Answered step by step

Verified Expert Solution

Question

1 Approved Answer

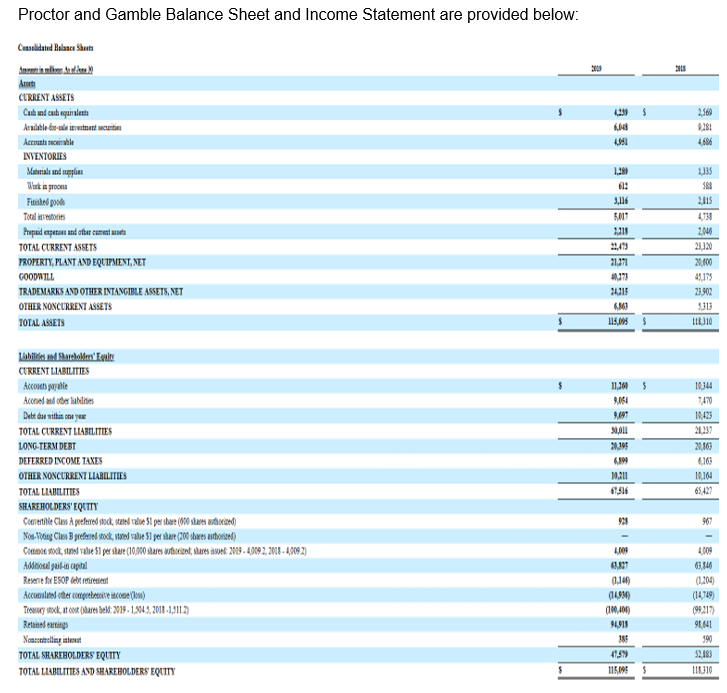

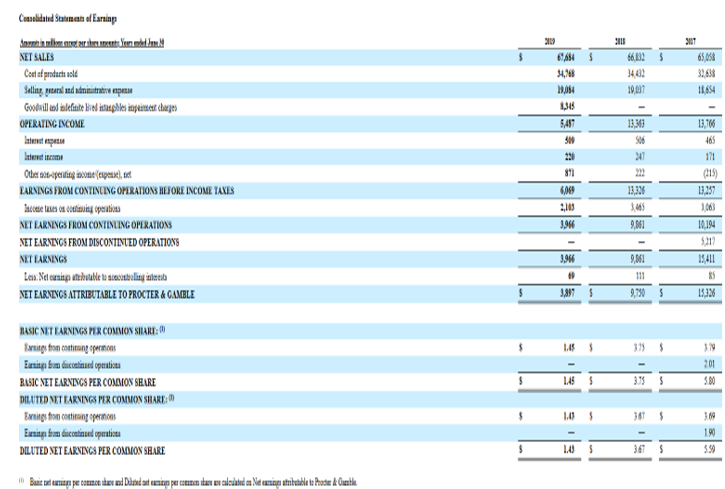

Proctor and Gamble Balance Sheet and Income Statement are provided below: begin{tabular}{|c|c|c|} hline & ss & sus hline multicolumn{3}{|l|}{ dext } hline multicolumn{3}{|l|}{

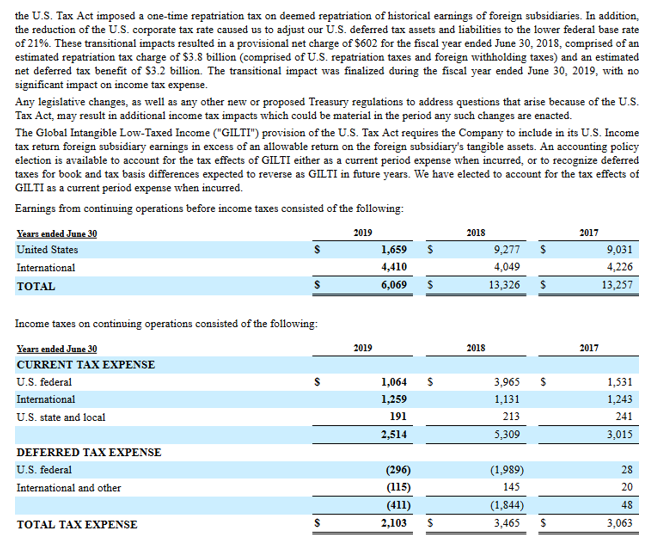

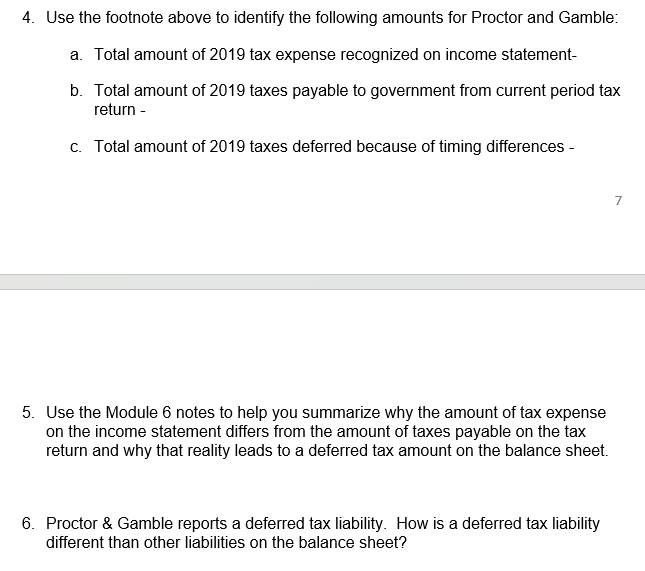

Proctor and Gamble Balance Sheet and Income Statement are provided below: \begin{tabular}{|c|c|c|} \hline & ss & sus \\ \hline \multicolumn{3}{|l|}{ dext } \\ \hline \multicolumn{3}{|l|}{ CTRRENI ASSETS } \\ \hline Cukn and equatuath & 4,a3 & 250 \\ \hline & 6,64 & 2.281 \\ \hline Actoath fecinith & & 486 \\ \hline \multicolumn{3}{|l|}{ DMETIORIIS } \\ \hline Manial and upplin & 1,280 & LSS \\ \hline What in procen & 6: & 588 \\ \hline Finiled pos & 3,116 & \\ \hline Toel inewotis & 5017 & 478 \\ \hline & 231 & 2040 \\ \hline TOTAL CTRREN ASSETS & 4.475 & 213N \\ \hline FROFETY, FLANT AND EQTIPIES, NET & 21,271 & 2,00 \\ \hline L & & \\ \hline TRADEMARKS AVD OTHER INTAVGIBLE ASSET5, NET & & 2990 \\ \hline OIHER NONCTRXENI ASSETS & & 2313 \\ \hline TOLAL ASSETS & a, 6 , & 111310 \\ \hline \multicolumn{3}{|l|}{ Labills and Burtolyer' Evile } \\ \hline \multicolumn{3}{|l|}{ CRRENT LASILITIES } \\ \hline Accouts prolit & 1129 & 1034 \\ \hline Acond ald oba labines & 9,154 & \\ \hline Detten nittin on yx & & 10,13 \\ \hline TOTAL CRREVT LMBLITES & si,0l1 & 2137 \\ \hline 10XG-TERM DEBT & 3195 & 2016 \\ \hline DEFEREED LYCONE TAXES & 499 & 8,16 \\ \hline OIHE NOXCTREST LLBLITIES & mat1 & 10,164 \\ \hline TOLAL LABUITES & & 65,427 \\ \hline \\ \hline & m & 967 \\ \hline & - & - \\ \hline & & 4000 \\ \hline AMoned palio aphet & & 69,40 \\ \hline & (1,14) & (1,204 \\ \hline & (14M) & (14+9) \\ \hline & & (99217 \\ \hline Retinisl tatins & & \\ \hline & st & 190 \\ \hline TOTAL SRARIROLDERS EQTTYY & & 52,183 \\ \hline TOLAL UABUITES AVD SRAREBOLDERS EQTTY & 115, we: & 1.10 \\ \hline \end{tabular} | NOTE 5 INCOME TAXES Income taxes are recognized for the amount of taxes payable for the current year and for the impact of deferred tax assets and liabilities, which represent future tax consequences of events that have been recognized differently in the financial statements than for tax purposes. Deferred tax assets and liabilities are established using the enacted statutory tax rates and are adjusted for any changes in such rates in the period of change. On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the "U.S. Tax Act"). The U.S. Tax Act significantly revised the future ongoing U.S. corporate income tax by, among other things, lowering the U.S. corporate income tax rates and implementing a hybrid territorial tax system. As the Company has a June 30 fiscal year-end, the lower corporate income tax rate was phased in, resulting in a U.S. statutory federal rate of approximately 28% for our fiscal year ended June 30, 2018, and 21% for subsequent fiscal years. However, the U.S. Tax Act eliminated the domestic manufacturing deduction and moved to a hybrid territorial system, which also largely eliminated the ability to credit certain foreign taxes that existed prior to enactment of the U.S. Tax Act. There are also certain transitional impacts of the U.S. Tax Act. As part of the transition to the new hybrid territorial tax system, the U.S. Tax Act imposed a one-time repatriation tax on deemed repatriation of historical earnings of foreign subsidiaries. In addition, the reduction of the U.S. corporate tax rate caused us to adjust our U.S. deferred tax assets and liabilities to the lower federal base rate of 21%. These transitional impacts resulted in a provisional net charge of $602 for the fiscal year ended June 30, 2018, comprised of an estimated repatriation tax charge of $3.8 billion (comprised of U.S. repatriation taxes and foreign withholding taxes) and an estimated net deferred tax benefit of $3.2 billion. The transitional impact was finalized during the fiscal year ended June 30, 2019, with no significant impact on income tax expense. Any legislative changes, as well as any other new or proposed Treasury regulations to address questions that arise because of the U.S. Tax Act, may result in additional income tax impacts which could be material in the period any such changes are enacted. The Global Intangible Low-Taxed Income ("GILTI") provision of the U.S. Tax Act requires the Company to include in its U.S. Income tax return foreign subsidiary earnings in excess of an allowable return on the foreign subsidiary's tangible assets. An accounting policy election is available to account for the tax effects of GILTI either as a current period expense when incurred, or to recognize deferred taxes for book and tax basis differences expected to reverse as GILTI in future years. We have elected to account for the tax effects of GIIII as a current period expense when incurred. Earnings from continuing operations before income taxes consisted of the following: Income taxes on continuing operations consisted of the following: 4. Use the footnote above to identify the following amounts for Proctor and Gamble: a. Total amount of 2019 tax expense recognized on income statement- b. Total amount of 2019 taxes payable to government from current period tax return - C. Total amount of 2019 taxes deferred because of timing differences - 7 5. Use the Module 6 notes to help you summarize why the amount of tax expense on the income statement differs from the amount of taxes payable on the tax return and why that reality leads to a deferred tax amount on the balance sheet. 6. Proctor \& Gamble reports a deferred tax liability. How is a deferred tax liability different than other liabilities on the balance sheet

Proctor and Gamble Balance Sheet and Income Statement are provided below: \begin{tabular}{|c|c|c|} \hline & ss & sus \\ \hline \multicolumn{3}{|l|}{ dext } \\ \hline \multicolumn{3}{|l|}{ CTRRENI ASSETS } \\ \hline Cukn and equatuath & 4,a3 & 250 \\ \hline & 6,64 & 2.281 \\ \hline Actoath fecinith & & 486 \\ \hline \multicolumn{3}{|l|}{ DMETIORIIS } \\ \hline Manial and upplin & 1,280 & LSS \\ \hline What in procen & 6: & 588 \\ \hline Finiled pos & 3,116 & \\ \hline Toel inewotis & 5017 & 478 \\ \hline & 231 & 2040 \\ \hline TOTAL CTRREN ASSETS & 4.475 & 213N \\ \hline FROFETY, FLANT AND EQTIPIES, NET & 21,271 & 2,00 \\ \hline L & & \\ \hline TRADEMARKS AVD OTHER INTAVGIBLE ASSET5, NET & & 2990 \\ \hline OIHER NONCTRXENI ASSETS & & 2313 \\ \hline TOLAL ASSETS & a, 6 , & 111310 \\ \hline \multicolumn{3}{|l|}{ Labills and Burtolyer' Evile } \\ \hline \multicolumn{3}{|l|}{ CRRENT LASILITIES } \\ \hline Accouts prolit & 1129 & 1034 \\ \hline Acond ald oba labines & 9,154 & \\ \hline Detten nittin on yx & & 10,13 \\ \hline TOTAL CRREVT LMBLITES & si,0l1 & 2137 \\ \hline 10XG-TERM DEBT & 3195 & 2016 \\ \hline DEFEREED LYCONE TAXES & 499 & 8,16 \\ \hline OIHE NOXCTREST LLBLITIES & mat1 & 10,164 \\ \hline TOLAL LABUITES & & 65,427 \\ \hline \\ \hline & m & 967 \\ \hline & - & - \\ \hline & & 4000 \\ \hline AMoned palio aphet & & 69,40 \\ \hline & (1,14) & (1,204 \\ \hline & (14M) & (14+9) \\ \hline & & (99217 \\ \hline Retinisl tatins & & \\ \hline & st & 190 \\ \hline TOTAL SRARIROLDERS EQTTYY & & 52,183 \\ \hline TOLAL UABUITES AVD SRAREBOLDERS EQTTY & 115, we: & 1.10 \\ \hline \end{tabular} | NOTE 5 INCOME TAXES Income taxes are recognized for the amount of taxes payable for the current year and for the impact of deferred tax assets and liabilities, which represent future tax consequences of events that have been recognized differently in the financial statements than for tax purposes. Deferred tax assets and liabilities are established using the enacted statutory tax rates and are adjusted for any changes in such rates in the period of change. On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the "U.S. Tax Act"). The U.S. Tax Act significantly revised the future ongoing U.S. corporate income tax by, among other things, lowering the U.S. corporate income tax rates and implementing a hybrid territorial tax system. As the Company has a June 30 fiscal year-end, the lower corporate income tax rate was phased in, resulting in a U.S. statutory federal rate of approximately 28% for our fiscal year ended June 30, 2018, and 21% for subsequent fiscal years. However, the U.S. Tax Act eliminated the domestic manufacturing deduction and moved to a hybrid territorial system, which also largely eliminated the ability to credit certain foreign taxes that existed prior to enactment of the U.S. Tax Act. There are also certain transitional impacts of the U.S. Tax Act. As part of the transition to the new hybrid territorial tax system, the U.S. Tax Act imposed a one-time repatriation tax on deemed repatriation of historical earnings of foreign subsidiaries. In addition, the reduction of the U.S. corporate tax rate caused us to adjust our U.S. deferred tax assets and liabilities to the lower federal base rate of 21%. These transitional impacts resulted in a provisional net charge of $602 for the fiscal year ended June 30, 2018, comprised of an estimated repatriation tax charge of $3.8 billion (comprised of U.S. repatriation taxes and foreign withholding taxes) and an estimated net deferred tax benefit of $3.2 billion. The transitional impact was finalized during the fiscal year ended June 30, 2019, with no significant impact on income tax expense. Any legislative changes, as well as any other new or proposed Treasury regulations to address questions that arise because of the U.S. Tax Act, may result in additional income tax impacts which could be material in the period any such changes are enacted. The Global Intangible Low-Taxed Income ("GILTI") provision of the U.S. Tax Act requires the Company to include in its U.S. Income tax return foreign subsidiary earnings in excess of an allowable return on the foreign subsidiary's tangible assets. An accounting policy election is available to account for the tax effects of GILTI either as a current period expense when incurred, or to recognize deferred taxes for book and tax basis differences expected to reverse as GILTI in future years. We have elected to account for the tax effects of GIIII as a current period expense when incurred. Earnings from continuing operations before income taxes consisted of the following: Income taxes on continuing operations consisted of the following: 4. Use the footnote above to identify the following amounts for Proctor and Gamble: a. Total amount of 2019 tax expense recognized on income statement- b. Total amount of 2019 taxes payable to government from current period tax return - C. Total amount of 2019 taxes deferred because of timing differences - 7 5. Use the Module 6 notes to help you summarize why the amount of tax expense on the income statement differs from the amount of taxes payable on the tax return and why that reality leads to a deferred tax amount on the balance sheet. 6. Proctor \& Gamble reports a deferred tax liability. How is a deferred tax liability different than other liabilities on the balance sheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started