Question

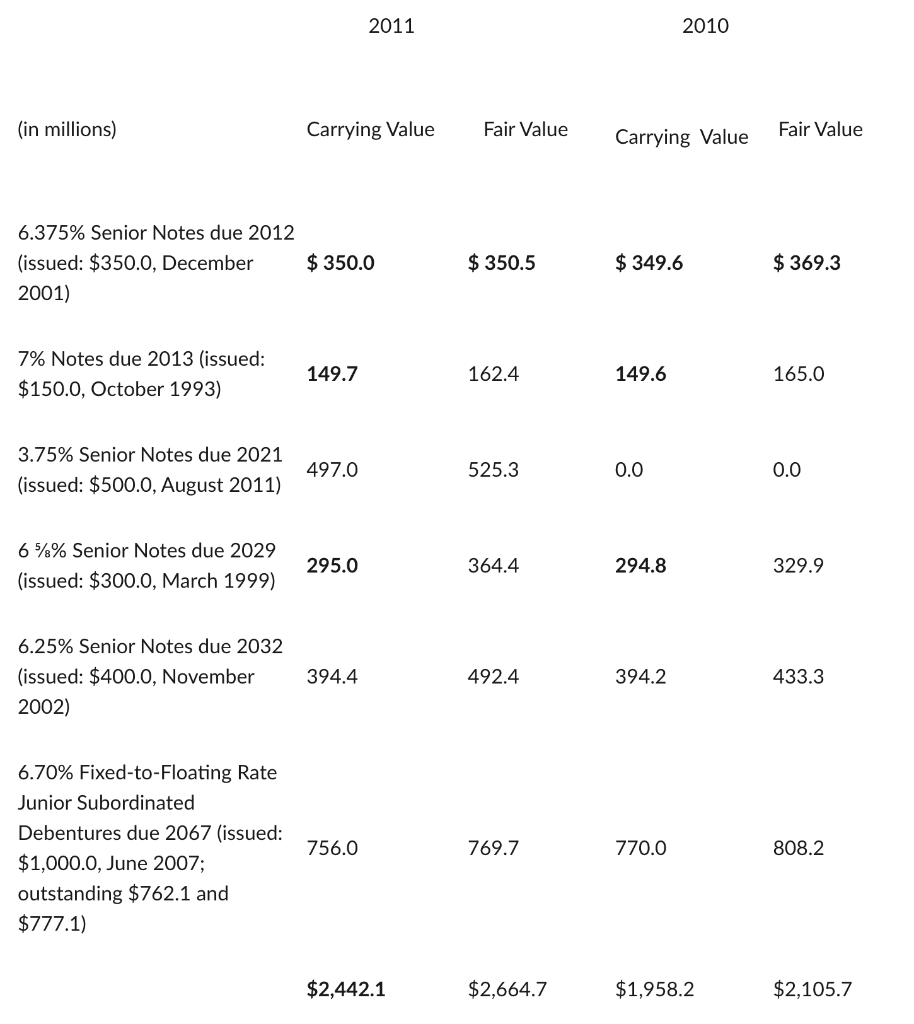

Progressive Corporation (a property and casualty insurance company) reported the following in its 2011 annual report: 2011 2010 (in millions) On December 31, 2011, we

Progressive Corporation (a property and casualty insurance company) reported the following in its 2011 annual report: 2011 2010 (in millions)

On December 31, 2011, we entered into an amendment to the 364-Day Secured Liquidity Credit Facility Agreement (Credit Facility Agreement) with PNC Bank, National Association (PNC), which extended the expiration date of our outstanding credit facility agreement until December 31, 2012, unless earlier terminated pursuant to the terms of the agreement. Under this agreement, we may borrow up to $125 million, which may be increased to $150 million at our request but subject to PNCs discretion. The purpose of the credit facility is to provide liquidity in the event of disruptions in our cash management operations, such as disruptions in the financial markets or related facilities that affect our ability to transfer or receive funds. Under this credit facility, we may borrow funds, on a revolving basis, either in the form of Eurodollar Loans or Base Rate Loans. Eurodollar Loans will bear interest at one-, two-, three-, or six-month LIBOR (as selected by us) plus 50 basis points for the selected period. . Our access to these funds is unrestricted. However, if we withdraw funds from this account for any reason other than in connection with a disruption in our cash management operations, the availability of borrowings under the PNC credit facility will be reduced on a dollar-for-dollar basis until such time as we replenish the funds to the deposit account. There are no rating triggers under the credit agreement. We had no borrowings under this arrangement in 2011 or 2010.

In January 2012, we retired the entire $350.0 million of our 6.375% Senior Notes at maturity.

1. What amount does Progressive report for long-term debt on its balance sheet of 2011?

2. Why is there a difference between the fair value and the carrying value of Progressives long-term debt in 2011? What are the plausible reasons for the difference?

3. Were the 6.375% notes originally issued at par, at a discount or at a premium? How do you know?

4. What is the amount of the unamortized discount on the 7% notes as of December 31, 2011? What is the amount of discount amortized for this note in 2011?

5. What cash interest payment did Progressive make for the 6 5/8 notes in 2011? What interest expense did Progressive record for these notes during 2011? Assume for this question that Progressive pays interest annually.

6. How much does the company owe under the line of credit with PNC Bank at year end? Why does Progressive discuss this in its debt footnote?

7. What is the current portion of long-term debt at December 31, 2011?

8. Progressive provides a schedule of the maturities of long-term debt in the footnote? Why is this information important in the analysis? What do you see in Progressives case? What additional information you need to perform a conclusive analysis of its debt situation?

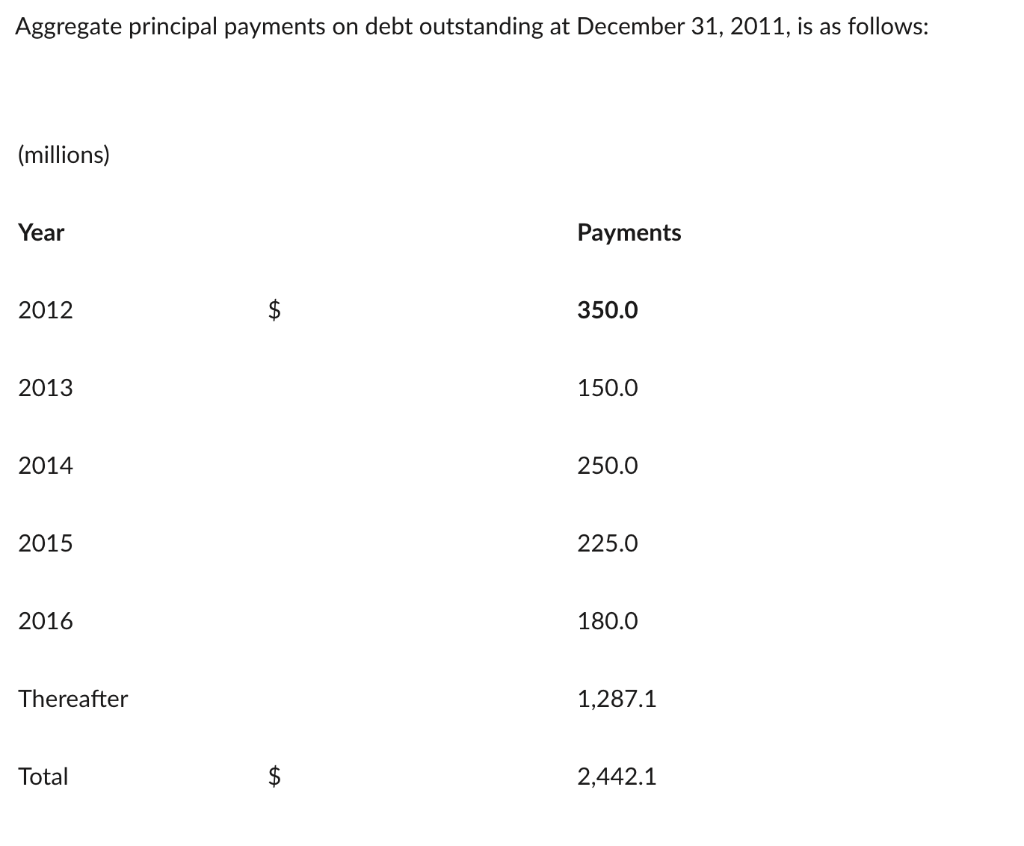

20112010 (in millions) Carrying Value Fair Value Carrying Value Fair Value 6.375\% Senior Notes due 2012 (issued: $350.0, December $350.0$350.5$349.6$369.3 2001) 7% Notes due 2013 (issued: $150.0, October 1993) 149.7 162.4 165.0 (issued:$500.0,August2011)497.0525.30.00.0 3.75% Senior Notes due 2021 65%8%SeniorNotesdue2029(issued:$300.0,March1999)295.02.4364.4294.8329.9 6.25\% Senior Notes due 2032 (issued:$400.0,November394.4492.4394.2433.3 2002) 6.70\% Fixed-to-Floating Rate Junior Subordinated Debenturesdue2067(issued:756.0769.7770.0808.2 $1,000.0, June 2007; outstanding $762.1 and $777.1) $2,442.1$2,664.7$1,958.2$2,105.7 Aggregate principal payments on debt outstanding at December 31,2011 , is as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started