Answered step by step

Verified Expert Solution

Question

1 Approved Answer

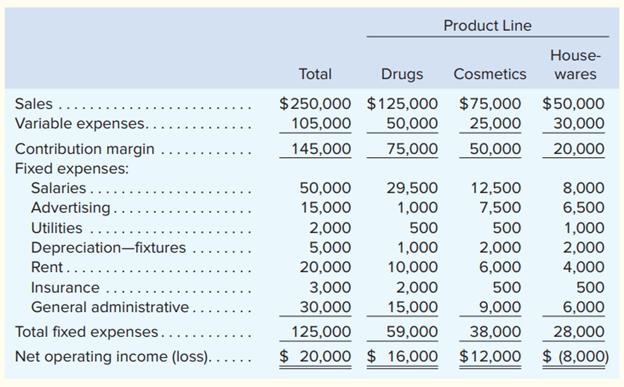

Product Line House- Total Drugs Cosmetics wares $250,000 $125,000 105,000 Sales.... $75,000 $50,000 Variable expenses.. 50,000 25,000 30,000 20,000 Contribution margin Fixed expenses: 145,000

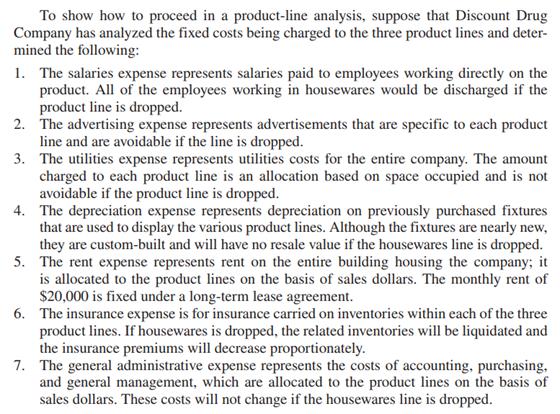

Product Line House- Total Drugs Cosmetics wares $250,000 $125,000 105,000 Sales.... $75,000 $50,000 Variable expenses.. 50,000 25,000 30,000 20,000 Contribution margin Fixed expenses: 145,000 75,000 50,000 Salaries... 50,000 29,500 12,500 8,000 1,000 500 Advertising. 15,000 7,500 6,500 Utilities 2,000 500 1,000 Depreciation-fixtures 5,000 20,000 1,000 2,000 2,000 Rent... 10,000 6,000 4,000 Insurance 3,000 2,000 500 500 General administrative. 9,000 6,000 28,000 38,000 $12,000 $ (8,000) 30,000 15,000 Total fixed expenses.. 59,000 125,000 $ 20,000 $ 16,000 Net operating income (loss). To show how to proceed in a product-line analysis, suppose that Discount Drug Company has analyzed the fixed costs being charged to the three product lines and deter- mined the following: 1. The salaries expense represents salaries paid to employees working directly on the product. All of the employees working in housewares would be discharged if the product line is dropped. 2. The advertising expense represents advertisements that are specific to each product line and are avoidable if the line is dropped. 3. The utilities expense represents utilities costs for the entire company. The amount charged to each product line is an allocation based on space occupied and is not avoidable if the product line is dropped. 4. The depreciation expense represents depreciation on previously purchased fixtures that are used to display the various product lines. Although the fixtures are nearly new, they are custom-built and will have no resale value if the housewares line is dropped. 5. The rent expense represents rent on the entire building housing the company; it is allocated to the product lines on the basis of sales dollars. The monthly rent of $20,000 is fixed under a long-term lease agreement. 6. The insurance expense is for insurance carried on inventories within each of the three product lines. If housewares is dropped, the related inventories will be liquidated and the insurance premiums will decrease proportionately. 7. The general administrative expense represents the costs of accounting, purchasing, and general management, which are allocated to the product lines on the basis of sales dollars. These costs will not change if the housewares line is dropped.

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started