Answered step by step

Verified Expert Solution

Question

1 Approved Answer

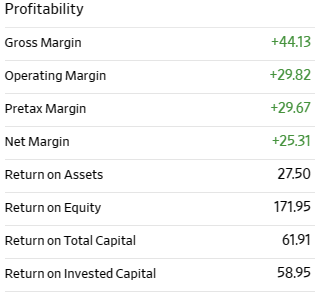

Profitability Gross Margin +44.13 Operating Margin +29.82 Pretax Margin +29.67 Net Margin +25.31 Return on Assets 27.50 Return on Equity 171.95 Return on Total

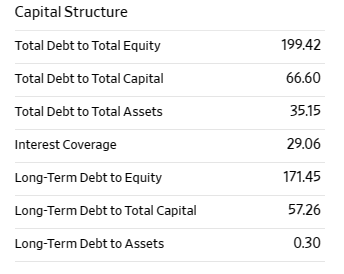

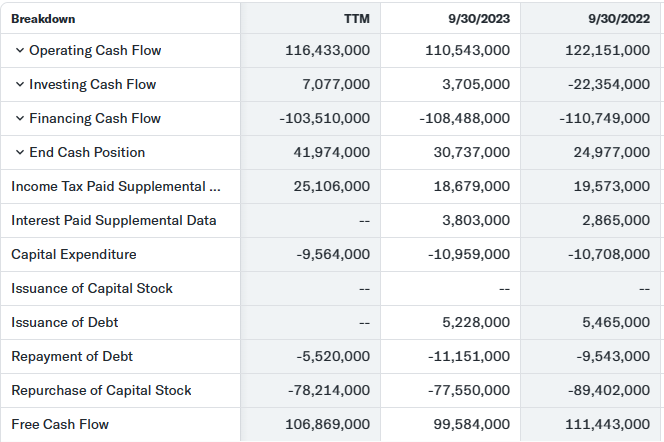

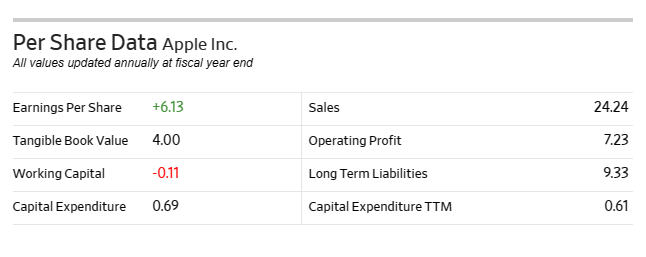

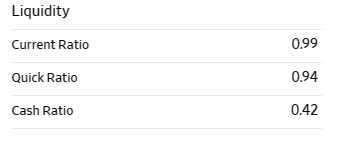

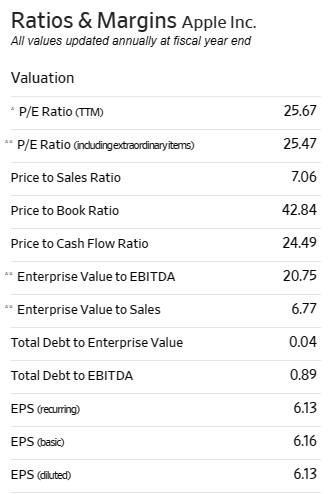

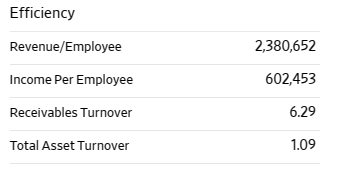

Profitability Gross Margin +44.13 Operating Margin +29.82 Pretax Margin +29.67 Net Margin +25.31 Return on Assets 27.50 Return on Equity 171.95 Return on Total Capital 61.91 Return on Invested Capital 58.95 Capital Structure Total Debt to Total Equity 199.42 Total Debt to Total Capital 66.60 Total Debt to Total Assets 35.15 Interest Coverage 29.06 Long-Term Debt to Equity 171.45 Long-Term Debt to Total Capital 57.26 Long-Term Debt to Assets 0.30 Total Operating Income as Repor... 118,658,000 114,301,000 119,437,000 108,949,000 Total Expenses 267,048,000 268,984,000 274,891,000 256,868,000 Net Income from Continuing & D... 100,913,000 96,995,000 99,803,000 94,680,000 Normalized Income 100,913,000 96,995,000 99,803,000 94,680,000 Interest Income -- 3,750,000 2,825,000 2,843,000 Interest Expense 3,933,000 2,931,000 2,645,000 Net Interest Income -183,000 -106,000 198,000 EBIT 122,026,000 117,669,000 122,034,000 111,852,000 EBITDA 133,477,000 129,188,000 133,138,000 123,136,000 Reconciled Cost of Revenue 212,035,000 214,137,000 223,546,000 212,981,000 Reconciled Depreciation 11,451,000 11,519,000 11,104,000 11,284,000 Net Income from Continuing Op... 100,913,000 96,995,000 99,803,000 94,680,000 Normalized EBITDA 133,477,000 129,188,000 133,138,000 123,136,000 Tax Rate for Calcs 0 0 0 0 Breakdown 9/30/2023 9/30/2022 9/30/2021 9/30/2020 Total Assets 352,583,000 352,755,000 351,002,000 323,888,000 Total Liabilities Net Minority I... 290,437,000 302,083,000 287,912,000 258,549,000 Total Equity Gross Minority In... 62,146,000 50,672,000 63,090,000 65,339,000 Total Capitalization 157,427,000 149,631,000 172,196,000 164,006,000 Common Stock Equity 62,146,000 50,672,000 63,090,000 65,339,000 Net Tangible Assets 62,146,000 50,672,000 63,090,000 65,339,000 Working Capital -1,742,000 -18,577,000 9,355,000 38,321,000 Invested Capital 173,234,000 170,741,000 187,809,000 177,775,000 Tangible Book Value 62,146,000 50,672,000 63,090,000 65,339,000 Total Debt 111,088,000 120,069,000 124,719,000 112,436,000 Net Debt 81,123,000 96,423,000 89,779,000 74,420,000 Share Issued 15,550,061 15,943,425 16,426,786 16,976,763 Ordinary Shares Number 15,550,061 15,943,425 16,426,786 16,976,763 Breakdown Operating Cash Flow Investing Cash Flow Financing Cash Flow End Cash Position Income Tax Paid Supplemental ... TTM 9/30/2023 9/30/2022 116,433,000 110,543,000 122,151,000 7,077,000 3,705,000 -22,354,000 -103,510,000 -108,488,000 -110,749,000 41,974,000 30,737,000 24,977,000 25,106,000 18,679,000 19,573,000 -- 3,803,000 Interest Paid Supplemental Data Capital Expenditure -9,564,000 -10,959,000 2,865,000 -10,708,000 Issuance of Capital Stock -- -- -- Issuance of Debt 5,228,000 5,465,000 Repayment of Debt -5,520,000 -11,151,000 -9,543,000 Repurchase of Capital Stock -78,214,000 -77,550,000 -89,402,000 Free Cash Flow 106,869,000 99,584,000 111,443,000 Earnings & Estimates Apple Inc. Qtr. EPS Est. +1.50 Q2 2024 Ann. EPS Est. +6.56 FY2024 Next Report 05/02/2024 Fiscal Yr Ends September 30 Qtr. Year Ago Ann. Year Ago Last Report No. of Analysts +1.52 Q2 2023 +6.13 FY 2023 05/02/2024 34 Per Share Data Apple Inc. All values updated annually at fiscal year end Sales Earnings Per Share +6.13 24.24 Tangible Book Value 4.00 Operating Profit 7.23 Working Capital -0.11 Long Term Liabilities 9.33 Capital Expenditure 0.69 Capital Expenditure TTM 0.61 Liquidity Current Ratio 0.99 Quick Ratio 0.94 Cash Ratio 0.42 Breakdown TTM 9/30/2023 9/30/2022 9/30/2021 Total Revenue 385,706,000 383,285,000 394,328,000 365,817,000 Cost of Revenue 212,035,000 214,137,000 223,546,000 212,981,000 Gross Profit Operating Expense 173,671,000 169,148,000 170,782,000 152,836,000 55,013,000 54,847,000 51,345,000 43,887,000 Operating Income 118,658,000 114,301,000 119,437,000 108,949,000 Net Non Operating Interest In... -- -183,000 -106,000 198,000 Other Income Expense -39,000 -382,000 -228,000 60,000 Pretax Income Tax Provision 118,436,000 113,736,000 119,103,000 109,207,000 17,523,000 16,741,000 19,300,000 14,527,000 Net Income Common Stockho... 100,913,000 96,995,000 99,803,000 94,680,000 Diluted NI Available to Com Stoc... 100,913,000 96,995,000 99,803,000 94,680,000 Basic EPS 6.46 6.16 6.15 5.67 Diluted EPS 6.43 6.13 6.11 5.61 Basic Average Shares 15,648,491 15,744,231 16,215,963 16,701,272 Diluted Average Shares 15,717,777.75 15,812,547 16,325,819 16,864,919 Ratios & Margins Apple Inc. All values updated annually at fiscal year end Valuation *P/E Ratio (TTM) 25.67 P/E Ratio (including extraordinary items) 25.47 Price to Sales Ratio 7.06 Price to Book Ratio 42.84 Price to Cash Flow Ratio 24.49 Enterprise Value to EBITDA 20.75 **Enterprise Value to Sales 6.77 Total Debt to Enterprise Value 0.04 Total Debt to EBITDA 0.89 EPS (recurring) 6.13 EPS (basic) 6.16 EPS (diluted) 6.13 Efficiency Revenue/Employee Income Per Employee Receivables Turnover Total Asset Turnover 2,380,652 602,453 6.29 1.09

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started