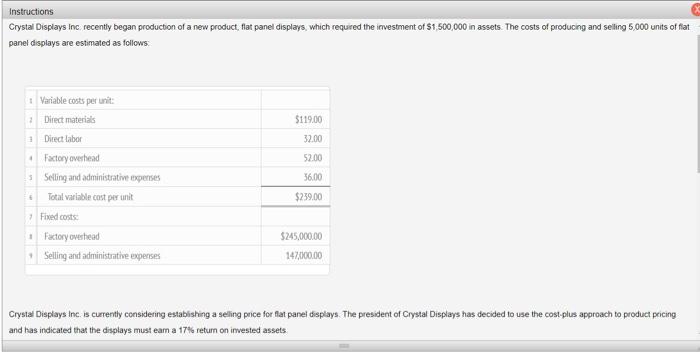

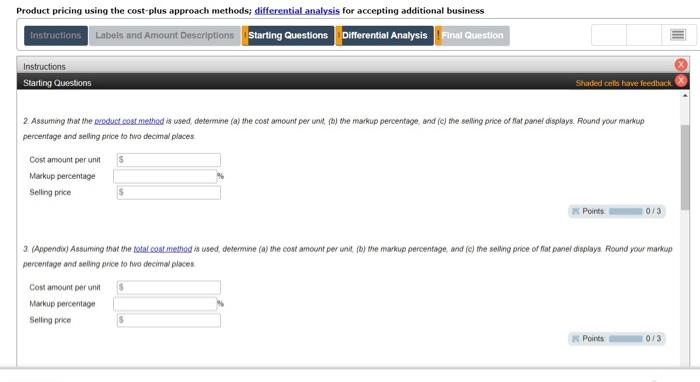

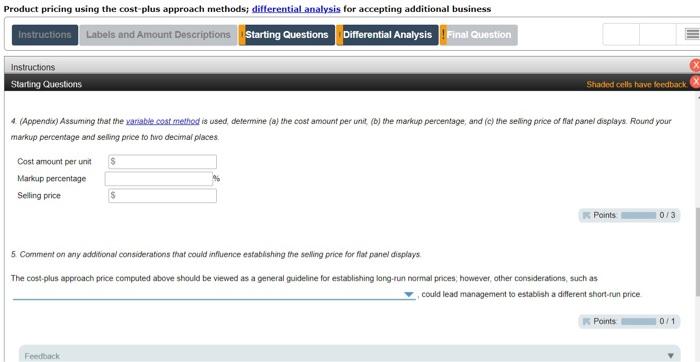

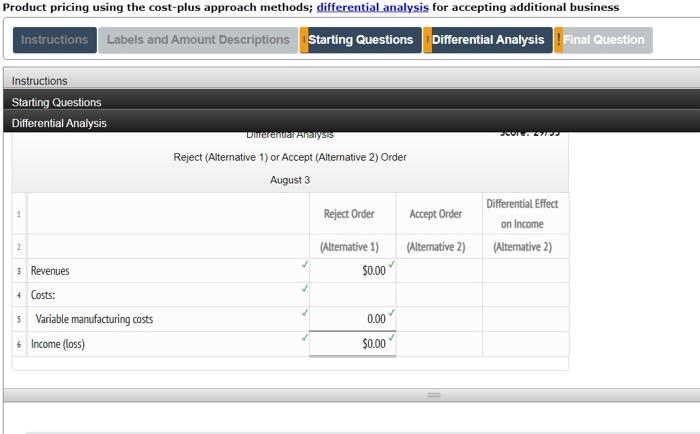

Product pricing using the cost-plus approach methods; differential analysis for accepting additional business Instructions Labels and Amount Descriptions Starting Questions Differential Analysis Final Question Instructions Starting Questions Shaded cells have feedback 2. Assuming that the product cost method is used determine (a) the cost amount perut (h) the markup percentage, and (c) the selling price or flat panel displays. Round your markup percentage and selling price to ho decimal places $ Cost amount per unit Markup percentage Selling price Points 0/3 2 (Appendix) Assuming that the total cost method is used determine (a) me cost amoemt per unit) me markup percentage, and (c) me seling price or at panel displays Round your markup percentage and selling price to vodeom places Cost amount per unit Markup percentage Selling price 5 Points 0/3 Product pricing using the cost-plus approach methods; differential analysis for accepting additional business Instructions Labels and Amount Descriptions Starting Questions Differential Analysis Final Question Instructions Starting Questions Shaded cells have feedback 4. (Appender) Assuming that the variable cost method is used determine (a) the cost amount per unit (b) the markup percentage, and (c) the selling price of fat panel displays. Round your markup percentage and selling price to hvo decimal places Cost amount per unit Markup percentage Selling price S Points 0/3 5. Comment on any additional considerations that could influence establishing the selling price for flat panel displays The cost-plus approach price computed above should be viewed as a general guideline for establishing long-run normal prices, however, other considerations, such as could lead management to establish a different short-run price Points 0/1 Feedback Product pricing using the cost-plus approach methods; differential analysis for accepting additional business Instructions Labels and Amount Descriptions Starting Questions Differential Analysis Final Question Instructions Starting Questions Differential Analysis Durerendal Analysis Reject (Alternative 1) or Accept (Alternative 2) Order August 3 Reject Order Accept Order Differential Effect on Income (Alternative 2) 2 (Alternative 1) (Alternative 2) 3 Revenues $0.00 + Costs: 5 Variable manufacturing costs 6 Income (Loss) 0.00 $0.00