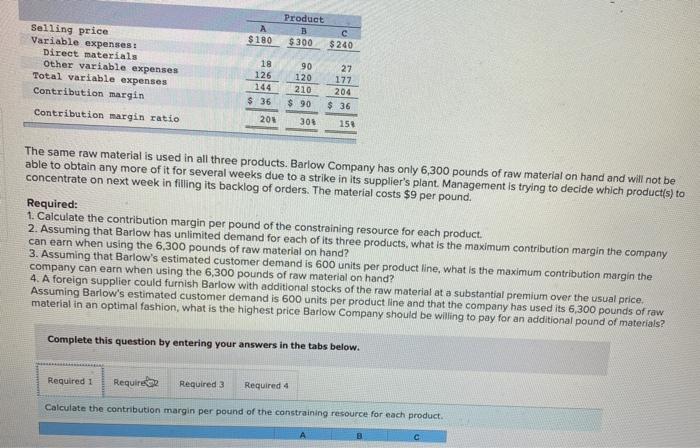

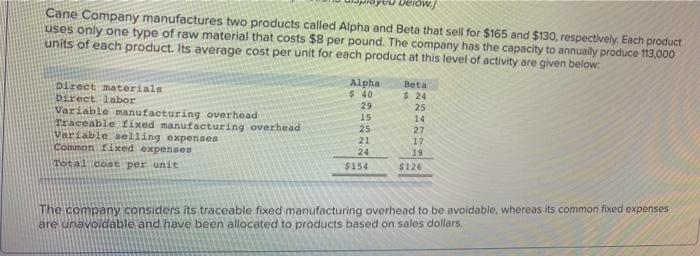

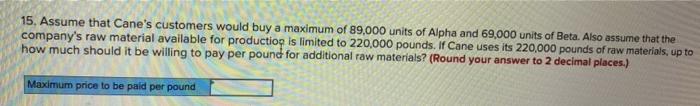

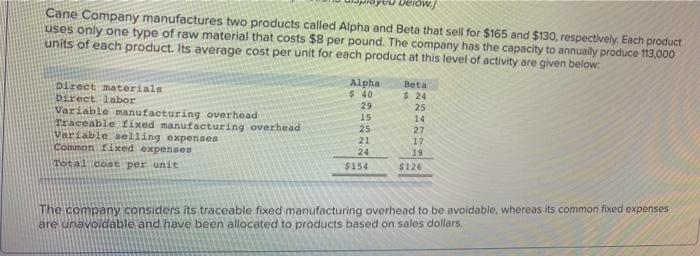

Product 3 C $300 $ 240 $180 Selling price Variable expenses: Direct materials Other variable expenses Total variable expenses Contribution margin 18 126 144 $36 90 120 210 $ 90 27 177 204 $36 Contribution margin ratio 200 30% 158 The same raw material is used in all three products. Barlow Company has only 6,300 pounds of raw material on hand and will not be able to obtain any more of it for several weeks due to a strike in its supplier's plant. Management is trying to decide which product(s) to concentrate on next week in filling its backlog of orders. The material costs $9 per pound. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Assuming that Barlow has unlimited demand for each of its three products, what is the maximum contribution margin the company can earn when using the 6,300 pounds of raw material on hand? 3. Assuming that Barlow's estimated customer demand is 600 units per product line, what is the maximum contribution margin the company can earn when using the 6,300 pounds of raw material on hand? 4. A foreign supplier could furnish Barlow with additional stocks of the raw material at a substantial premium over the usual price, Assuming Barlow's estimated customer demand is 600 units per product line and that the company has used its 6,300 pounds of raw material in an optimal fashion, what is the highest price Barlow Company should be willing to pay for an additional pound of materials? Complete this question by entering your answers in the tabs below. Required 1 Required Required 3 Required 4 Calculate the contribution margin per pound of the constraining resource for each product. below. Cane Company manufactures two products called Alpha and Beta that sell for $165 and $130, respectively. Each product uses only one type of raw material that costs $8 per pound. The company has the capacity to annually produce 113,000 units of each product. Its average cost per unit for each product at this level of activity are given below: Beta $ 24 25 Direct materials Direct labor Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Total cost per unit Alpha $ 40 29 15 25 21 24 $154 27 17 19 5126 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. 15. Assume that Cane's customers would buy a maximum of 89,000 units of Alpha and 69,000 units of Beta. Also assume that the company's raw material available for productio is limited to 220,000 pounds. If Cane uses its 220,000 pounds of raw materials, up to how much should it be willing to pay per pound for additional raw materials? (Round your answer to 2 decimal places.) Maximum price to be paid per pound