Question: Professor Schulman ACC 203 Problem 1. Accounting equation. a. Office Store has assets equal to $ 123,000 and liabilities equal to $ 47,000 at year-

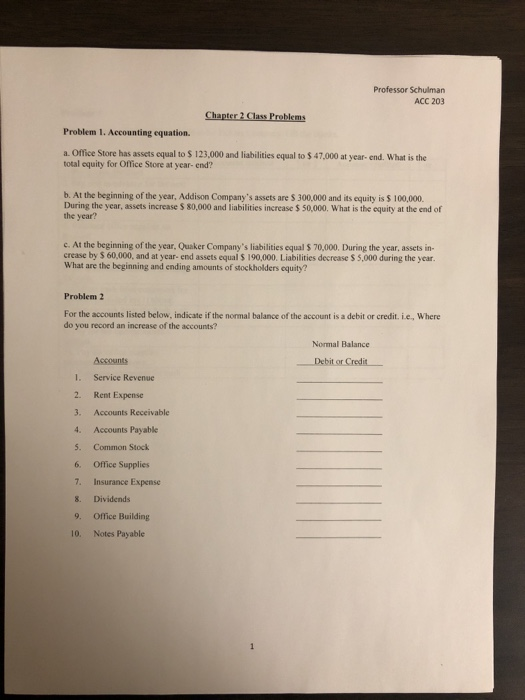

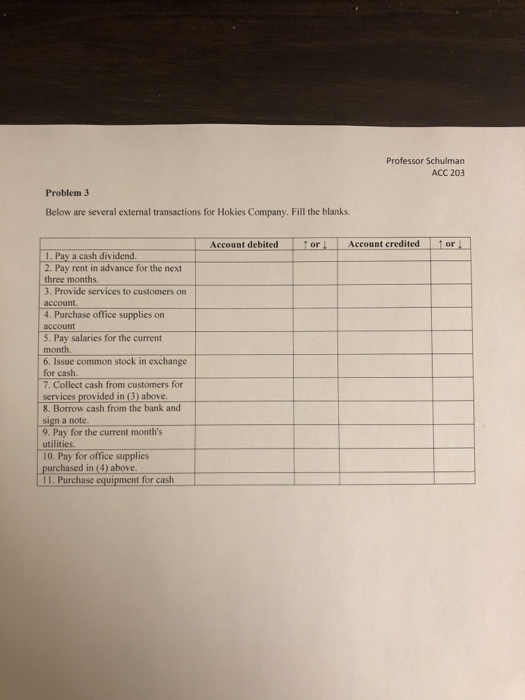

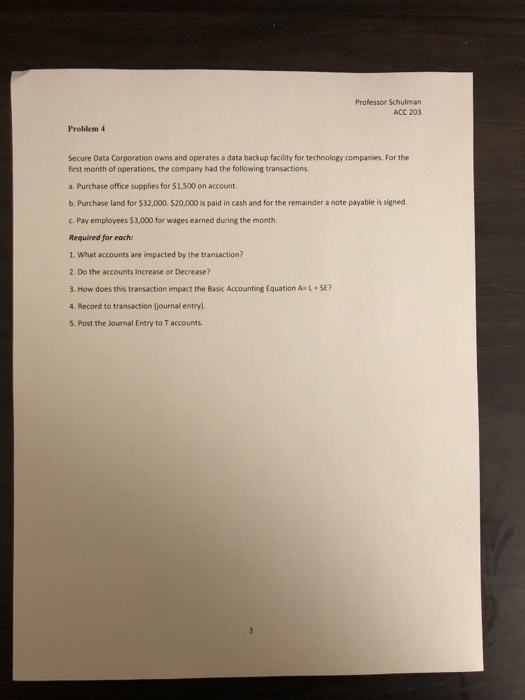

Professor Schulman ACC 203 Problem 1. Accounting equation. a. Office Store has assets equal to $ 123,000 and liabilities equal to $ 47,000 at year- end. What is the total equity for Office Store at year- end? b. At the beginning of the year, Addison Company's assets are S 300,000 and its equity is $ 100,000 During the year, assets increase S 80,000 and liabilities increase S 50,000. What is the equity at the end of the year? c. At the beginning of the year, Quaker Company's liabilities equal $ 70,000. During the year, assets in- crease by $ 60,000, and at year-end assets equal $ 190,000. Liabilities decrease S 5,000 during the year. What are the beginning and ending amounts of stockholders equity? Problem 2 For the accounts listed below, indicate if the normal balance of the account is a debit or credit. i.e, Where do you record an increase of the accounts? Normal Balance Accounts I. Service Revenue 2. Rent Expense 3. Accounts Receivable 4. Accounts Payable 5. Common Stock 6. Office Supplies 7. Insurance Expense 8. Dividends 9. Office Building 10. Notes Payable Professor Schulman ACC 203 Problem 3 Below are several external transactions for Hokies Company. Fill the blanks. Account debited or I Account eredited for 1. Pay a cash dividend. 2. Pay rent in advance for the next three months 3. Provide services to customers on account. 4. Purchase office supplies on account 5. Pay salaries for the current month 6. Issue common stock in exchange for cash. 7. Collect cash from customers for services provided in (3) above. 8. Borrow cash from the bank and sign a note 9. Pay for the current month's utilities. 10. Pay for office supplies purchased in (4) above. II. Purchase equipment for cash Professor Schulman ACC 203 Problem 4 Secure Data Corporation owns and operates a data backup facility for technology companies. For the first month of operations, the company had the following transactions a. Purchase office supplies for $1,500 on account b. Purchase land for $32,000. $20,000 is paid in cash and for the remainder a note payable is signed c. Pay employees $3,000 for wages earned during the month Required for each: 1. What accounts are impacted by the transaction? 2. Do the accounts Increase or Decrease? 3. How does this transaction impact the Basic Accounting Equation A L SE? 4. Record to transaction (journal entry) S. Post the Journal Entry to T accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts