?

D) Determine the cost per unit output when the capacity is (1) 6,000 per week or (2) 10,000 per week. Fill in the following type of table for each case and comment on the results.

| Item | Calculation | cost |

| Raw material for molding Parts purchased from outside Electricity Molding labour Assembly labour Rent Supervision Depreciation Total cost |

|

|

Purchase parts from vendors XYZ Component Operation Mold parts Purchased parts Inventory Molded parts Inventory Final assembly Finished goods Components

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started