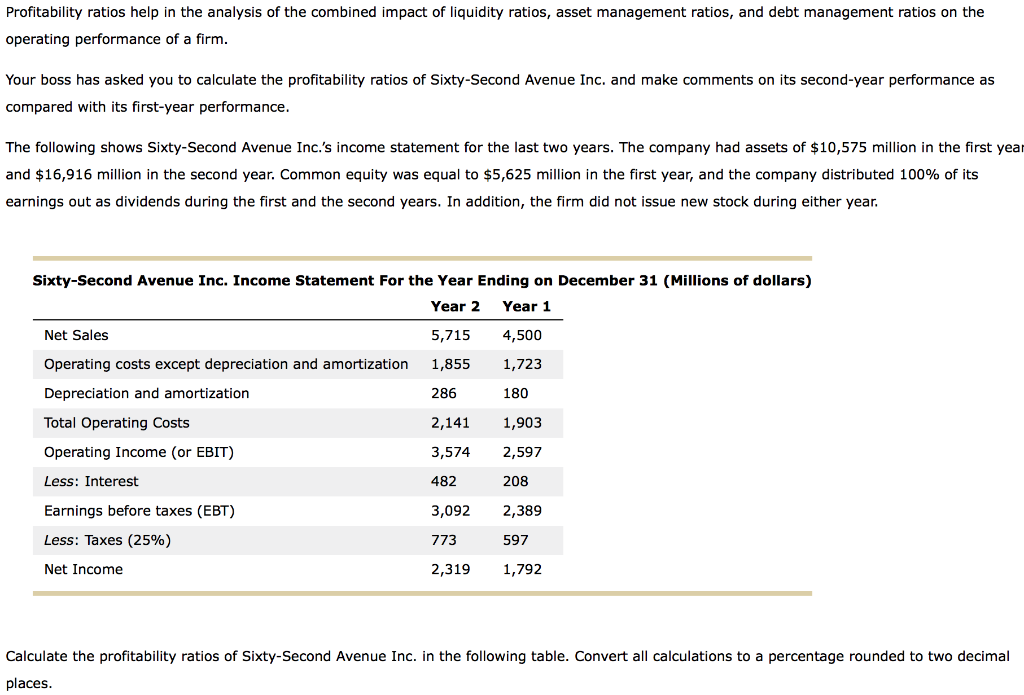

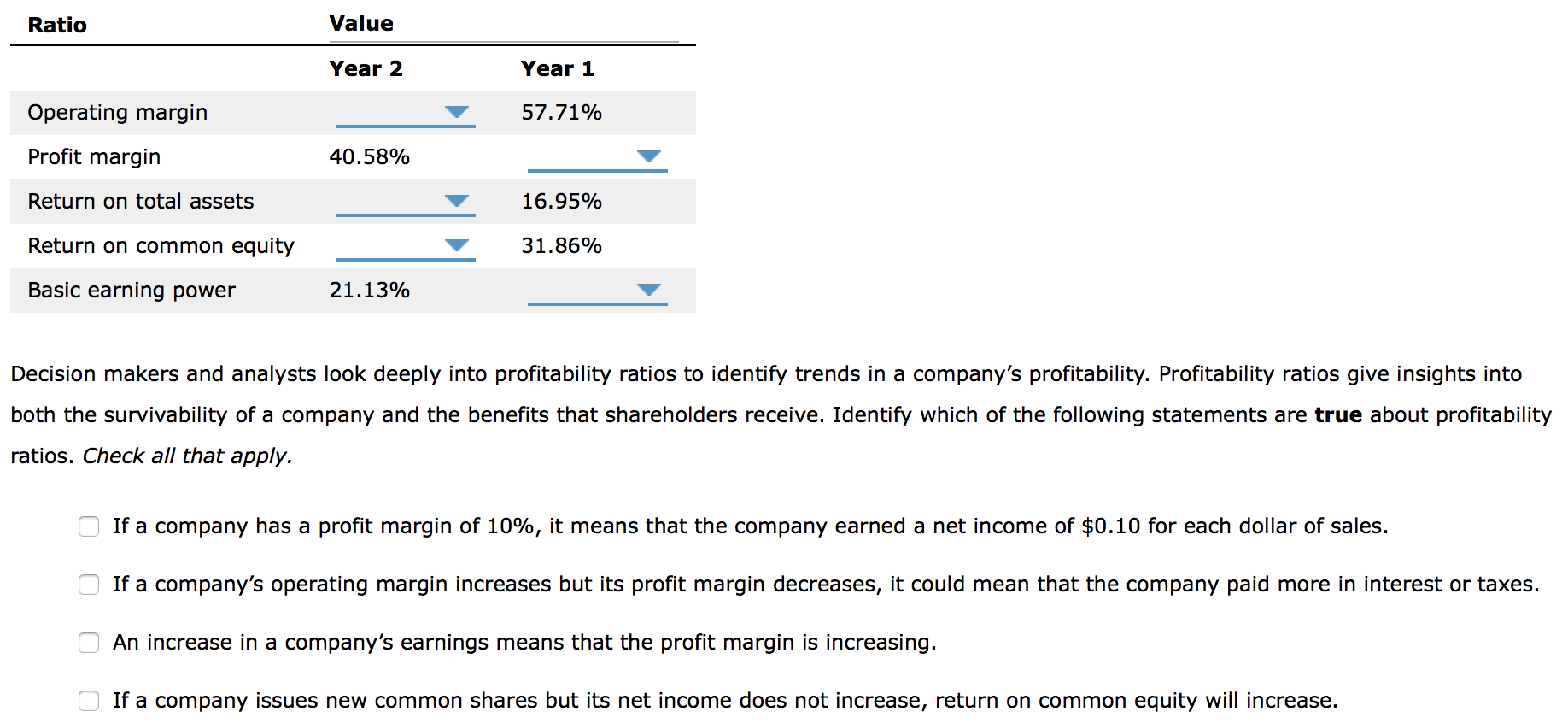

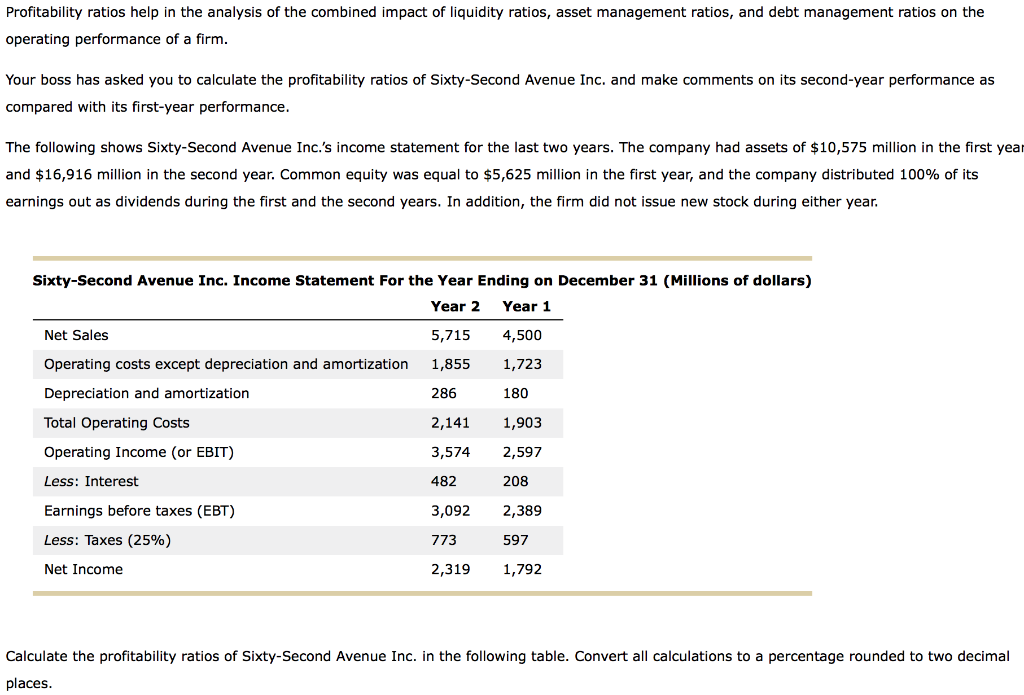

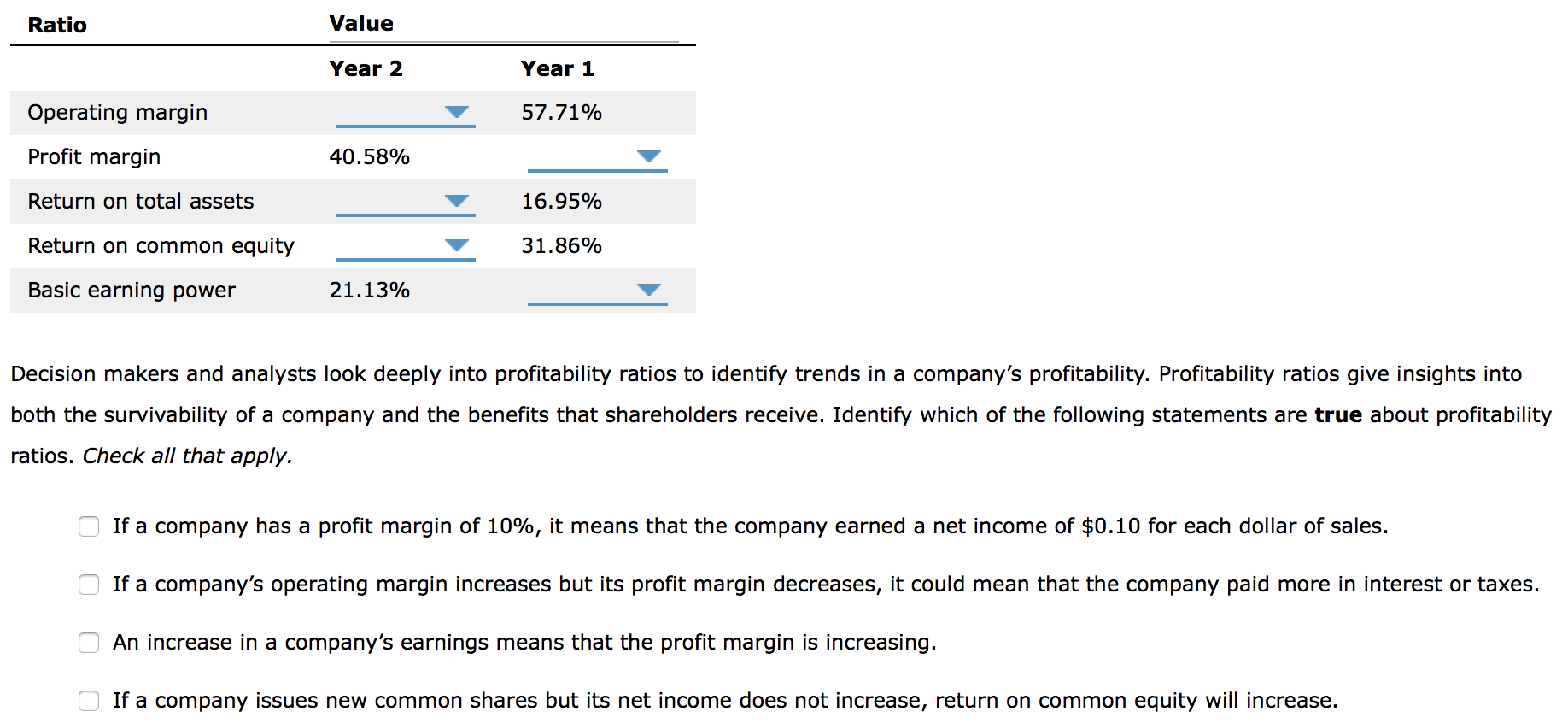

Profitability ratios help in the analysis of the combined impact of liquidity ratios, asset management ratios, and debt management ratios on the operating performance of a firm. Your boss has asked you to calculate the profitability ratios of Sixty-Second Avenue Inc. and make comments on its second-year performance as compared with its first-year performance. The following shows Sixty-Second Avenue Inc.'s income statement for the last two years. The company had assets of $10,575 million in the first year and $16,916 million in the second year. Common equity was equal to $5,625 million in the first year, and the company distributed 100% of its earnings out as dividends during the first and the second years. In addition, the firm did not issue new stock during either year. Sixty-Second Avenue Inc. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 Year 1 Net Sales 5,715 4,500 Operating costs except depreciation and amortization 1,855 1,723 Depreciation and amortization 286 180 Total Operating Costs 2,141 1,903 Operating Income (or EBIT) 3,574 2,597 Less: Interest 482 208 3,092 2,389 Earnings before taxes (EBT) Less: Taxes (25%) 773 597 Net Income 2,319 1,792 Calculate the profitability ratios of Sixty-Second Avenue Inc. in the following table. Convert all calculations to a percentage rounded to two decimal places. Ratio Value Year 2 Year 1 Operating margin 57.71% Profit margin 40.58% Return on total assets 16.95% Return on common equity 31.86% Basic earning power 21.13% Decision makers and analysts look deeply into profitability ratios to identify trends in a company's profitability. Profitability ratios give insights into both the survivability of a company and the benefits that shareholders receive. Identify which of the following statements are true about profitability ratios. Check all that apply. If a company has a profit margin of 10%, it means that the company earned a net income of $0.10 for each dollar of sales. If a company's operating margin increases but its profit margin decreases, it could mean that the company paid more in interest or taxes. An increase in a company's earnings means that the profit margin is increasing. If a company issues new common shares but its net income does not increase, return on common equity will increase