Answered step by step

Verified Expert Solution

Question

1 Approved Answer

professor gave only one sheet. CLASS EXERCISE The management of The Grissom Company has decided to acquire the use of production machinery that is manufactured

professor gave only one sheet.

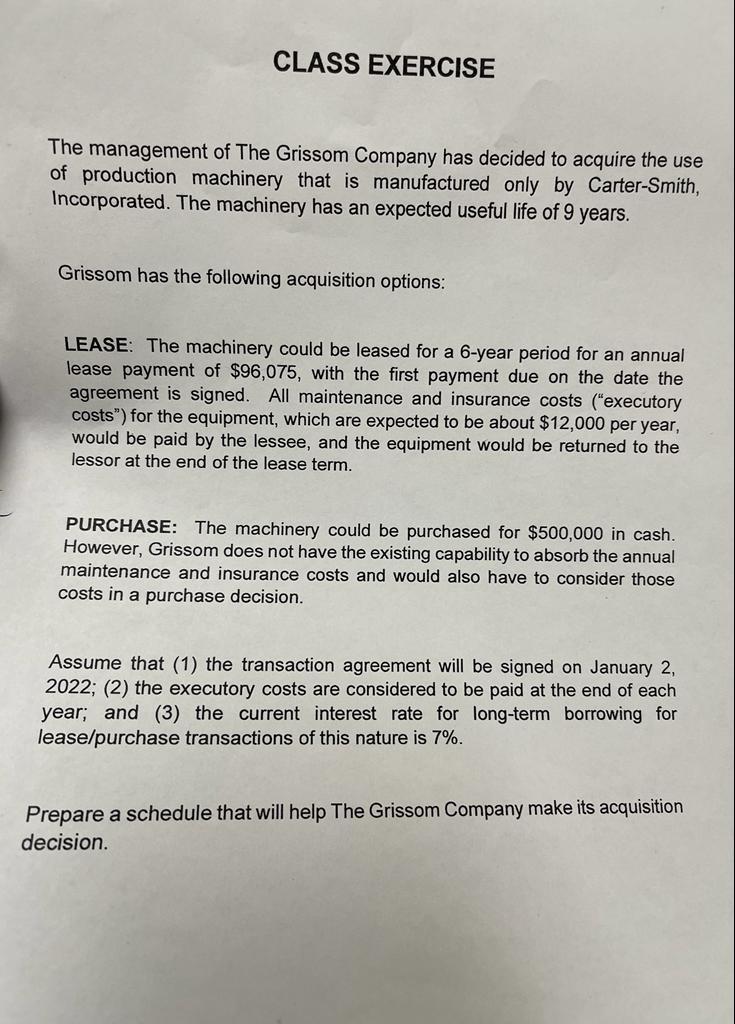

CLASS EXERCISE The management of The Grissom Company has decided to acquire the use of production machinery that is manufactured only by Carter-Smith, Incorporated. The machinery has an expected useful life of 9 years. Grissom has the following acquisition options: LEASE: The machinery could be leased for a 6-year period for an annual lease payment of $96,075, with the first payment due on the date the agreement is signed. All maintenance and insurance costs ("executory costs") for the equipment, which are expected to be about $12,000 per year, would be paid by the lessee, and the equipment would be returned to the lessor at the end of the lease term. PURCHASE: The machinery could be purchased for $500,000 in cash. However, Grissom does not have the existing capability to absorb the annual maintenance and insurance costs and would also have to consider those costs in a purchase decision. Assume that (1) the transaction agreement will be signed on January 2, 2022; (2) the executory costs are considered to be paid at the end of each year; and (3) the current interest rate for long-term borrowing for lease/purchase transactions of this nature is 7%. Prepare a schedule that will help The Grissom Company make its acquisition decision. CLASS EXERCISE The management of The Grissom Company has decided to acquire the use of production machinery that is manufactured only by Carter-Smith, Incorporated. The machinery has an expected useful life of 9 years. Grissom has the following acquisition options: LEASE: The machinery could be leased for a 6-year period for an annual lease payment of $96,075, with the first payment due on the date the agreement is signed. All maintenance and insurance costs ("executory costs") for the equipment, which are expected to be about $12,000 per year, would be paid by the lessee, and the equipment would be returned to the lessor at the end of the lease term. PURCHASE: The machinery could be purchased for $500,000 in cash. However, Grissom does not have the existing capability to absorb the annual maintenance and insurance costs and would also have to consider those costs in a purchase decision. Assume that (1) the transaction agreement will be signed on January 2, 2022; (2) the executory costs are considered to be paid at the end of each year; and (3) the current interest rate for long-term borrowing for lease/purchase transactions of this nature is 7%. Prepare a schedule that will help The Grissom Company make its acquisition decisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started