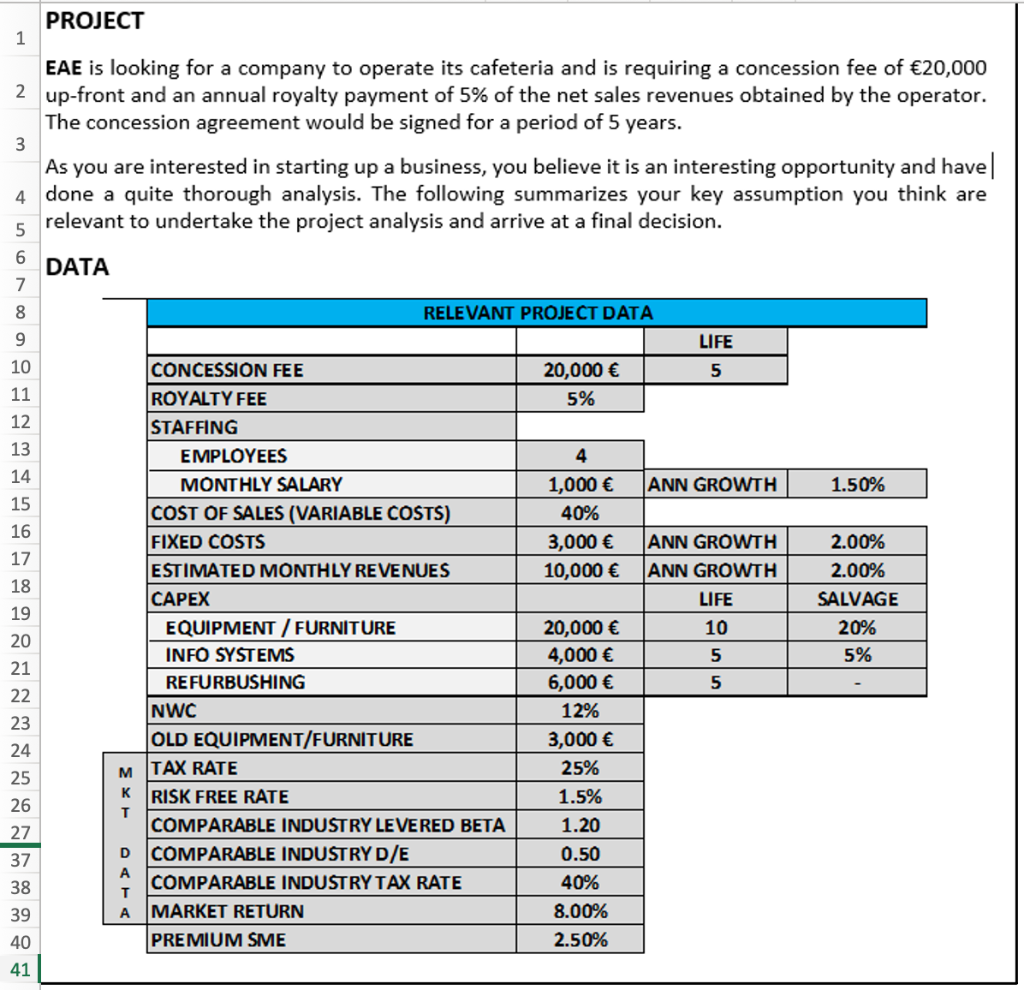

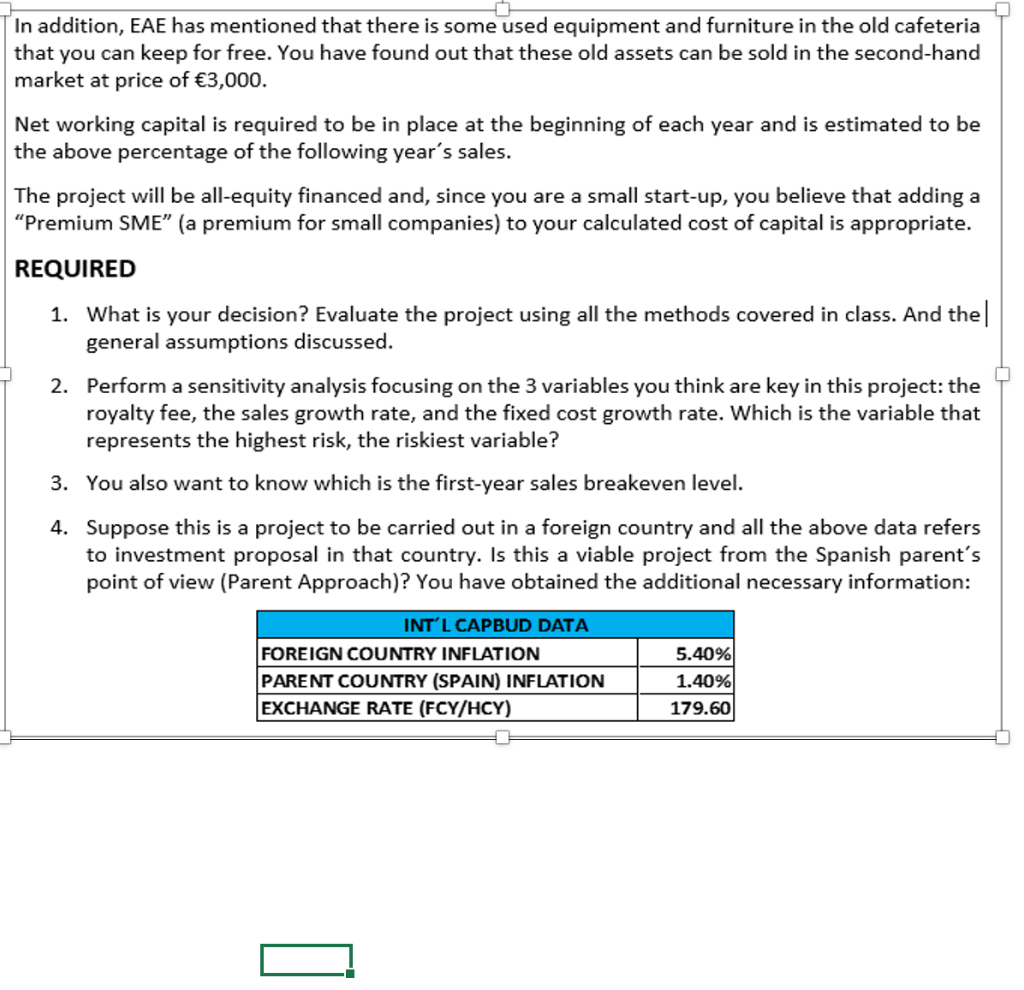

PROJECT 1 EAE is looking for a company to operate its cafeteria and is requiring a concession fee of 20,000 2 up-front and an annual royalty payment of 5% of the net sales revenues obtained by the operator. The concession agreement would be signed for a period of 5 years. 3 As you are interested in starting up a business, you believe it is an interesting opportunity and have| 4 done a quite thorough analysis. The following summarizes your key assumption you think are relevant to undertake the project analysis and arrive at a final decision. 5 6 DATA 7 8 9 RELEVANT PROJECT DATA LIFE 10 5 20,000 5% 11 12 13 14 ANN GROWTH 1.50% 15 4 1,000 40% 3,000 10,000 16 17 18 19 ANN GROWTH ANN GROWTH LIFE 10 5 5 CONCESSION FEE ROYALTY FEE STAFFING EMPLOYEES MONTHLY SALARY COST OF SALES (VARIABLE COSTS) FIXED COSTS ESTIMATED MONTHLY REVENUES CAPEX EQUIPMENT / FURNITURE INFO SYSTEMS REFURBUSHING NWC OLD EQUIPMENT/FURNITURE M TAX RATE K RISK FREE RATE COMPARABLE INDUSTRY LEVERED BETA D COMPARABLE INDUSTRYD/E A COMPARABLE INDUSTRY TAX RATE T A MARKET RETURN PREMIUM SME 2.00% 2.00% SALVAGE 20% 5% 20 21 22 23 24 25 20,000 4,000 6,000 12% 3,000 25% 1.5% 1.20 0.50 40% 8.00% 2.50% T 26 27 37 38 39 40 41 In addition, EAE has mentioned that there is some used equipment and furniture in the old cafeteria that you can keep for free. You have found out that these old assets can be sold in the second-hand market at price of 3,000. Net working capital is required to be in place at the beginning of each year and is estimated to be the above percentage of the following year's sales. The project will be all-equity financed and, since you are a small start-up, you believe that adding a Premium SME (a premium for small companies) to your calculated cost of capital is appropriate. REQUIRED 1. What is your decision? Evaluate the project using all the methods covered in class. And the| general assumptions discussed. 2. Perform a sensitivity analysis focusing on the 3 variables you think are key in this project: the royalty fee, the sales growth rate, and the fixed cost growth rate. Which is the variable that represents the highest risk, the riskiest variable? 3. You also want to know which is the first-year sales breakeven level. 4. Suppose this is a project to be carried out in a foreign country and all the above data refers to investment proposal in that country. Is this a viable project from the Spanish parent's point of view (Parent Approach)? You have obtained the additional necessary information: INT'L CAPBUD DATA FOREIGN COUNTRY INFLATION PARENT COUNTRY (SPAIN) INFLATION EXCHANGE RATE (FCY/HCY) 5.40% 1.40% 179.60 PROJECT 1 EAE is looking for a company to operate its cafeteria and is requiring a concession fee of 20,000 2 up-front and an annual royalty payment of 5% of the net sales revenues obtained by the operator. The concession agreement would be signed for a period of 5 years. 3 As you are interested in starting up a business, you believe it is an interesting opportunity and have| 4 done a quite thorough analysis. The following summarizes your key assumption you think are relevant to undertake the project analysis and arrive at a final decision. 5 6 DATA 7 8 9 RELEVANT PROJECT DATA LIFE 10 5 20,000 5% 11 12 13 14 ANN GROWTH 1.50% 15 4 1,000 40% 3,000 10,000 16 17 18 19 ANN GROWTH ANN GROWTH LIFE 10 5 5 CONCESSION FEE ROYALTY FEE STAFFING EMPLOYEES MONTHLY SALARY COST OF SALES (VARIABLE COSTS) FIXED COSTS ESTIMATED MONTHLY REVENUES CAPEX EQUIPMENT / FURNITURE INFO SYSTEMS REFURBUSHING NWC OLD EQUIPMENT/FURNITURE M TAX RATE K RISK FREE RATE COMPARABLE INDUSTRY LEVERED BETA D COMPARABLE INDUSTRYD/E A COMPARABLE INDUSTRY TAX RATE T A MARKET RETURN PREMIUM SME 2.00% 2.00% SALVAGE 20% 5% 20 21 22 23 24 25 20,000 4,000 6,000 12% 3,000 25% 1.5% 1.20 0.50 40% 8.00% 2.50% T 26 27 37 38 39 40 41 In addition, EAE has mentioned that there is some used equipment and furniture in the old cafeteria that you can keep for free. You have found out that these old assets can be sold in the second-hand market at price of 3,000. Net working capital is required to be in place at the beginning of each year and is estimated to be the above percentage of the following year's sales. The project will be all-equity financed and, since you are a small start-up, you believe that adding a Premium SME (a premium for small companies) to your calculated cost of capital is appropriate. REQUIRED 1. What is your decision? Evaluate the project using all the methods covered in class. And the| general assumptions discussed. 2. Perform a sensitivity analysis focusing on the 3 variables you think are key in this project: the royalty fee, the sales growth rate, and the fixed cost growth rate. Which is the variable that represents the highest risk, the riskiest variable? 3. You also want to know which is the first-year sales breakeven level. 4. Suppose this is a project to be carried out in a foreign country and all the above data refers to investment proposal in that country. Is this a viable project from the Spanish parent's point of view (Parent Approach)? You have obtained the additional necessary information: INT'L CAPBUD DATA FOREIGN COUNTRY INFLATION PARENT COUNTRY (SPAIN) INFLATION EXCHANGE RATE (FCY/HCY) 5.40% 1.40% 179.60