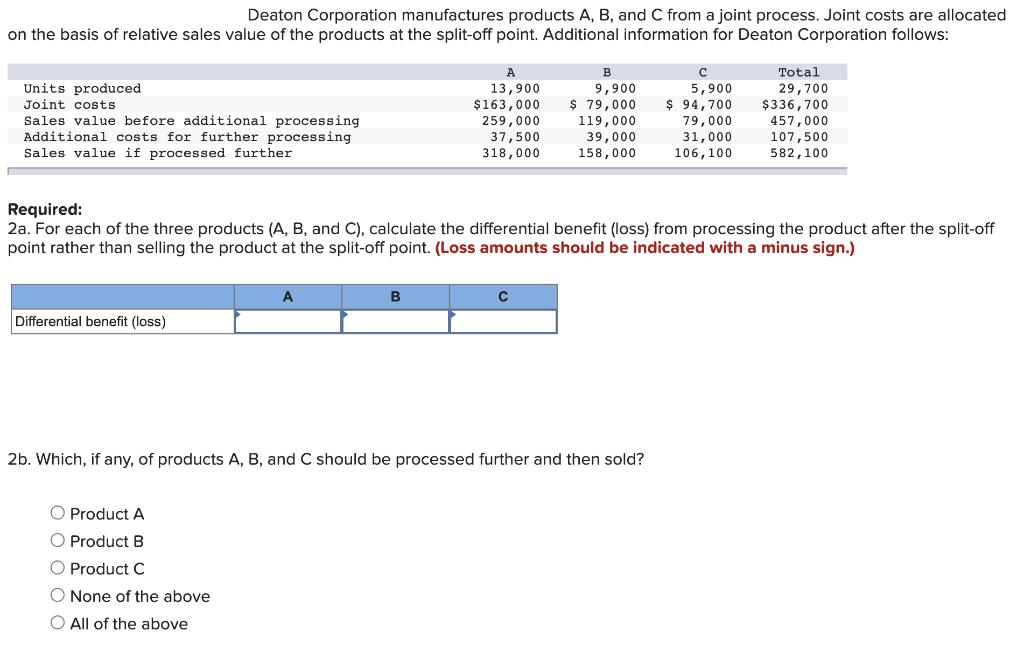

Deaton Corporation manufactures products A, B, and C from a joint process. Joint costs are allocated on the basis of relative sales value of

Deaton Corporation manufactures products A, B, and C from a joint process. Joint costs are allocated on the basis of relative sales value of the products at the split-off point. Additional information for Deaton Corporation follows: Total Units produced Joint costs 13,900 $163,000 259,000 37,500 318,000 9,900 $ 79,000 5,900 $ 94,700 79,000 31,000 29,700 $336,700 457,000 107,500 582,100 Sales value before additional processing Additional costs for further processing 119,000 39,000 Sales value if processed further 158,000 106,100 Required: 2a. For each of the three products (A, B, and C), calculate the differential benefit (loss) from processing the product after the split-off point rather than selling the product at the split-off point. (Loss amounts should be indicated with a minus sign.) B Differential benefit (loss) 2b. Which, if any, of products A, B, and C should be processed further and then sold? O Product A O Product B Product C O None of the above O All of the above O O

Step by Step Solution

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

2a A Sales value if processed further Sales value before ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started