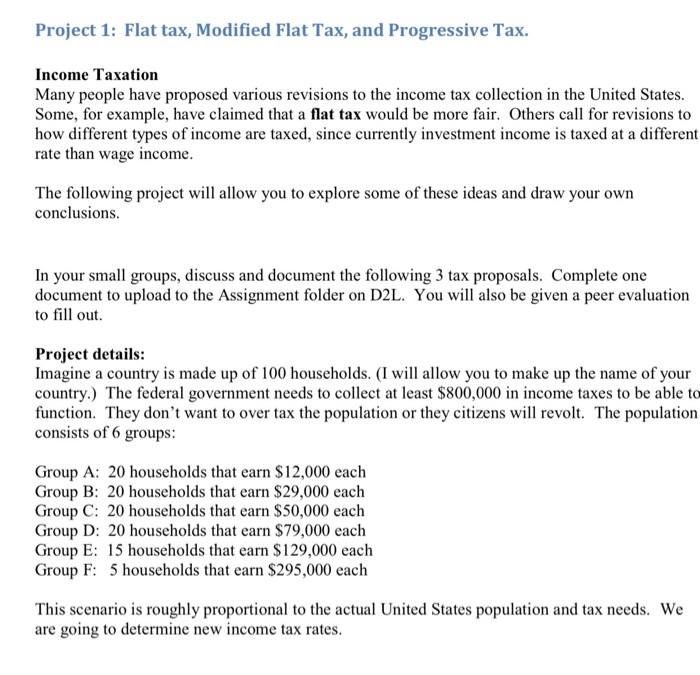

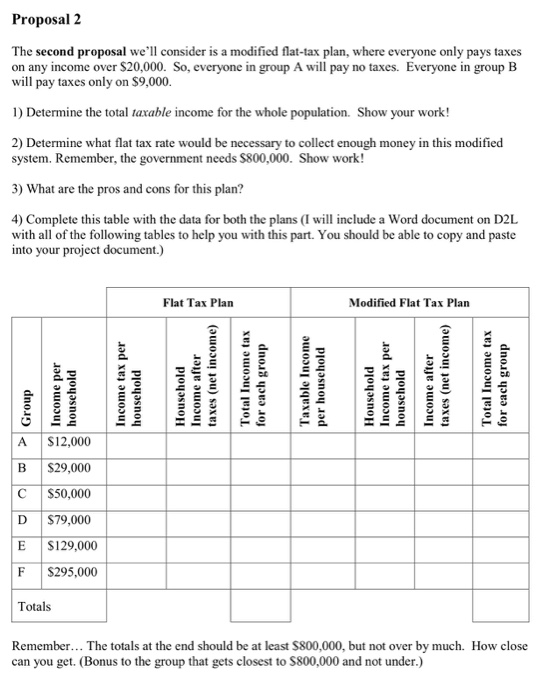

Project 1: Flat tax, Modified Flat Tax, and Progressive Tax. Income Taxation Many people have proposed various revisions to the income tax collection in the United States. Some, for example, have claimed that a flat tax would be more fair. Others call for revisions to how different types of income are taxed, since currently investment income is taxed at a different rate than wage income. The following project will allow you to explore some of these ideas and draw your own conclusions. In your small groups, discuss and document the following 3 tax proposals. Complete one document to upload to the Assignment folder on D2L. You will also be given a peer evaluation to fill out. Project details: Imagine a country is made up of 100 households. (I will allow you to make up the name of your country.) The federal government needs to collect at least $800,000 in income taxes to be able to function. They don't want to over tax the population or they citizens will revolt. The population consists of 6 groups: Group A: 20 households that earn $12,000 each Group B: 20 households that earn $29,000 each Group C: 20 households that earn $50,000 each Group D: 20 households that earn $79,000 each Group E: 15 households that earn $129,000 each Group F: 5 households that earn $295,000 each This scenario is roughly proportional to the actual United States population and tax needs. We are going to determine new income tax rates. Proposal 2 The second proposal we'll consider is a modified flat-tax plan, where everyone only pays taxes on any income over $20,000. So, everyone in group A will pay no taxes. Everyone in group B will pay taxes only on $9,000. 1) Determine the total taxable income for the whole population. Show your work! 2) Determine what flat tax rate would be necessary to collect enough money in this modified system. Remember, the government needs $800,000. Show work! 3) What are the pros and cons for this plan? 4) Complete this table with the data for both the plans (I will include a Word document on D2L with all of the following tables to help you with this part . You should be able to copy and paste into your project document.) Flat Tax Plan Modified Flat Tax Plan Group Income per household A $12,000 B $29,000 C $50,000 D $79,000 E $129,000 F $295,000 Totals Remember... The totals at the end should be at least 5800,000, but not over by much. How close can you get. (Bonus to the group that gets closest to $800,000 and not under.)