Question

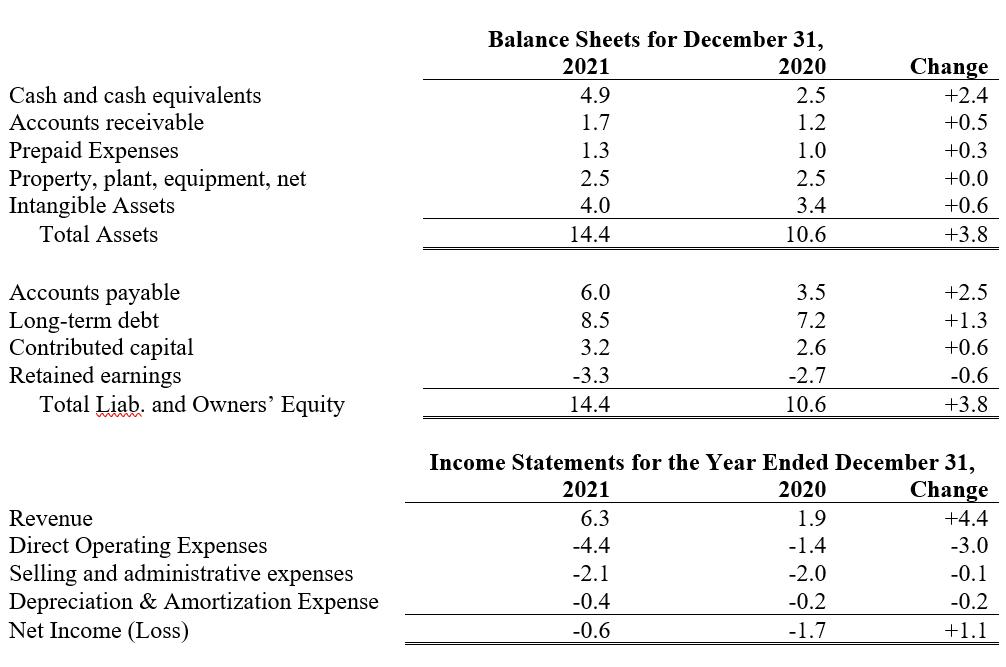

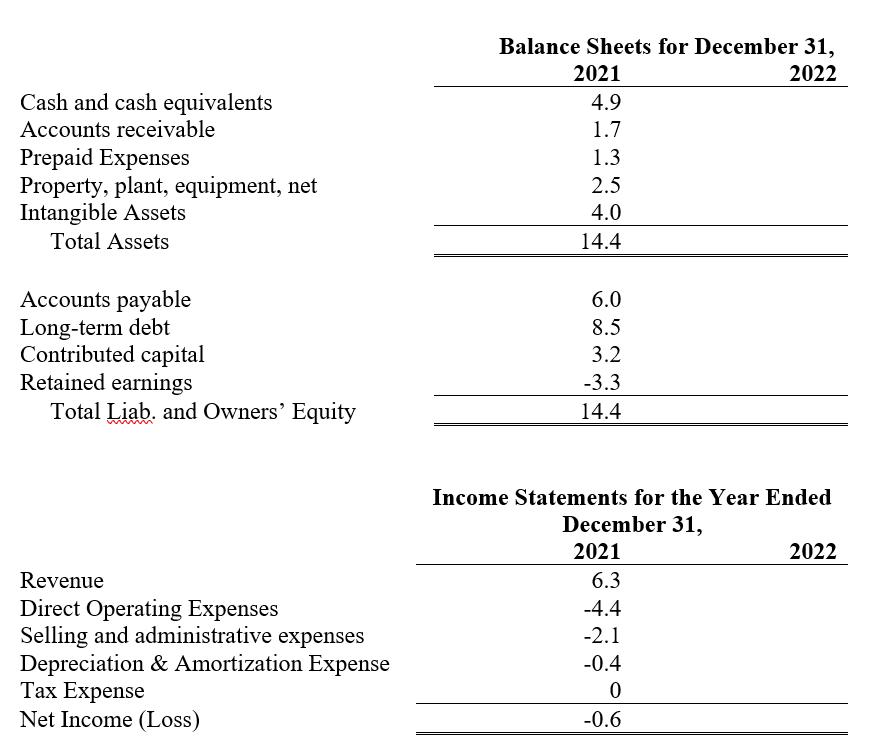

Pro-forma Statements (Stubhub Entertainment, Inc.) 1. Prepare a balance sheet for Stubhub as of December 31, 2022 and an income statement for Stubhub for the

Pro-forma Statements (Stubhub Entertainment, Inc.) 1. Prepare a balance sheet for Stubhub as of December 31, 2022 and an income statement for Stubhub for the year ended December 31, 2022, using the following assumptions.

Use revenues as foundation and long-term debt as your plug. You will find it helpful to use the 2021 financial statement below.

Round all your numbers to the nearest tenth (penny).

Please show answer via FSET method.

a. Revenue will grow by 40% in 2022.

b. Direct Operating Expenses will be 66% of Revenue.

c. Selling and administrative expenses in 2022 will return to the same absolute level as they were in 2020.

d. Depreciation of PP&E will be $0.3 in 2022, and amortization of intangible assets will be $0.2 in 2022.

e. Income tax expense is 20% of pre-tax net income if pre-tax net income is positive, and zero otherwise.

f. Stubhub’s return on assets (defined as Net Income (Loss) divided by average total assets) for 2022 will be 2.94%.

g. The accounts receivable turnover ratio (defined as revenue divided by average accounts receivable) will be 4.63 for 2022.

h. The percentage change in prepaid expenses from 2021 to 2022 will be the same as the percentage change in Selling and administrative expenses from 2021 to 2022.

i. Stubhub will purchase $0.5 in property, plant and equipment and $0.8 in intangible assets during 2022. They will not sell any of either during the year.

j. Accounts payable at the end of 2022 will be $6.8.

k. Stubhub will issue $0.2 in new common stock during 2022, and will not repurchase any shares or pay any dividends.

BS

BS template

Cash and cash equivalents Accounts receivable Prepaid Expenses Property, plant, equipment, net Intangible Assets Total Assets Accounts payable Long-term debt Contributed capital Retained earnings Total Liab. and Owners' Equity Revenue Direct Operating Expenses Selling and administrative expenses Depreciation & Amortization Expense Net Income (Loss) Balance Sheets for December 31, 2020 2021 4.9 1.7 1.3 2.5 4.0 14.4 6.0 8.5 3.2 -3.3 14.4 2.5 1.2 1.0 2.5 3.4 10.6 3.5 7.2 2.6 -2.7 10.6 Change +2.4 +0.5 +0.3 +0.0 +0.6 +3.8 1.9 -1.4 -2.0 -0.2 -1.7 +2.5 +1.3 +0.6 -0.6 +3.8 come Statements for the Year Ended December 31, 2021 2020 Change 6.3 -4.4 -2.1 -0.4 -0.6 +4.4 -3.0 -0.1 -0.2 +1.1

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Balance sheet for December 31 2021 2022 Cash and cash equivalents 49 22 Account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started