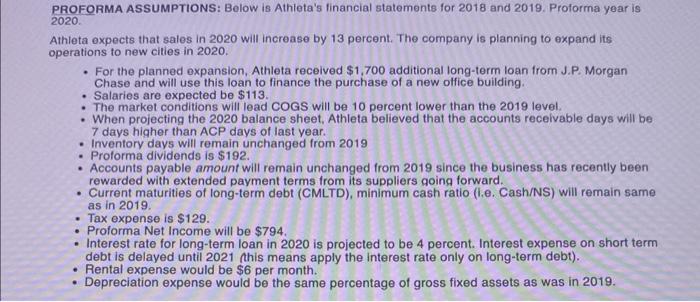

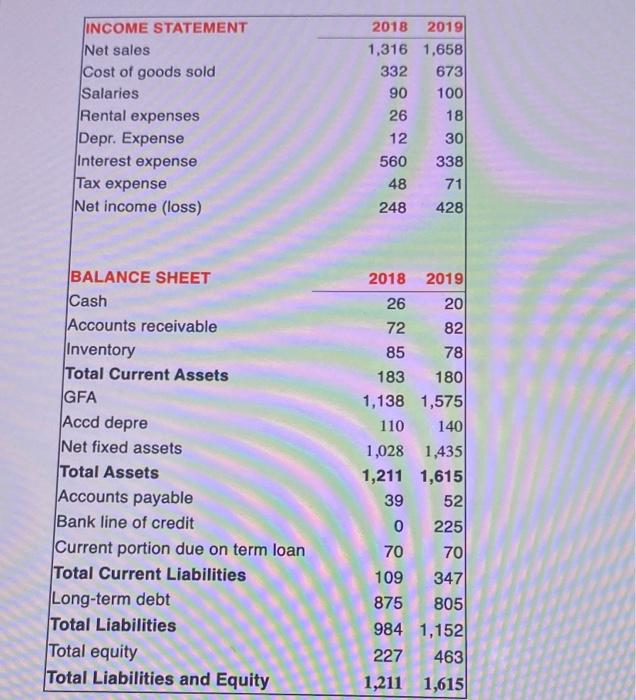

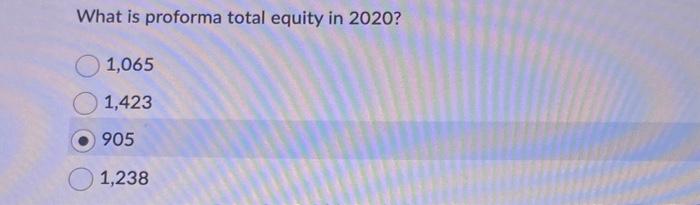

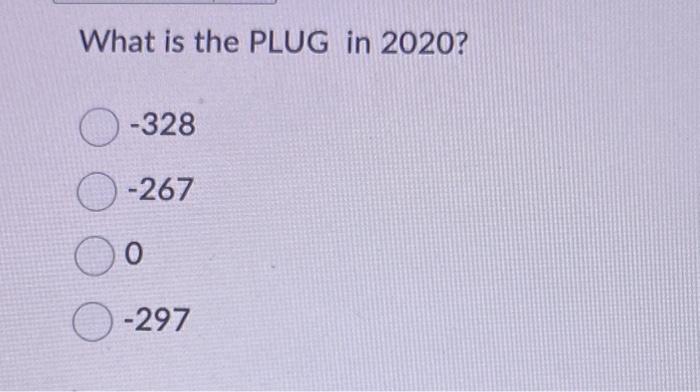

PROFORMA ASSUMPTIONS: Below is Athleta's financial statements for 2018 and 2019. Proforma year is 2020. Athleta expects that sales in 2020 will increase by 13 percent. The company is planning to expand its operations to new cities in 2020 . - For the planned expansion, Athleta received \$1,700 additional Iong-term loan from J.P. Morgan Chase and will use this loan to finance the purchase of a new office building. - Salaries are expected be $113. - The market conditions will lead COGS will be 10 percent lower than the 2019 level. - When projecting the 2020 balance sheet, Athleta believed that the accounts receivable days will be 7 days higher than ACP days of last year. - Inventory days will remain unchanged from 2019 - Protorma dividends is $192. - Accounts payable amount will remain unchanged from 2019 since the business has recently been rewarded with extended payment terms from its suppliers going forward. - Current maturities of long-term debt (CMLTD), minimum cash ratio (i.e. Cash/NS) will remain same as in 2019. - Tax expense is $129. - Proforma Net Income will be $794. - Interest rate for long-term loan in 2020 is projected to be 4 percent. Interest expense on short term debt is delayed until 2021 (this means apply the interest rate only on long-term debt). - Rental expense would be $6 per month. - Depreciation expense would be the same percentage of gross fixed assets as was in 2019. \begin{tabular}{llrr|} \hline INCOME STATEMENT & 2018 & 2019 \\ Net sales & 1,316 & 1,658 \\ Cost of goods sold & 332 & 673 \\ Salaries & 90 & 100 \\ Rental expenses & 26 & 18 \\ Depr. Expense & 12 & 30 \\ Interest expense & 560 & 338 \\ Tax expense & 48 & 71 \\ Net income (loss) & 248 & 428 \\ & & \\ \hline BALANCE SHEET & 2018 & 2019 \\ \hline Cash & 26 & 20 \\ Accounts receivable & 72 & 82 \\ Inventory & 85 & 78 \\ Total Current Assets & 183 & 180 \\ GFA & 1,138 & 1,575 \\ Accd depre & 110 & 140 \\ Net fixed assets & 1,028 & 1,435 \\ Total Assets & 1,211 & 1,615 \\ Accounts payable & 39 & 52 \\ Bank line of credit & 0 & 225 \\ Current portion due on term loan & 70 & 70 \\ Total Current Liabilities & 109 & 347 \\ Long-term debt & 875 & 805 \\ Total Liabilities & 927 & 1,152 \\ \hline \end{tabular} What is proforma total equity in 2020? 1,065 1,423 905 1,238 What is the PLUG in 2020? 328 267 0 297 What is proforma cash holdings? 32 44 16 23 What is the proforma line of credit (short-term bank loan) in 2020