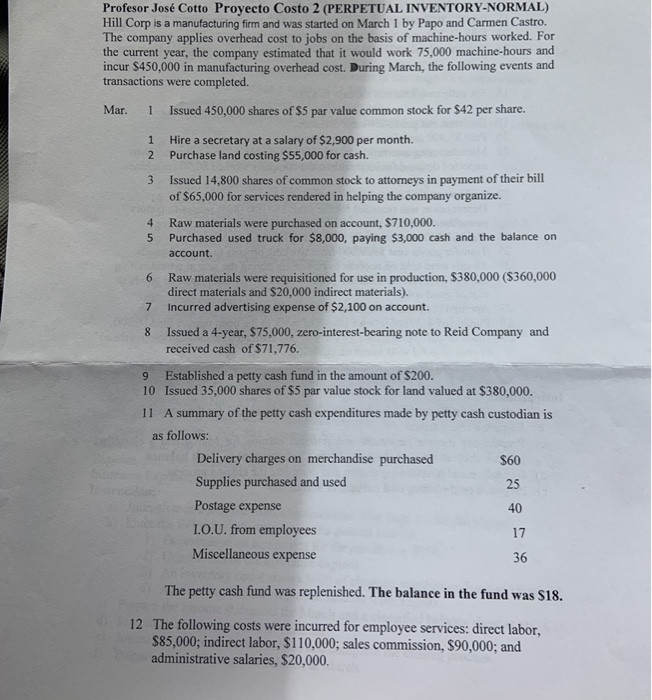

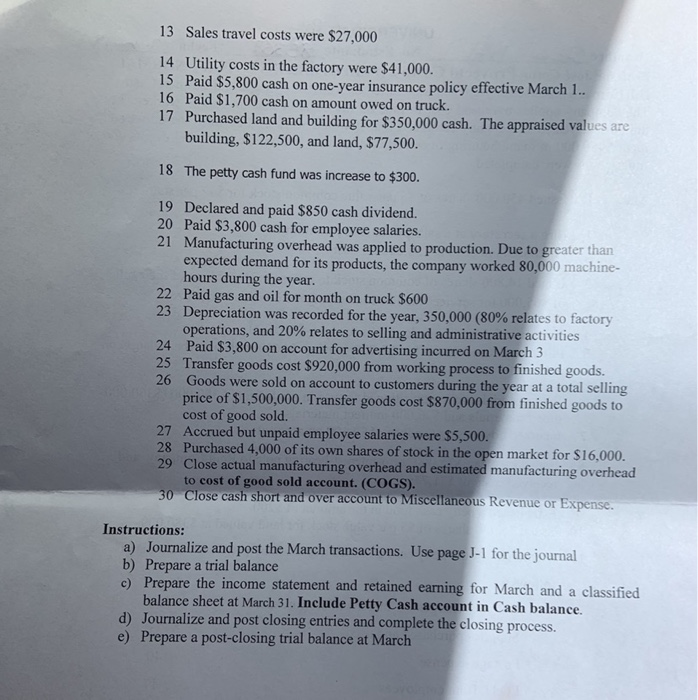

Profesor Jos Cotto Proyecto Costo 2 (PERPETUAL INVENTORY-NORMAL) Hill Corp is a manufacturing firm and was started on March 1 by Papo and Carmen Castro. The company applies overhead cost to jobs on the basis of machine-hours worked. For the current year, the company estimated that it would work 75.000 machine-hours and incur $450,000 in manufacturing overhead cost. During March, the following events and transactions were completed. Mar. 1 Issued 450,000 shares of $5 par value common stock for $42 per share. 1 2 Hire a secretary at a salary of $2,900 per month. Purchase land costing $55,000 for cash. 3 Issued 14,800 shares of common stock to attorneys in payment of their bill of $65,000 for services rendered in helping the company organize. 4 5 Raw materials were purchased on account, $710,000. Purchased used truck for $8,000, paying $3,000 cash and the balance on account. 6 7 Raw materials were requisitioned for use in production, $380,000 ($360,000 direct materials and $20,000 indirect materials). incurred advertising expense of $2,100 on account. Issued a 4-year, $75,000, zero-interest-bearing note to Reid Company and received cash of $71,776. 8 9 Established a petty cash fund in the amount of $200. 10 Issued 35,000 shares of $5 par value stock for land valued at $380,000. 11 A summary of the petty cash expenditures made by petty cash custodian is as follows: Delivery charges on merchandise purchased Supplies purchased and used Postage expense I.O.U. from employees Miscellaneous expense 36 The petty cash fund was replenished. The balance in the fund was $18. 12 The following costs were incurred for employee services: direct labor, $85,000; indirect labor, $110,000; sales commission, $90,000; and administrative salaries, $20,000. 13 Sales travel costs were $27,000 14 Utility costs in the factory were $41,000. 15 Paid $5,800 cash on one-year insurance policy effective March 1.. 16 Paid $1,700 cash on amount owed on truck. 17 Purchased land and building for $350,000 cash. The appraised values are building, $122,500, and land, $77,500. 18 The petty cash fund was increase to $300. 19 Declared and paid $850 cash dividend. 20 Paid $3,800 cash for employee salaries. 21 Manufacturing overhead was applied to production. Due to greater than expected demand for its products, the company worked 80,000 machine- hours during the year. 22 Paid gas and oil for month on truck $600 23 Depreciation was recorded for the year, 350,000 (80% relates to factory operations, and 20% relates to selling and administrative activities 24 Paid $3,800 on account for advertising incurred on March 3 25 Transfer goods cost $920,000 from working process to finished goods. 26 Goods were sold on account to customers during the year at a total selling price of $1,500,000. Transfer goods cost $870,000 from finished goods to cost of good sold. 27 Accrued but unpaid employee salaries were $5,500. 28 Purchased 4,000 of its own shares of stock in the open market for $16.000. 29 Close actual manufacturing overhead and estimated manufacturing overhead to cost of good sold account. (COGS). 30 Close cash short and over account to Miscellaneous Revenue or Expense. Instructions: a) Journalize and post the March transactions. Use page J-1 for the journal b) Prepare a trial balance c) Prepare the income statement and retained earning for March and a classified balance sheet at March 31. Include Petty Cash account in Cash balance. d) Journalize and post closing entries and complete the closing process. e) Prepare a post-closing trial balance at March Profesor Jos Cotto Proyecto Costo 2 (PERPETUAL INVENTORY-NORMAL) Hill Corp is a manufacturing firm and was started on March 1 by Papo and Carmen Castro. The company applies overhead cost to jobs on the basis of machine-hours worked. For the current year, the company estimated that it would work 75.000 machine-hours and incur $450,000 in manufacturing overhead cost. During March, the following events and transactions were completed. Mar. 1 Issued 450,000 shares of $5 par value common stock for $42 per share. 1 2 Hire a secretary at a salary of $2,900 per month. Purchase land costing $55,000 for cash. 3 Issued 14,800 shares of common stock to attorneys in payment of their bill of $65,000 for services rendered in helping the company organize. 4 5 Raw materials were purchased on account, $710,000. Purchased used truck for $8,000, paying $3,000 cash and the balance on account. 6 7 Raw materials were requisitioned for use in production, $380,000 ($360,000 direct materials and $20,000 indirect materials). incurred advertising expense of $2,100 on account. Issued a 4-year, $75,000, zero-interest-bearing note to Reid Company and received cash of $71,776. 8 9 Established a petty cash fund in the amount of $200. 10 Issued 35,000 shares of $5 par value stock for land valued at $380,000. 11 A summary of the petty cash expenditures made by petty cash custodian is as follows: Delivery charges on merchandise purchased Supplies purchased and used Postage expense I.O.U. from employees Miscellaneous expense 36 The petty cash fund was replenished. The balance in the fund was $18. 12 The following costs were incurred for employee services: direct labor, $85,000; indirect labor, $110,000; sales commission, $90,000; and administrative salaries, $20,000. 13 Sales travel costs were $27,000 14 Utility costs in the factory were $41,000. 15 Paid $5,800 cash on one-year insurance policy effective March 1.. 16 Paid $1,700 cash on amount owed on truck. 17 Purchased land and building for $350,000 cash. The appraised values are building, $122,500, and land, $77,500. 18 The petty cash fund was increase to $300. 19 Declared and paid $850 cash dividend. 20 Paid $3,800 cash for employee salaries. 21 Manufacturing overhead was applied to production. Due to greater than expected demand for its products, the company worked 80,000 machine- hours during the year. 22 Paid gas and oil for month on truck $600 23 Depreciation was recorded for the year, 350,000 (80% relates to factory operations, and 20% relates to selling and administrative activities 24 Paid $3,800 on account for advertising incurred on March 3 25 Transfer goods cost $920,000 from working process to finished goods. 26 Goods were sold on account to customers during the year at a total selling price of $1,500,000. Transfer goods cost $870,000 from finished goods to cost of good sold. 27 Accrued but unpaid employee salaries were $5,500. 28 Purchased 4,000 of its own shares of stock in the open market for $16.000. 29 Close actual manufacturing overhead and estimated manufacturing overhead to cost of good sold account. (COGS). 30 Close cash short and over account to Miscellaneous Revenue or Expense. Instructions: a) Journalize and post the March transactions. Use page J-1 for the journal b) Prepare a trial balance c) Prepare the income statement and retained earning for March and a classified balance sheet at March 31. Include Petty Cash account in Cash balance. d) Journalize and post closing entries and complete the closing process. e) Prepare a post-closing trial balance at March