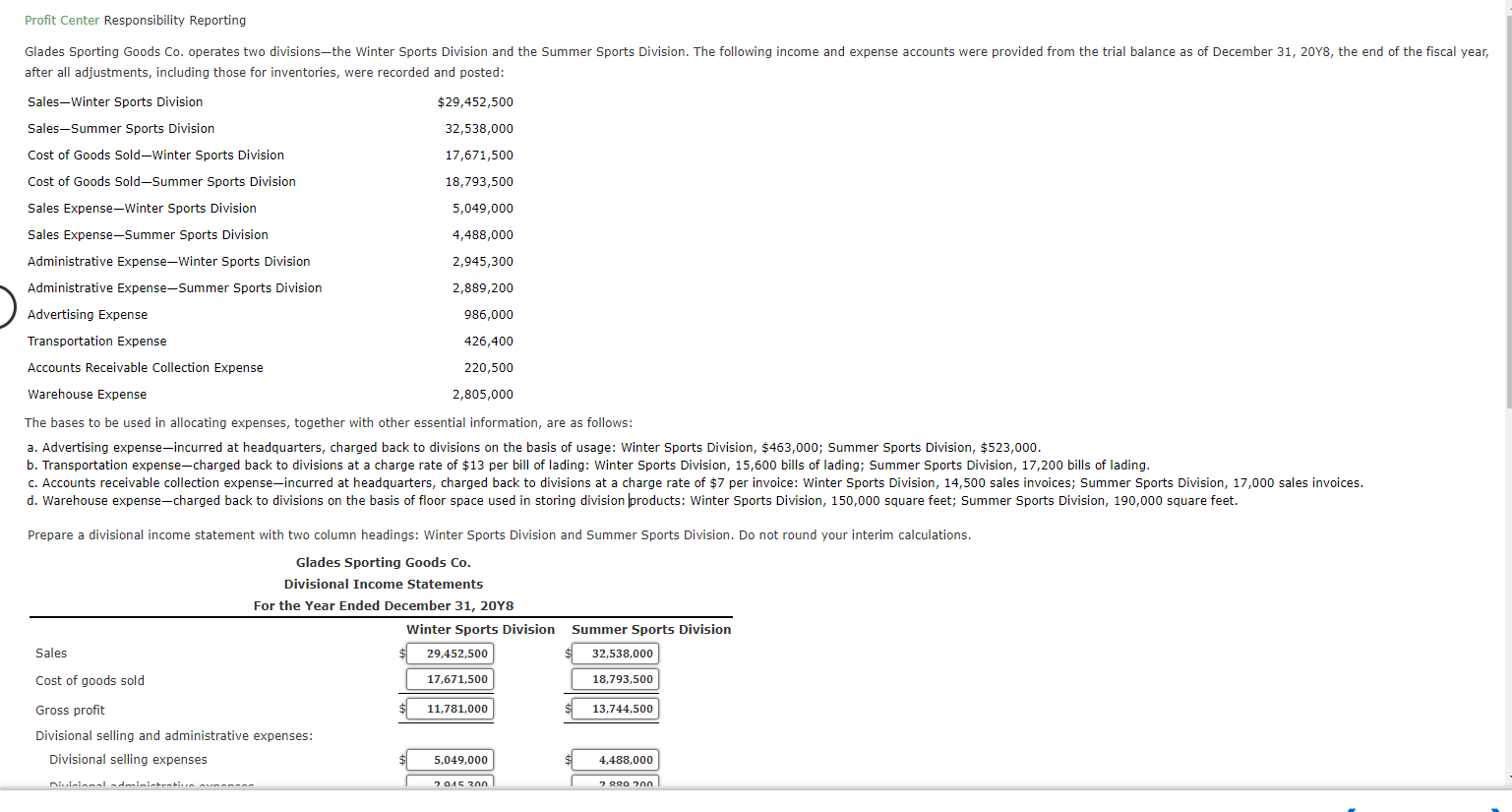

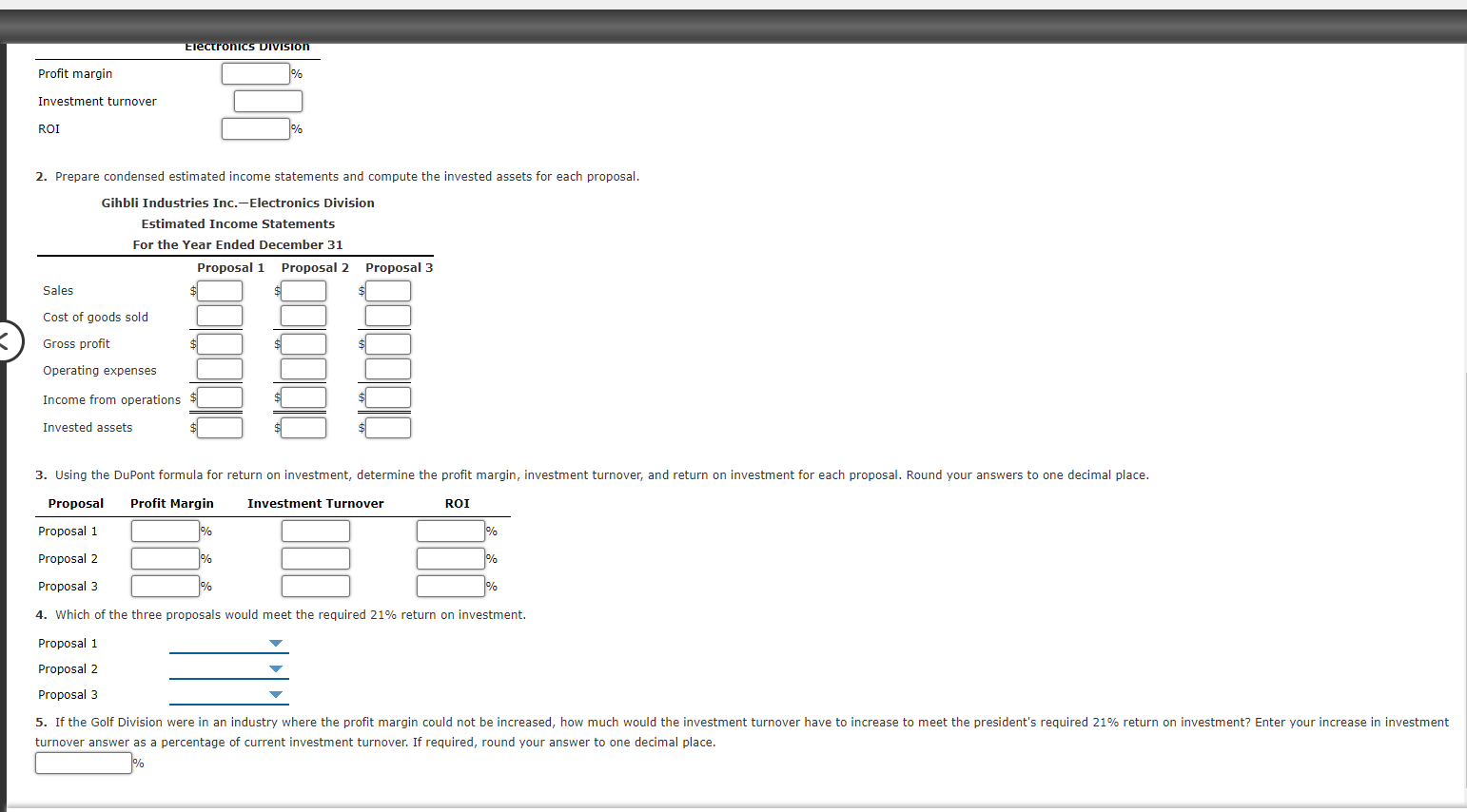

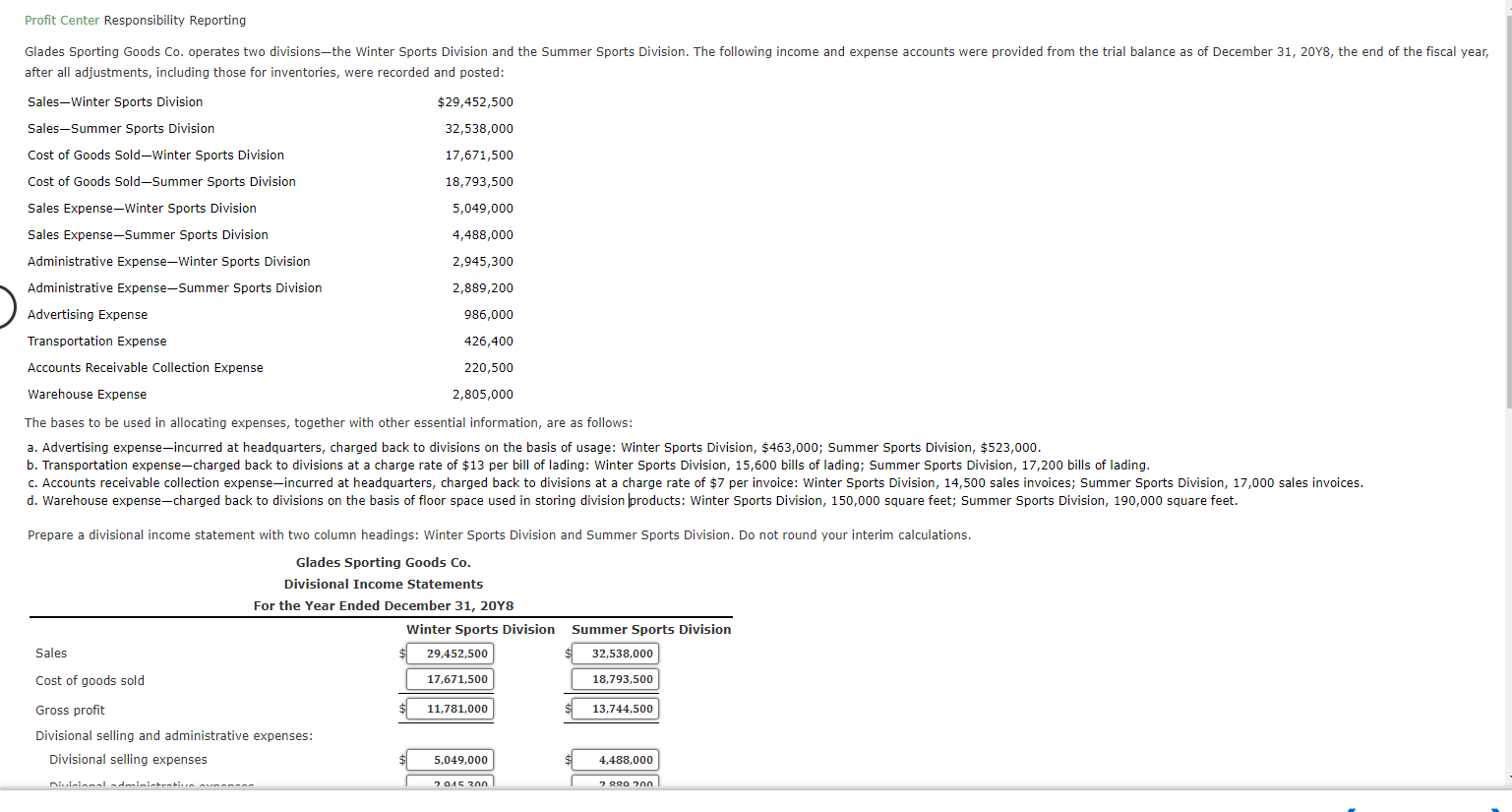

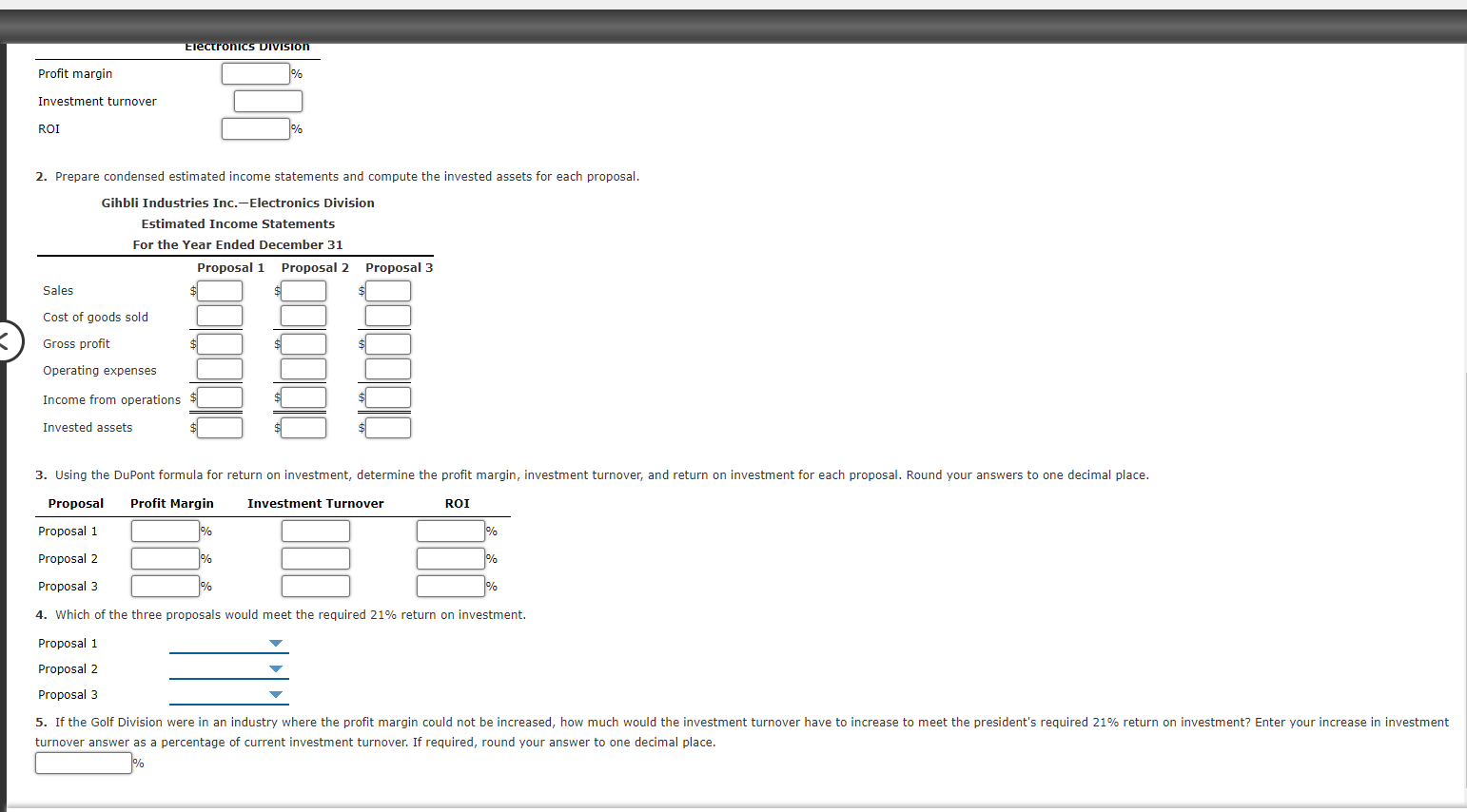

Profit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisionsthe Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: $29,452,500 Sales-Winter Sports Division Sales-Summer Sports Division Cost of Goods Sold-Winter Sports Division 32,538,000 17,671,500 18,793,500 5,049,000 4,488,000 Cost of Goods Sold-Summer Sports Division Sales Expense-Winter Sports Division Sales Expense-Summer Sports Division Administrative Expense-Winter Sports Division Administrative Expense-Summer Sports Division Advertising Expense Transportation Expense 2,945,300 2,889,200 986,000 426,400 Accounts Receivable Collection Expense 220,500 Warehouse Expense 2,805,000 The bases to be used in allocating expenses, together with other essential information, are as follows: a. Advertising expense-incurred at headquarters, charged back to divisions on the basis of usage: Winter Sports Division, $463,000; Summer Sports Division, $523,000. b. Transportation expense-charged back to divisions at a charge rate of $13 per bill of lading: Winter Sports Division, 15,600 bills of lading; Summer Sports Division, 17,200 bills of lading. c. Accounts receivable collection expense-incurred at headquarters, charged back to divisions at a charge rate of $7 per invoice: Winter Sports Division, 14,500 sales invoices; Summer Sports Division, 17,000 sales invoices. d. Warehouse expense-charged back to divisions on the basis of floor space used in storing division products: Winter Sports Division, 150,000 square feet; Summer Sports Division, 190,000 square feet. Prepare a divisional income statement with two column headings: Winter Sports Division and Summer Sports Division. Do not round your interim calculations. Glades Sporting Goods Co. Divisional Income Statements For the Year Ended December 31, 2018 Winter Sports Division Summer Sports Division 29,452,500 32,538,000 Sales Cost of goods sold 17,671,500 18,793,500 11,781,000 13,744,500 Gross profit Divisional selling and administrative expenses: Divisional selling expenses 5,049,000 4,488,000 Dennlinistrati.. RANDOM 2015 20 2 890 700 Electronics Division Profit margin Investment turnover ROI 1% 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. Gibbli Industries Inc.-Electronics Division Estimated Income Statements For the Year Ended December 31 Proposal 1 Proposal 2 Proposal 3 Sales Cost of goods sold Gross profit $ $ Operating expenses Income from operations Invested assets 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round your answers to one decimal place. Proposal Profit Margin Investment Turnover ROI Proposal 1 Proposal 2 Proposal 3 4. Which of the three proposals would meet the required 21% return on investment. Proposal 1 Proposal 2 Proposal 3 5. If the Golf Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 21% return on investment? Enter your increase in investment turnover answer as a percentage of current investment turnover. If required, round your answer to one decimal place. Profit Center Responsibility Reporting Glades Sporting Goods Co. operates two divisionsthe Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y8, the end of the fiscal year, after all adjustments, including those for inventories, were recorded and posted: $29,452,500 Sales-Winter Sports Division Sales-Summer Sports Division Cost of Goods Sold-Winter Sports Division 32,538,000 17,671,500 18,793,500 5,049,000 4,488,000 Cost of Goods Sold-Summer Sports Division Sales Expense-Winter Sports Division Sales Expense-Summer Sports Division Administrative Expense-Winter Sports Division Administrative Expense-Summer Sports Division Advertising Expense Transportation Expense 2,945,300 2,889,200 986,000 426,400 Accounts Receivable Collection Expense 220,500 Warehouse Expense 2,805,000 The bases to be used in allocating expenses, together with other essential information, are as follows: a. Advertising expense-incurred at headquarters, charged back to divisions on the basis of usage: Winter Sports Division, $463,000; Summer Sports Division, $523,000. b. Transportation expense-charged back to divisions at a charge rate of $13 per bill of lading: Winter Sports Division, 15,600 bills of lading; Summer Sports Division, 17,200 bills of lading. c. Accounts receivable collection expense-incurred at headquarters, charged back to divisions at a charge rate of $7 per invoice: Winter Sports Division, 14,500 sales invoices; Summer Sports Division, 17,000 sales invoices. d. Warehouse expense-charged back to divisions on the basis of floor space used in storing division products: Winter Sports Division, 150,000 square feet; Summer Sports Division, 190,000 square feet. Prepare a divisional income statement with two column headings: Winter Sports Division and Summer Sports Division. Do not round your interim calculations. Glades Sporting Goods Co. Divisional Income Statements For the Year Ended December 31, 2018 Winter Sports Division Summer Sports Division 29,452,500 32,538,000 Sales Cost of goods sold 17,671,500 18,793,500 11,781,000 13,744,500 Gross profit Divisional selling and administrative expenses: Divisional selling expenses 5,049,000 4,488,000 Dennlinistrati.. RANDOM 2015 20 2 890 700 Electronics Division Profit margin Investment turnover ROI 1% 2. Prepare condensed estimated income statements and compute the invested assets for each proposal. Gibbli Industries Inc.-Electronics Division Estimated Income Statements For the Year Ended December 31 Proposal 1 Proposal 2 Proposal 3 Sales Cost of goods sold Gross profit $ $ Operating expenses Income from operations Invested assets 3. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment for each proposal. Round your answers to one decimal place. Proposal Profit Margin Investment Turnover ROI Proposal 1 Proposal 2 Proposal 3 4. Which of the three proposals would meet the required 21% return on investment. Proposal 1 Proposal 2 Proposal 3 5. If the Golf Division were in an industry where the profit margin could not be increased, how much would the investment turnover have to increase to meet the president's required 21% return on investment? Enter your increase in investment turnover answer as a percentage of current investment turnover. If required, round your answer to one decimal place