Question

Saly and Jena formed a partnership with capital contributions of $300,000 and $400,000, respectively. Their partnership agreement calls dividing net income or loss in

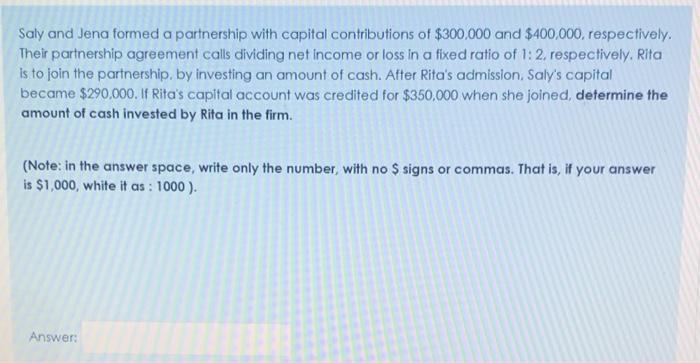

Saly and Jena formed a partnership with capital contributions of $300,000 and $400,000, respectively. Their partnership agreement calls dividing net income or loss in a fixed ratio of 1: 2, respectively. Rita is to join the partnership, by investing an amount of cash. After Rita's admission, Saly's capital became $290,000. If Rita's capital account was credited for $350,000 when she joined, determine the amount of cash invested by Rita in the firm. (Note: in the answer space, write only the number, with no $ signs or commas. That is, if your answer is $1,000, white it as : 1000). Answer:

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Answer 1 320000 WORKING Salys Capi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App