Answered step by step

Verified Expert Solution

Question

1 Approved Answer

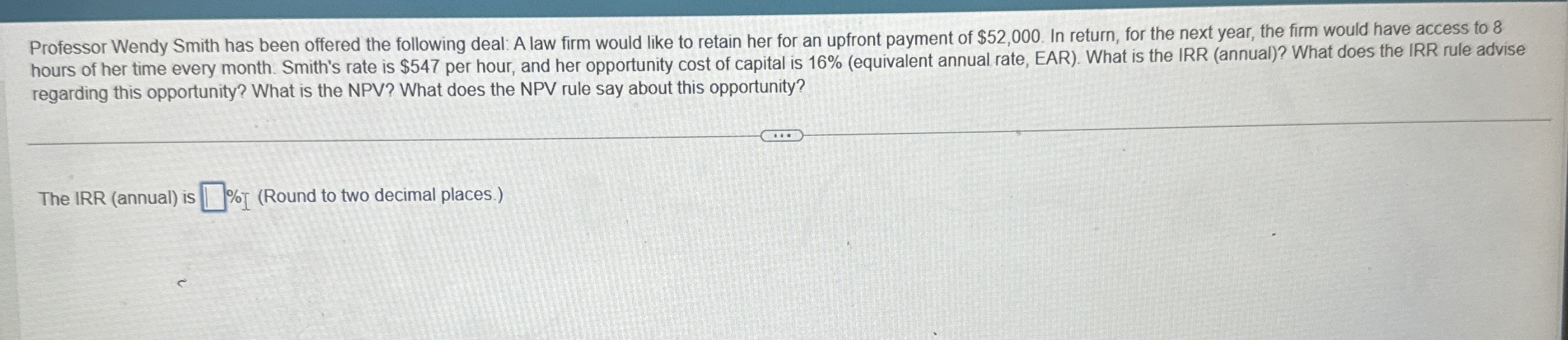

Professor Wendy Smith has been offered the following deal: A law firm would like to retain her for an upfront payment of $ 5 2

Professor Wendy Smith has been offered the following deal: A law firm would like to retain her for an upfront payment of $ In return, for the next year, the firm would have access to

hours of her time every month. Smith's rate is $ per hour, and her opportunity cost of capital is equivalent annual rate, EAR What is the IRR annual What does the IRR rule advise

regarding this opportunity? What is the NPV What does the NPV rule say about this opportunity?

The IRR annual is

Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started