Answered step by step

Verified Expert Solution

Question

1 Approved Answer

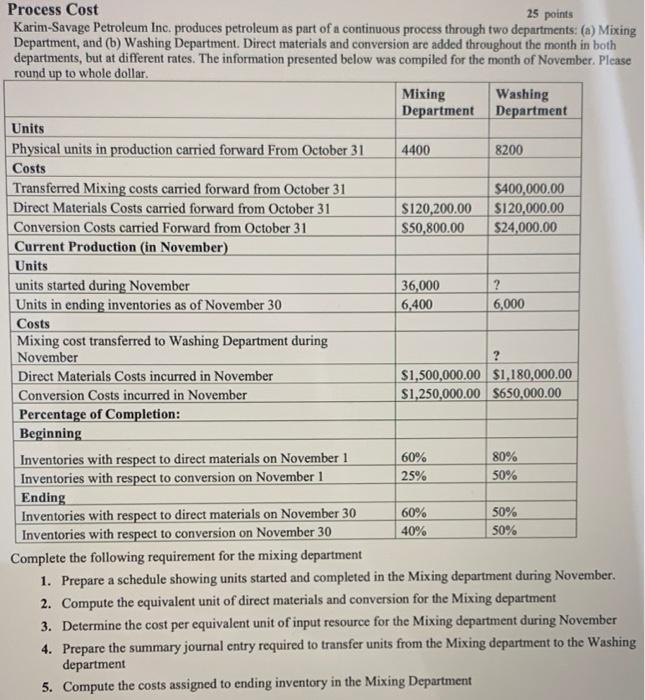

Process Cost 25 points Karim-Savage Petroleum Inc. produces petroleum as part of a continuous process through two departments: (a) Mixing Department, and (b) Washing

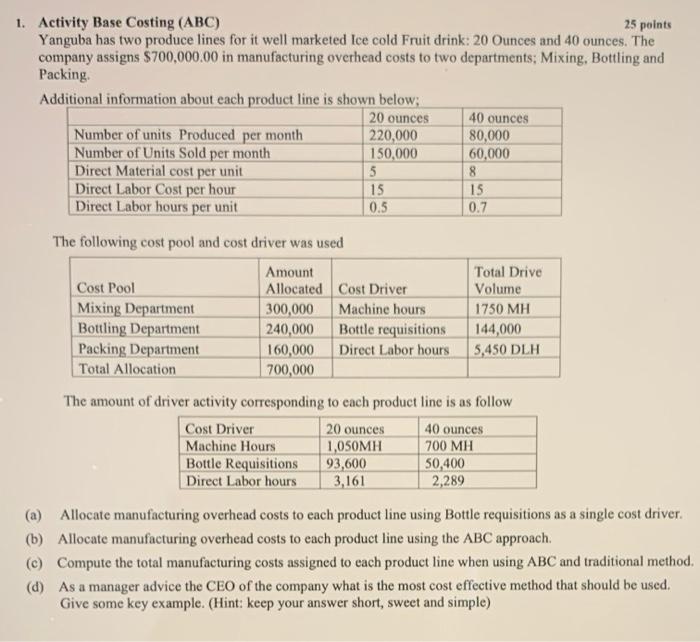

Process Cost 25 points Karim-Savage Petroleum Inc. produces petroleum as part of a continuous process through two departments: (a) Mixing Department, and (b) Washing Department. Direct materials and conversion are added throughout the month in both departments, but at different rates. The information presented below was compiled for the month of November. Please round up to whole dollar. Units Physical units in production carried forward From October 31 Costs Transferred Mixing costs carried forward from October 31 Direct Materials Costs carried forward from October 31 Conversion Costs carried Forward from October 31 Current Production (in November) Units units started during November Units in ending inventories as of November 30 Costs Mixing cost transferred to Washing Department during November Direct Materials Costs incurred in November Conversion Costs incurred in November Percentage of Completion: Beginning Mixing Department 4400 $120,200.00 $50,800.00 36,000 6,400 60% 25% Washing Department 8200 60% 40% $400,000.00 $120,000.00 $24,000.00 $1,500,000.00 $1,180,000.00 $1,250,000.00 $650,000.00 ? 6,000 80% 50% Inventories with respect to direct materials on November 1 Inventories with respect to conversion on November 1 Ending Inventories with respect to direct materials on November 30 Inventories with respect to conversion on November 30 Complete the following requirement for the mixing department 1. Prepare a schedule showing units started and completed in the Mixing department during November. 2. Compute the equivalent unit of direct materials and conversion for the Mixing department 3. Determine the cost per equivalent unit of input resource for the Mixing department during November 4. Prepare the summary journal entry required to transfer units from the Mixing department to the Washing department 5. Compute the costs assigned to ending inventory in the Mixing Department 50% 50% 25 points 1. Activity Base Costing (ABC) Yanguba has two produce lines for it well marketed Ice cold Fruit drink: 20 Ounces and 40 ounces. The company assigns $700,000.00 in manufacturing overhead costs to two departments; Mixing, Bottling and Packing. Additional information about each product line is shown below; 20 ounces Number of units Produced per month Number of Units Sold per month Direct Material cost per unit Direct Labor Cost per hour Direct Labor hours per unit The following cost pool and cost driver was used Amount Allocated Cost Pool Mixing Department Bottling Department Packing Department Total Allocation 300,000 240,000 160,000 700,000 The amount of driver activity corresponding Cost Driver Machine Hours Bottle Requisitions Direct Labor hours 220,000 150,000 5 15 0.5 Cost Driver Machine hours Bottle requisitions Direct Labor hours 40 ounces 80,000 60,000 50,400 2,289 8 15 0.7 Total Drive Volume 1750 MH 144,000 5,450 DLH to each product line is as follow 20 ounces 40 ounces 1,050MH 700 MH 93,600 3,161 (a) Allocate manufacturing overhead costs to each product line using Bottle requisitions as a single cost driver. (b) Allocate manufacturing overhead costs to each product line using the ABC approach. (c) Compute the total manufacturing costs assigned to each product line when using ABC and traditional method. (d) As a manager advice the CEO of the company what is the most cost effective method that should be used. Give some key example. (Hint: keep your answer short, sweet and simple)

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Computation of units completed in the Mixing Departments during November Opening Work In process units from October 31 4400 Add Units started during November 36000 Total Number of units 40400 Less C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started