Answered step by step

Verified Expert Solution

Question

1 Approved Answer

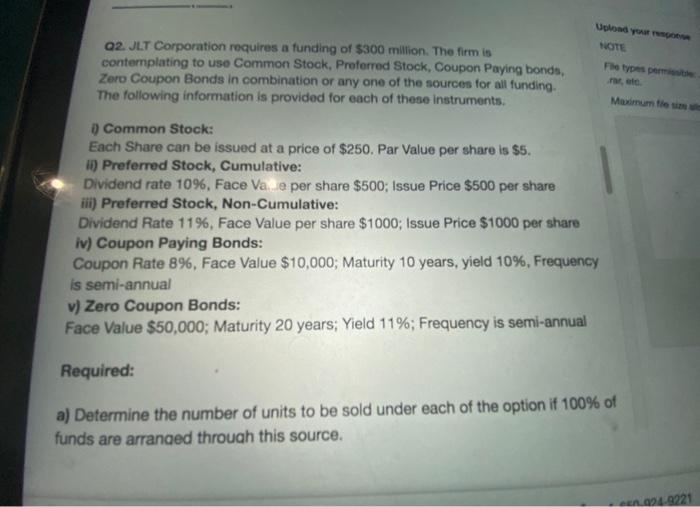

process required please Upon you NOTE 02. JLT Corporation requires a funding of $300 million. The firm is contemplating to use Common Stock, Preferred Stock,

process required please

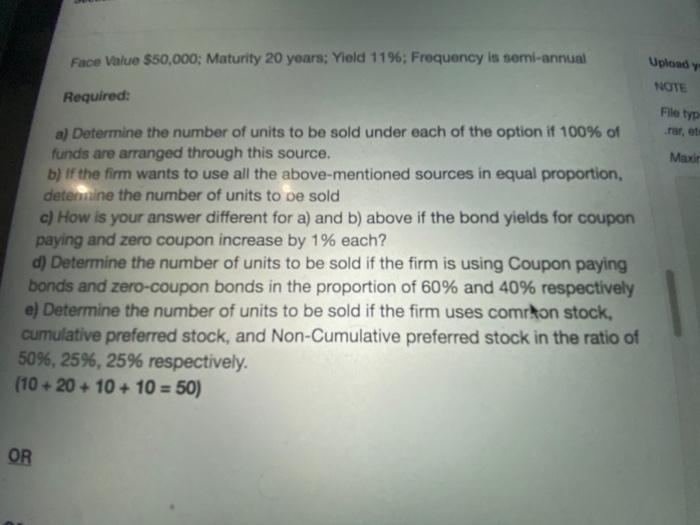

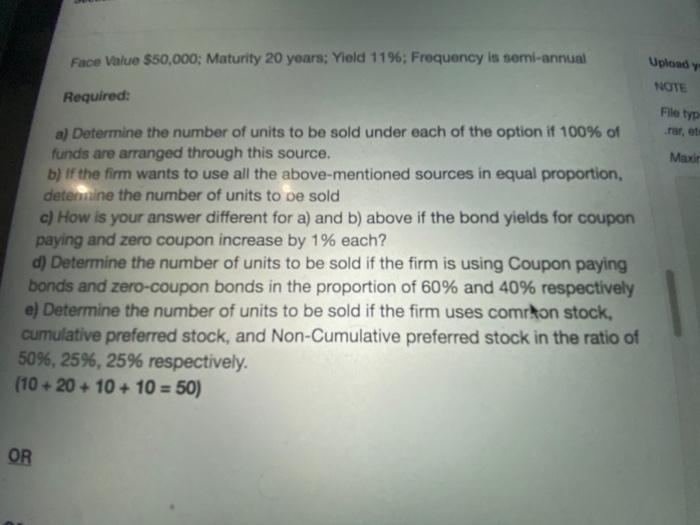

Upon you NOTE 02. JLT Corporation requires a funding of $300 million. The firm is contemplating to use Common Stock, Preferred Stock, Coupon Paying bonds, Zero Coupon Bonds in combination or any one of the sources for all funding. The following information is provided for each of these instruments The types permite Madmumtiem Common Stock: Each Share can be issued at a price of $250. Par Value per share is $5. 11) Preferred Stock, Cumulative: Dividend rate 10%, Face Vale per share $500; Issue Price $500 per share iii) Preferred Stock, Non-Cumulative: Dividend Rate 11%, Face Value per share $1000; Issue Price $1000 per share iv) Coupon Paying Bonds: Coupon Rate 8%, Face Value $10,000; Maturity 10 years, yield 10%, Frequency is semi-annual v) Zero Coupon Bonds: Face Value $50,000; Maturity 20 years; Yield 11%; Frequency is semi-annual Required: a) Determine the number of units to be sold under each of the option if 100% of funds are arranged through this source. en 924-9221 Face Value $50,000; Maturity 20 years; Yield 11%; Frequency is semi-annual Upload y NOTE Required: File typ Maxdir a) Determine the number of units to be sold under each of the option if 100% of funds are arranged through this source. b) If the firm wants to use all the above-mentioned sources in equal proportion, detenuine the number of units to be sold c) How is your answer different for a) and b) above if the bond yields for coupon paying and zero coupon increase by 1% each? d) Determine the number of units to be sold if the firm is using Coupon paying bonds and zero-coupon bonds in the proportion of 60% and 40% respectively e) Determine the number of units to be sold if the firm uses comrkon stock, cumulative preferred stock, and Non-Cumulative preferred stock in the ratio of 50%, 25%, 25% respectively. (10 + 20 + 10 + 10 = 50) OR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started