Answered step by step

Verified Expert Solution

Question

1 Approved Answer

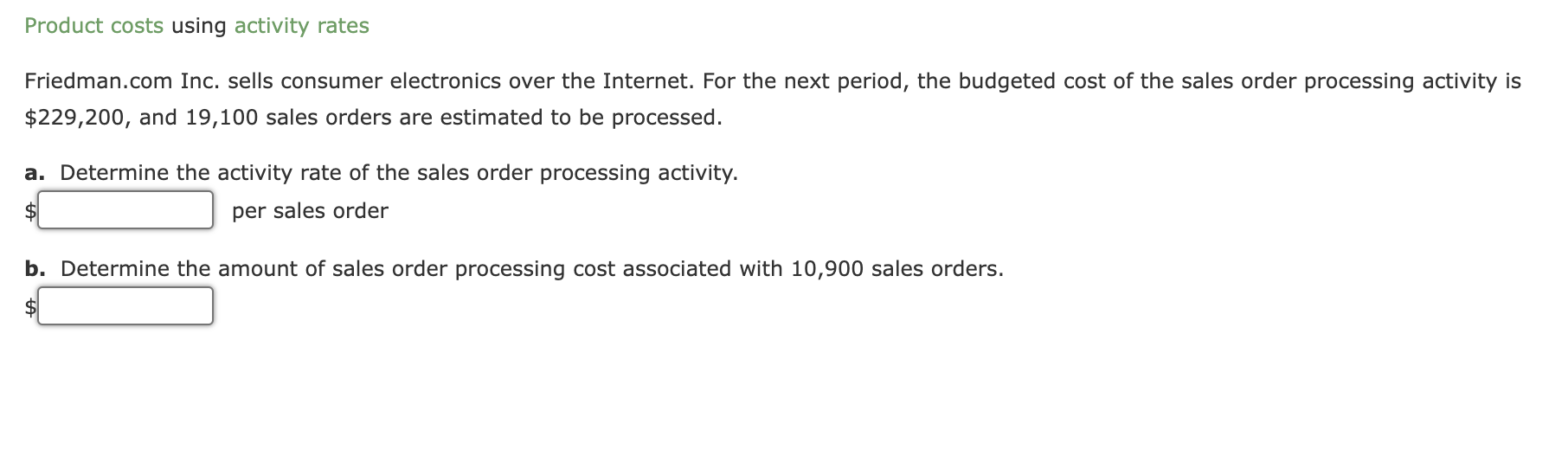

Product costs using activity rates Friedman.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing

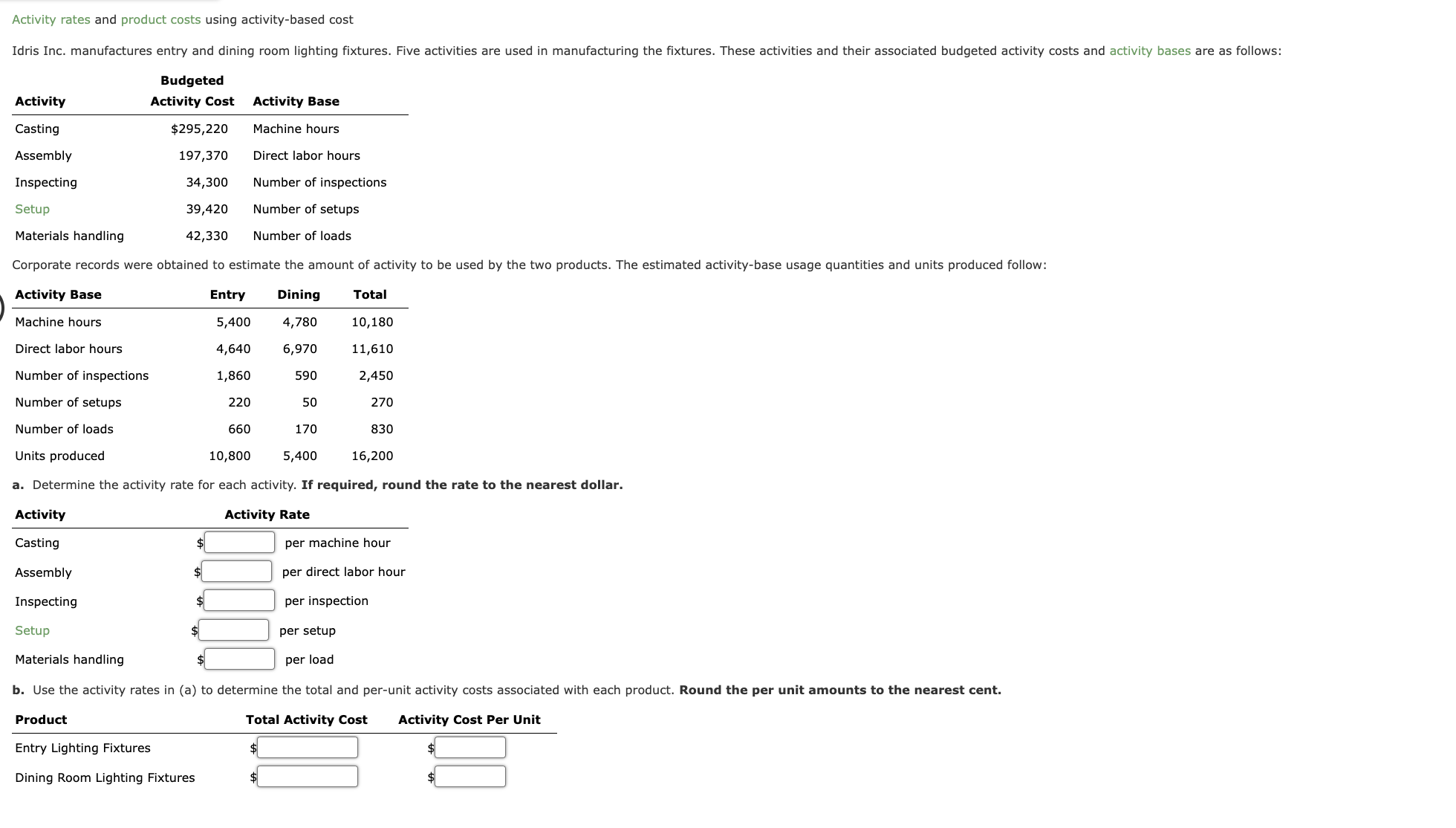

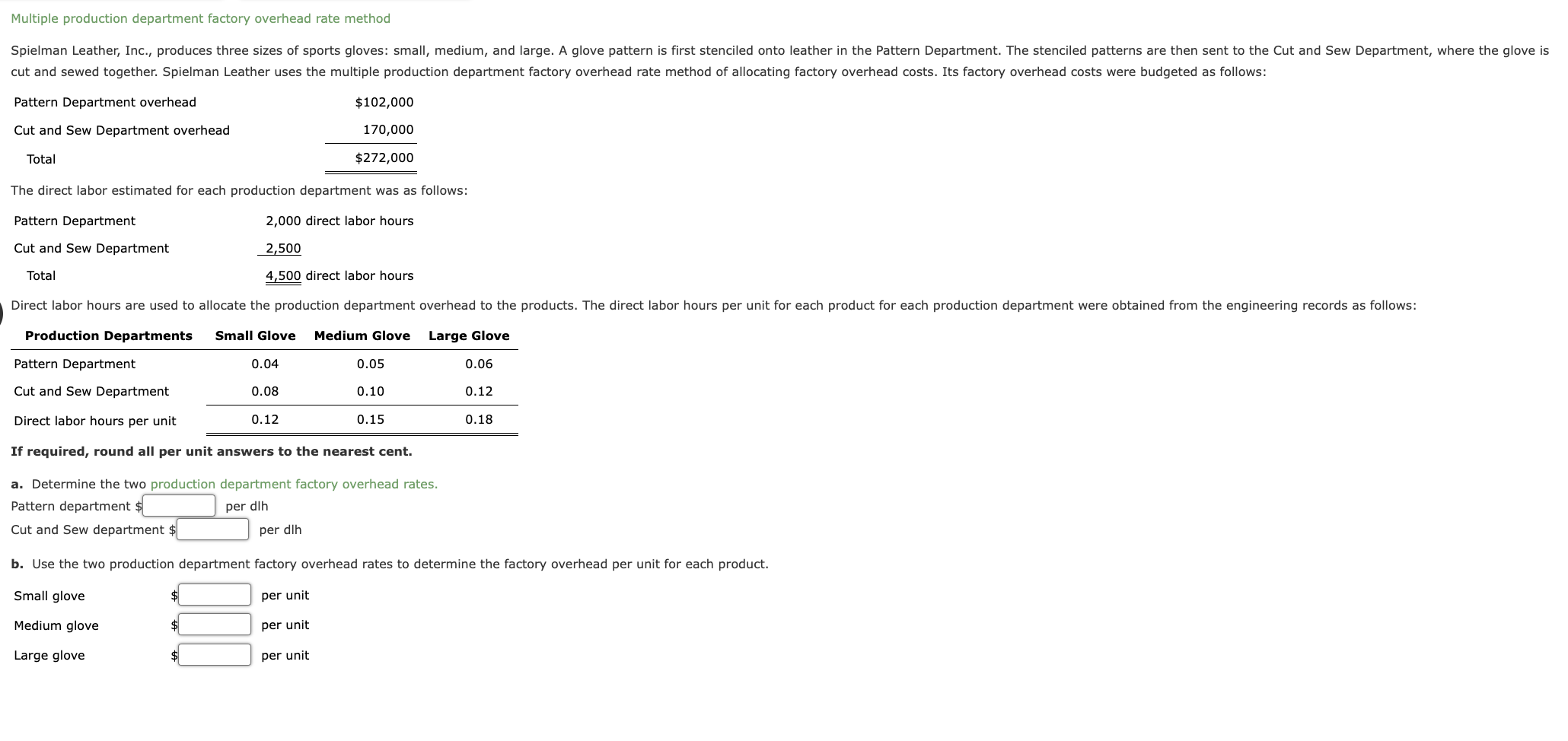

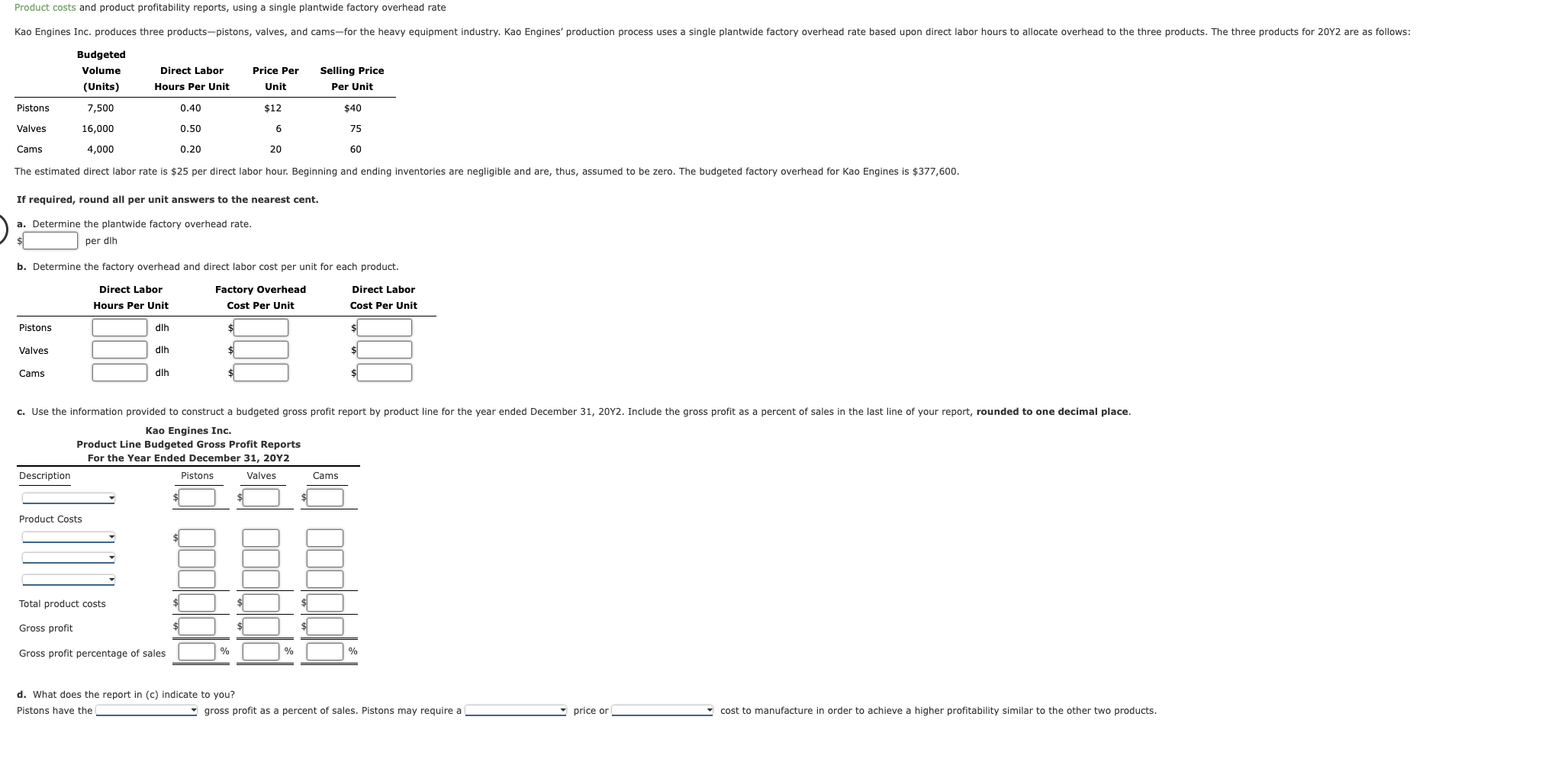

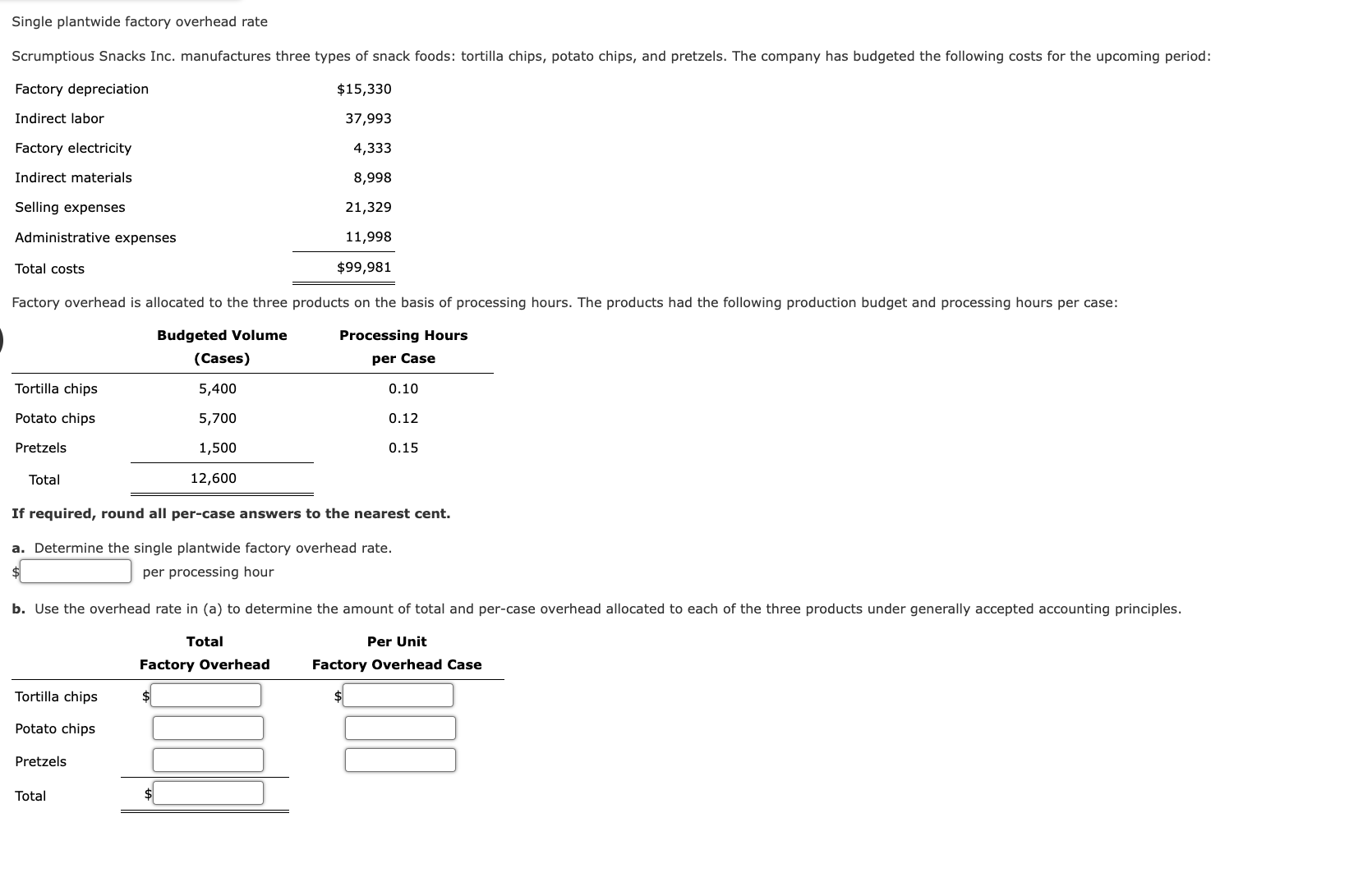

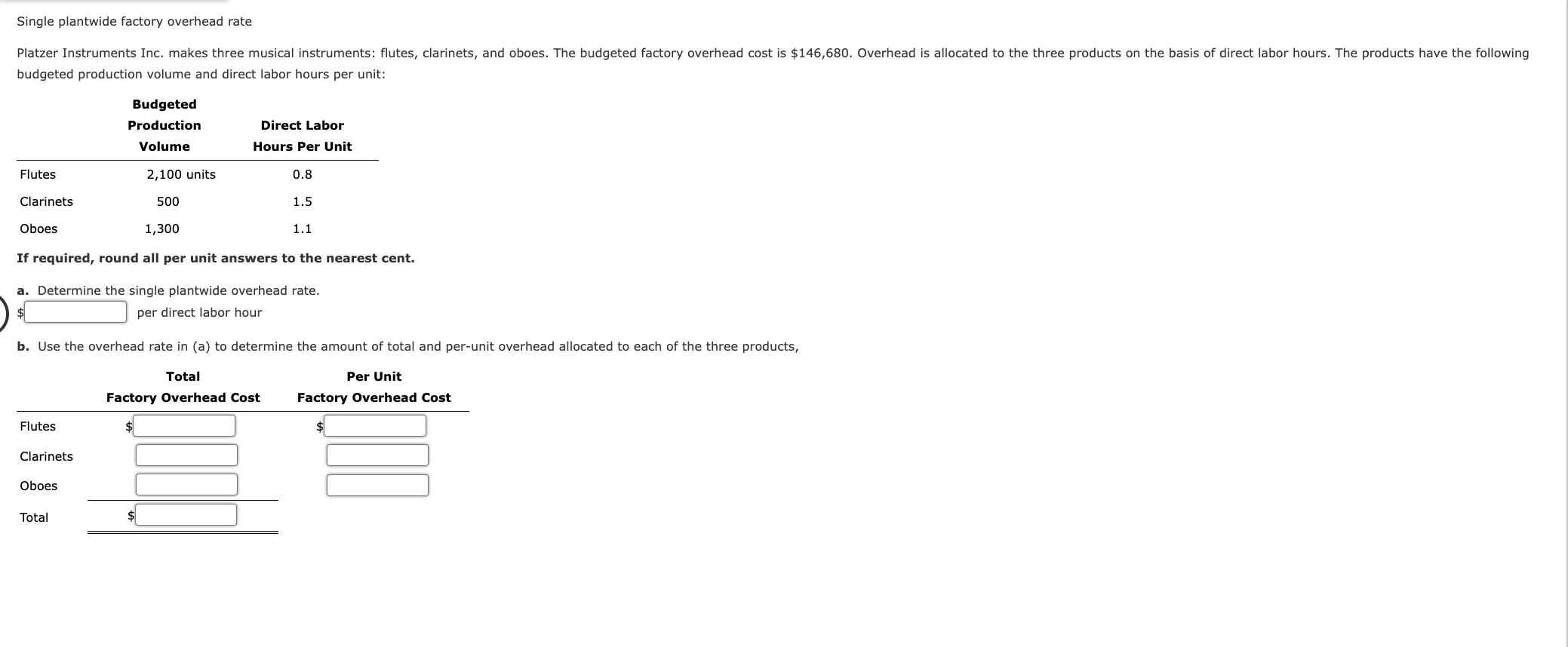

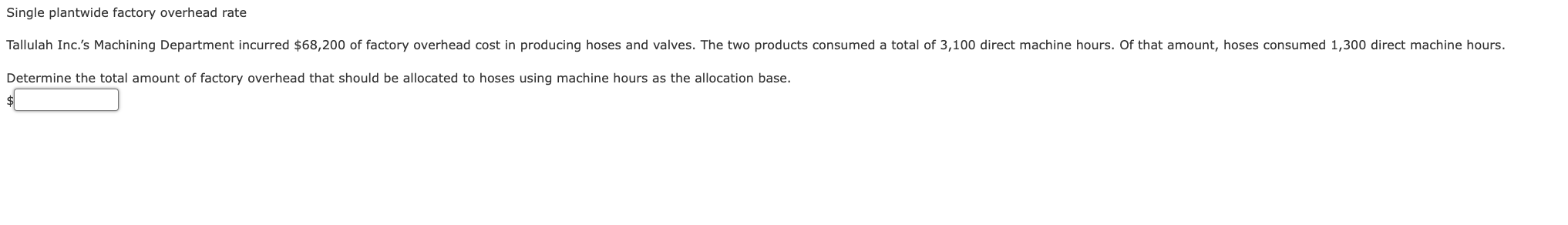

Product costs using activity rates Friedman.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $229,200, and 19,100 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. per sales order b. Determine the amount of sales order processing cost associated with 10,900 sales orders. Activity rates and product costs using activity-based cost \begin{tabular}{lrl} & \multicolumn{1}{c}{BudgetedActivityCost} & Activity Base \\ \hline Casting & $295,220 & Machine hours \\ Assembly & 197,370 & Direct labor hours \\ Inspecting & 34,300 & Number of inspections \\ Setup & 39,420 & Number of setups \\ Materials handling & 42,330 & Number of loads \end{tabular} \begin{tabular}{lrrc} Activity Base & Entry & Dining & \multicolumn{1}{c}{ Total } \\ \hline Machine hours & 5,400 & 4,780 & 10,180 \\ Direct labor hours & 4,640 & 6,970 & 11,610 \\ Number of inspections & 1,860 & 590 & 2,450 \\ Number of setups & 220 & 50 & 270 \\ Number of loads & 660 & 170 & 830 \\ Units produced & 10,800 & 5,400 & 16,200 \end{tabular} a. Determine the activity rate for each activity. If required, round the rate to the nearest dollar. \begin{tabular}{lcc} Product & Total Activity Cost & Activity Cost Per Unit \\ \hline Entry Lighting Fixtures & $ & $ \\ Dining Room Lighting Fixtures & $ \end{tabular} Multiple production department factory overhead rate method The direct labor estimated for each production department was as follows: If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates. Pattern department per dlh Cut and Sew department & per dlh b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product. SmallgloveMediumgloveLargeglove$perunitperunitperunit If required, round all per unit answers to the nearest cent. a. Determine the plantwide factory overhead rate. $ per dlh b. Determine the factory overhead and direct labor cost per unit for each product. Kao Engines Inc. d. What does the report in (c) indicate to you? Pistons have the ? gross profit as a percent of sales. Pistons may require a price or cost to manufacture in order to achieve a higher profitability similar to the other two products. Single plantwide factory overhead rate Scrumptious Snacks Inc. manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. per processing hour b. Use the overhead rate in (a) to determine the amount of total and per-case overhead allocated to each of the three products under generally accepted accounting principles. Single plantwide factory overhead rate budgeted production volume and direct labor hours per unit: If required, round all per unit answers to the nearest cent. a. Determine the single plantwide overhead rate. per direct labor hour b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products, Determine the total amount of factory overhead that should be allocated to hoses using machine hours as the allocation base

Product costs using activity rates Friedman.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $229,200, and 19,100 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. per sales order b. Determine the amount of sales order processing cost associated with 10,900 sales orders. Activity rates and product costs using activity-based cost \begin{tabular}{lrl} & \multicolumn{1}{c}{BudgetedActivityCost} & Activity Base \\ \hline Casting & $295,220 & Machine hours \\ Assembly & 197,370 & Direct labor hours \\ Inspecting & 34,300 & Number of inspections \\ Setup & 39,420 & Number of setups \\ Materials handling & 42,330 & Number of loads \end{tabular} \begin{tabular}{lrrc} Activity Base & Entry & Dining & \multicolumn{1}{c}{ Total } \\ \hline Machine hours & 5,400 & 4,780 & 10,180 \\ Direct labor hours & 4,640 & 6,970 & 11,610 \\ Number of inspections & 1,860 & 590 & 2,450 \\ Number of setups & 220 & 50 & 270 \\ Number of loads & 660 & 170 & 830 \\ Units produced & 10,800 & 5,400 & 16,200 \end{tabular} a. Determine the activity rate for each activity. If required, round the rate to the nearest dollar. \begin{tabular}{lcc} Product & Total Activity Cost & Activity Cost Per Unit \\ \hline Entry Lighting Fixtures & $ & $ \\ Dining Room Lighting Fixtures & $ \end{tabular} Multiple production department factory overhead rate method The direct labor estimated for each production department was as follows: If required, round all per unit answers to the nearest cent. a. Determine the two production department factory overhead rates. Pattern department per dlh Cut and Sew department & per dlh b. Use the two production department factory overhead rates to determine the factory overhead per unit for each product. SmallgloveMediumgloveLargeglove$perunitperunitperunit If required, round all per unit answers to the nearest cent. a. Determine the plantwide factory overhead rate. $ per dlh b. Determine the factory overhead and direct labor cost per unit for each product. Kao Engines Inc. d. What does the report in (c) indicate to you? Pistons have the ? gross profit as a percent of sales. Pistons may require a price or cost to manufacture in order to achieve a higher profitability similar to the other two products. Single plantwide factory overhead rate Scrumptious Snacks Inc. manufactures three types of snack foods: tortilla chips, potato chips, and pretzels. The company has budgeted the following costs for the upcoming period: Factory overhead is allocated to the three products on the basis of processing hours. The products had the following production budget and processing hours per case: If required, round all per-case answers to the nearest cent. a. Determine the single plantwide factory overhead rate. per processing hour b. Use the overhead rate in (a) to determine the amount of total and per-case overhead allocated to each of the three products under generally accepted accounting principles. Single plantwide factory overhead rate budgeted production volume and direct labor hours per unit: If required, round all per unit answers to the nearest cent. a. Determine the single plantwide overhead rate. per direct labor hour b. Use the overhead rate in (a) to determine the amount of total and per-unit overhead allocated to each of the three products, Determine the total amount of factory overhead that should be allocated to hoses using machine hours as the allocation base Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started