Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Professional Analytics Corp. purchased machinery on February 27, 2006 for $900,000. The double declining balance method was used and the estimated economic useful life

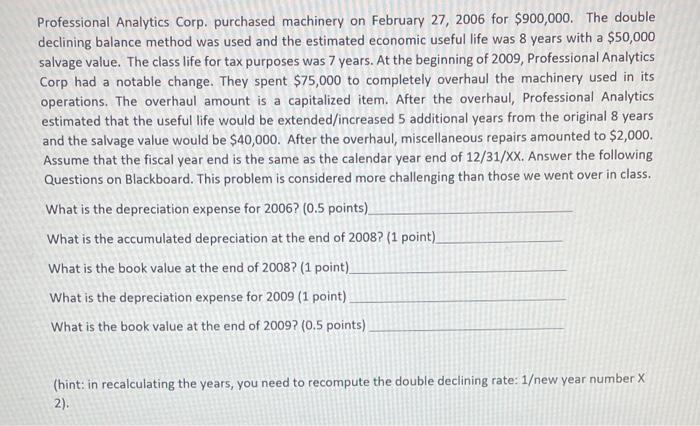

Professional Analytics Corp. purchased machinery on February 27, 2006 for $900,000. The double declining balance method was used and the estimated economic useful life was 8 years with a $50,000 salvage value. The class life for tax purposes was 7 years. At the beginning of 2009, Professional Analytics Corp had a notable change. They spent $75,000 to completely overhaul the machinery used in its operations. The overhaul amount is a capitalized item. After the overhaul, Professional Analytics estimated that the useful life would be extended/increased 5 additional years from the original 8 years and the salvage value would be $40,000. After the overhaul, miscellaneous repairs amounted to $2,000. Assume that the fiscal year end is the same as the calendar year end of 12/31/XX. Answer the following Questions on Blackboard. This problem is considered more challenging than those we went over in class. What is the depreciation expense for 2006? (0.5 points) What is the accumulated depreciation at the end of 2008? (1 point) What is the book value at the end of 2008? (1 point) What is the depreciation expense for 2009 (1 point) What is the book value at the end of 2009? (0.5 points) (hint: in recalculating the years, you need to recompute the double declining rate: 1/new year number X 2).

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense and book value for the given scenarios we need to apply the double declining balance method Lets go through each question step by step 1 Depreciation expense for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started