Answered step by step

Verified Expert Solution

Question

1 Approved Answer

produce a standard cost card for each product and the budgeted operating statement in an absorption costing format for GRIX GRIX, a small subsidiary of

produce a standard cost card for each product and the budgeted operating statement in an absorption costing format for GRIX

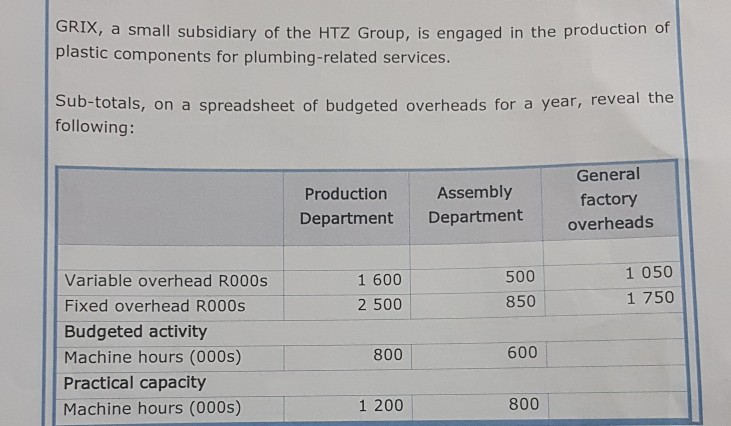

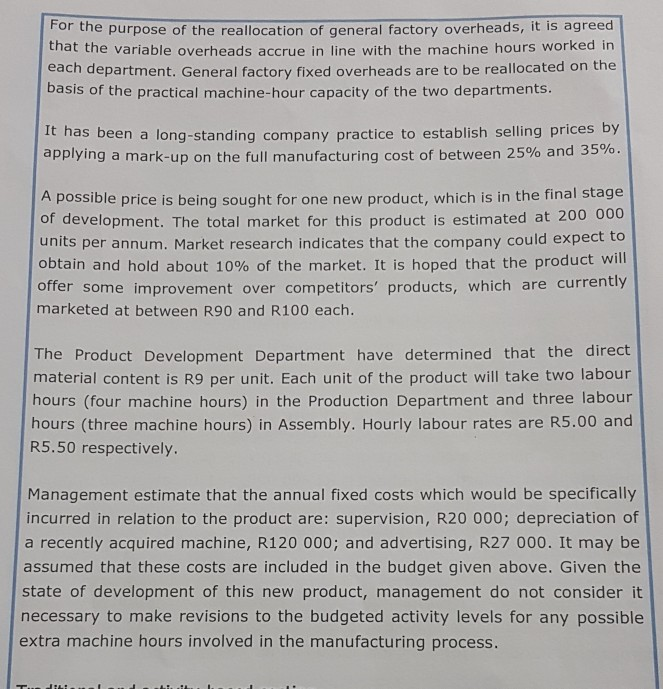

GRIX, a small subsidiary of the HTZ Group, is engaged in the production plastic components for plumbing-related services. Sub-totals, on a spreadsheet of budgeted overheads for a year, reveal the following: Production Department Assembly Department General factory overheads 500 1 600 2 500 1 050 1 750 850 Variable overhead R000s Fixed overhead ROO0s Budgeted activity Machine hours (000s) Practical capacity Machine hours (000s) 800 600 1 200 800 rur the purpose of the reallocation of general factory overheads, it is agreed what the variable overheads accrue in line with the machine hours worked in each department. General factory fixed overheads are to be reallocated on the basis of the practical machine-hour capacity of the two departments. 1 has been a long-standing company practice to establish selling prices by applying a mark-up on the full manufacturing cost of between 25% and 35%. A possible price is being sought for one new product, which is in the final stage of development. The total market for this product is estimated at 200 000 units per annum. Market research indicates that the company could expect to obtain and hold about 10% of the market. It is hoped that the product will offer some improvement over competitors' products, which are currently marketed at between R90 and R100 each. The Product Development Department have determined that the direct material content is R9 per unit. Each unit of the product will take two labour hours (four machine hours) in the Production Department and three labour hours (three machine hours) in Assembly. Hourly labour rates are R5.00 and R5.50 respectively. Management estimate that the annual fixed costs which would be specifically incurred in relation to the product are: supervision, R20 000; depreciation of a recently acquired machine, R120 000; and advertising, R27 000. It may be assumed that these costs are included in the budget given above. Given the state of development of this new product, management do not consider it necessary to make revisions to the budgeted activity levels for any possible extra machine hours involved in the manufacturing process. GRIX, a small subsidiary of the HTZ Group, is engaged in the production plastic components for plumbing-related services. Sub-totals, on a spreadsheet of budgeted overheads for a year, reveal the following: Production Department Assembly Department General factory overheads 500 1 600 2 500 1 050 1 750 850 Variable overhead R000s Fixed overhead ROO0s Budgeted activity Machine hours (000s) Practical capacity Machine hours (000s) 800 600 1 200 800 rur the purpose of the reallocation of general factory overheads, it is agreed what the variable overheads accrue in line with the machine hours worked in each department. General factory fixed overheads are to be reallocated on the basis of the practical machine-hour capacity of the two departments. 1 has been a long-standing company practice to establish selling prices by applying a mark-up on the full manufacturing cost of between 25% and 35%. A possible price is being sought for one new product, which is in the final stage of development. The total market for this product is estimated at 200 000 units per annum. Market research indicates that the company could expect to obtain and hold about 10% of the market. It is hoped that the product will offer some improvement over competitors' products, which are currently marketed at between R90 and R100 each. The Product Development Department have determined that the direct material content is R9 per unit. Each unit of the product will take two labour hours (four machine hours) in the Production Department and three labour hours (three machine hours) in Assembly. Hourly labour rates are R5.00 and R5.50 respectively. Management estimate that the annual fixed costs which would be specifically incurred in relation to the product are: supervision, R20 000; depreciation of a recently acquired machine, R120 000; and advertising, R27 000. It may be assumed that these costs are included in the budget given above. Given the state of development of this new product, management do not consider it necessary to make revisions to the budgeted activity levels for any possible extra machine hours involved in the manufacturing processStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started