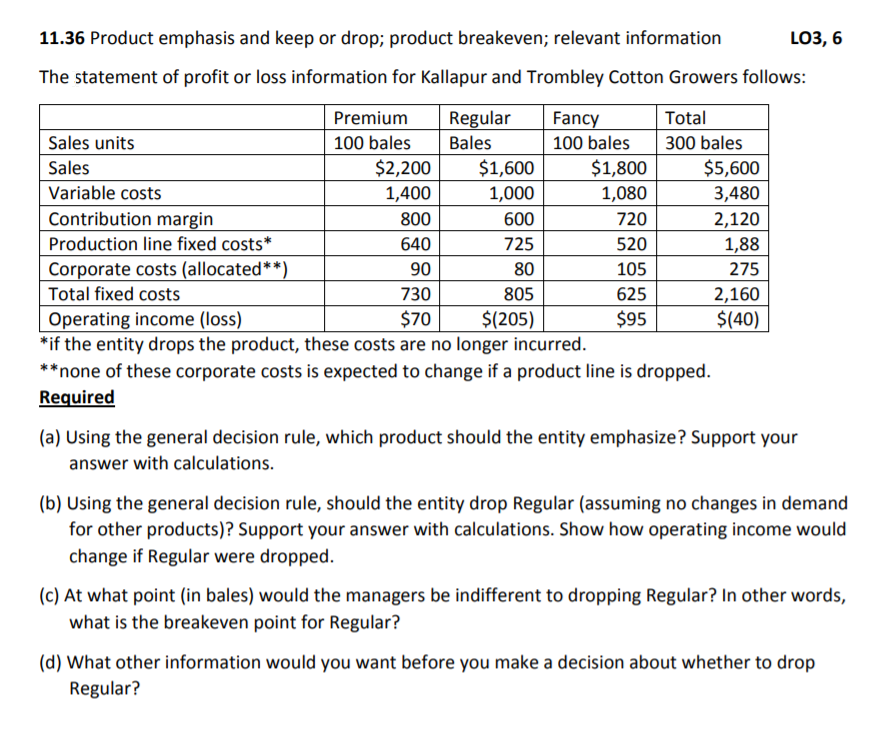

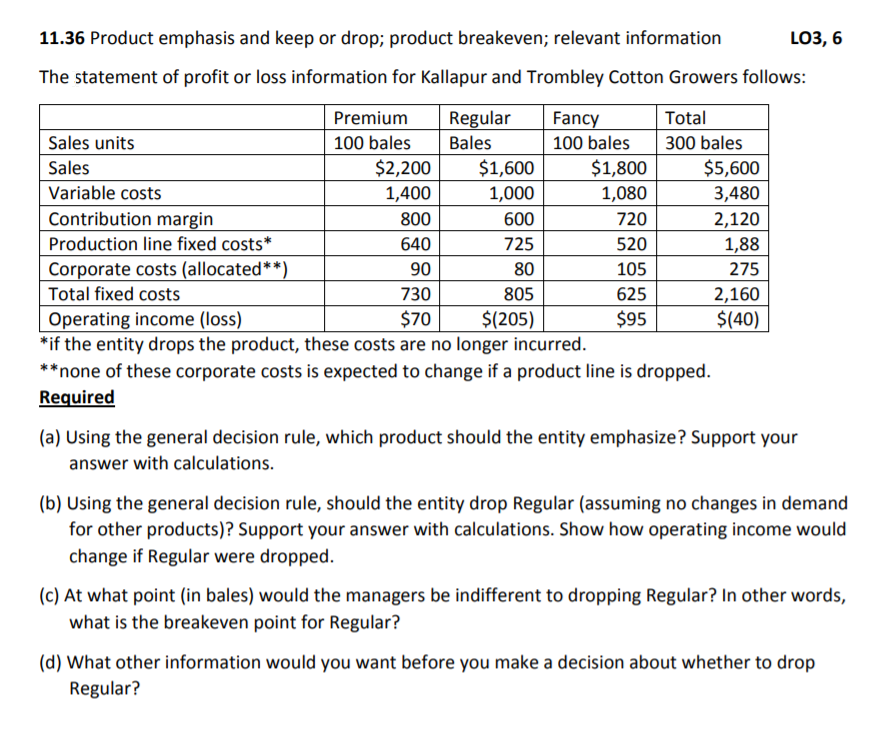

Product emphasis and keep or drop; product breakeven; relevant information. The statement of profit or loss information for Kallapur and Trombley Cotton Growers follows:

(a) Using the general decision rule, which product should the entity emphasize? Support your answer with calculations.

(b) Using the general decision rule, should the entity drop Regular (assuming no changes in demand for other products)? Support your answer with calculations. Show how operating income would change if Regular were dropped.

(c) At what point (in bales) would the managers be indifferent to dropping Regular? In other words, what is the breakeven point for Regular?

(d) What other information would you want before you make a decision about whether to drop Regular?

11.36 Product emphasis and keep or drop; product breakeven; relevant information LO3, 6 The statement of profit or loss information for Kallapur and Trombley Cotton Growers follows: Premium Regular Fancy Total 300 bales Sales units 100 bales Bales 100 bales $2,200 1,400 $1,600 1,000 $1,800 $5,600 Sales Variable costs 1,080 3,480 Contribution margin Production line fixed costs Corporate costs (allocated** Total fixed costs Operating income (loss) *if the entity drops the product, these costs are no longer incurred 2,120 1,88 800 600 720 640 725 520 90 80 105 275 730 805 625 2,160 $(40) $70 $(205) $95 *none of these corporate costs is expected to change if a product line is dropped. Required (a) Using the general decision rule, which product should the entity emphasize? Support your answer with calculations. (b) Using the general decision rule, should the entity drop Regular (assuming no changes in demand for other products)? Support your answer with calculations. Show how operating income would change if Regular were dropped (c) At what point (in bales) would the managers be indifferent to dropping Regular? In other words what is the breakeven point for Regular? (d) What other information would you want before you make a decision about whether to drop Regular? 11.36 Product emphasis and keep or drop; product breakeven; relevant information LO3, 6 The statement of profit or loss information for Kallapur and Trombley Cotton Growers follows: Premium Regular Fancy Total 300 bales Sales units 100 bales Bales 100 bales $2,200 1,400 $1,600 1,000 $1,800 $5,600 Sales Variable costs 1,080 3,480 Contribution margin Production line fixed costs Corporate costs (allocated** Total fixed costs Operating income (loss) *if the entity drops the product, these costs are no longer incurred 2,120 1,88 800 600 720 640 725 520 90 80 105 275 730 805 625 2,160 $(40) $70 $(205) $95 *none of these corporate costs is expected to change if a product line is dropped. Required (a) Using the general decision rule, which product should the entity emphasize? Support your answer with calculations. (b) Using the general decision rule, should the entity drop Regular (assuming no changes in demand for other products)? Support your answer with calculations. Show how operating income would change if Regular were dropped (c) At what point (in bales) would the managers be indifferent to dropping Regular? In other words what is the breakeven point for Regular? (d) What other information would you want before you make a decision about whether to drop Regular