Answered step by step

Verified Expert Solution

Question

1 Approved Answer

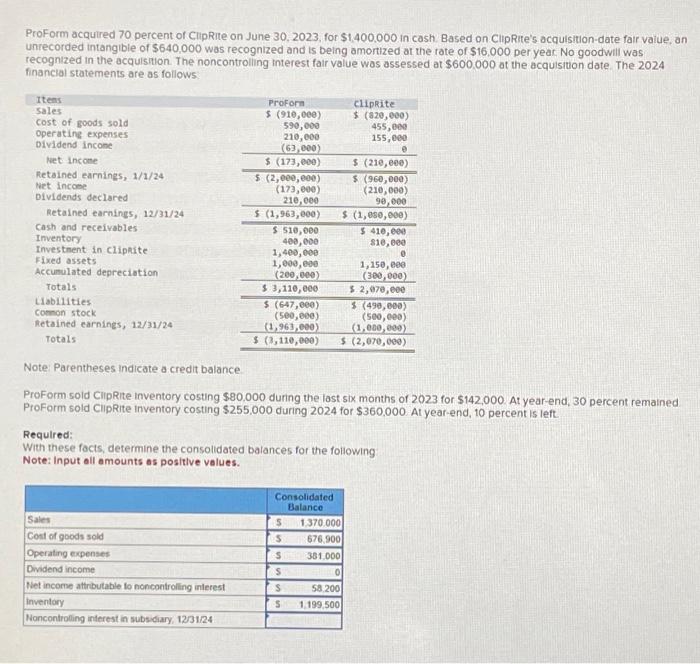

ProForm acquired 70 percent of ClipRite on June 30, 2023, for $1,400,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $640,000

ProForm acquired 70 percent of ClipRite on June 30, 2023, for $1,400,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $640,000 was recognized and is being amortized at the rate of $16,000 per year. No goodwill was recognized in the acquisition. The noncontrolling Interest fair value was assessed at $600,000 at the acquisition date. The 2024 financial statements are as follows Items sales Cost of goods sold Operating expenses Dividend income Net income Retained earnings, 1/1/24 Net income Dividends declared Retained earnings, 12/31/24 Cash and receivables Inventory Investment in ClipRite Fixed assets Accumulated depreciation Totals Liabilities Common stock Retained earnings, 12/31/24 Totals ProForm $ (910,000) 590,000 210,000 (63,000) (173,000) Sales Cost of goods sold $ $ (2,000,000) (173,000) 210,000 $ (1,963,000) Operating expenses Dividend income Net income attributable to noncontrolling interest Inventory Noncontrolling interest in subsidiary, 12/31/24 $ 510,000 400,000 1,400,000 1,000,000 (200,000) $ 3,110,000 $ (647,000) (500,000) (1,963,000) $ (3,110,000) Consolidated Balance clipRite $ (820,000) 455,000 155,000 Required: With these facts, determine the consolidated balances for the following: Note: Input all amounts as positive values. S $ S S S S Note: Parentheses Indicate a credit balance. ProForm sold ClipRite Inventory costing $80,000 during the last six months of 2023 for $142,000. At year-end, 30 percent remained ProForm sold ClipRite Inventory costing $255,000 during 2024 for $360,000 At year-end, 10 percent is left. 0 $ (210,000) $ (960,000) (210,000) 90,000 $ (1, ese,000) 1.370.000 676,900 381,000 PRESTAMO 58.200 1,199,500 $ 410,000 $10,000 1,150,000 (300,000) $ 2,070,000 $ (490,000) (500,000) (1,080,000) $ (2,070,000) 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started