Question

ProForm acquired 80 percent of ClipRite on June 30, 2017, for $1,520,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $500,000

ProForm acquired 80 percent of ClipRite on June 30, 2017, for $1,520,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $500,000 was recognized and is being amortized at the rate of $17,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $380,000 at the acquisition date. The 2018 financial statements are as follows:

| ProForm | ClipRite | ||||||

| Sales | $ | (1,010,000 | ) | $ | (1,020,000 | ) | |

| Cost of goods sold | 640,000 | 505,000 | |||||

| Operating expenses | 310,000 | 205,000 | |||||

| Dividend income | (48,000 | ) | 0 | ||||

| Net income | $ | (108,000 | ) | $ | (310,000 | ) | |

| Retained earnings, 1/1/18 | $ | (3,000,000 | ) | $ | (1,060,000 | ) | |

| Net income | (108,000 | ) | (310,000 | ) | |||

| Dividends declared | 310,000 | 60,000 | |||||

| Retained earnings, 12/31/18 | $ | (2,798,000 | ) | $ | (1,310,000 | ) | |

| Cash and receivables | $ | 610,000 | $ | 510,000 | |||

| Inventory | 500,000 | 910,000 | |||||

| Investment in ClipRite | 1,520,000 | 0 | |||||

| Fixed assets | 2,000,000 | 1,650,000 | |||||

| Accumulated depreciation | (200,000 | ) | (200,000 | ) | |||

| Totals | $ | 4,430,000 | $ | 2,870,000 | |||

| Liabilities | $ | (832,000 | ) | $ | (760,000 | ) | |

| Common stock | (800,000 | ) | (800,000 | ) | |||

| Retained earnings, 12/31/18 | (2,798,000 | ) | (1,310,000 | ) | |||

| Totals | $ | (4,430,000 | ) | $ | (2,870,000 | ) | |

ProForm sold ClipRite inventory costing $90,000 during the last six months of 2017 for $300,000. At year-end, 30 percent remained. ProForm sells ClipRite inventory costing $305,000 during 2018 for $460,000. At year-end, 10 percent is left.

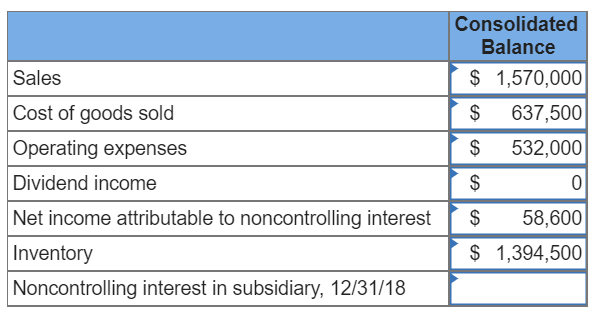

Determine the consolidated balances for the following accounts:

Consolidated Balance $ 1,570,000 S 637,500 $ 532,000 Sales Cost of goods sold Operating expenses Dividend income Net income attributable to noncontrolling interest58,600 Inventory Noncontrolling interest in subsidiary, 12/31/18 $ 1,394,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started