Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Project 1: Interest Rate Risk and Immunization Strategy - Round off your final answers to three decimal places. For parts 2) and 4) of Question

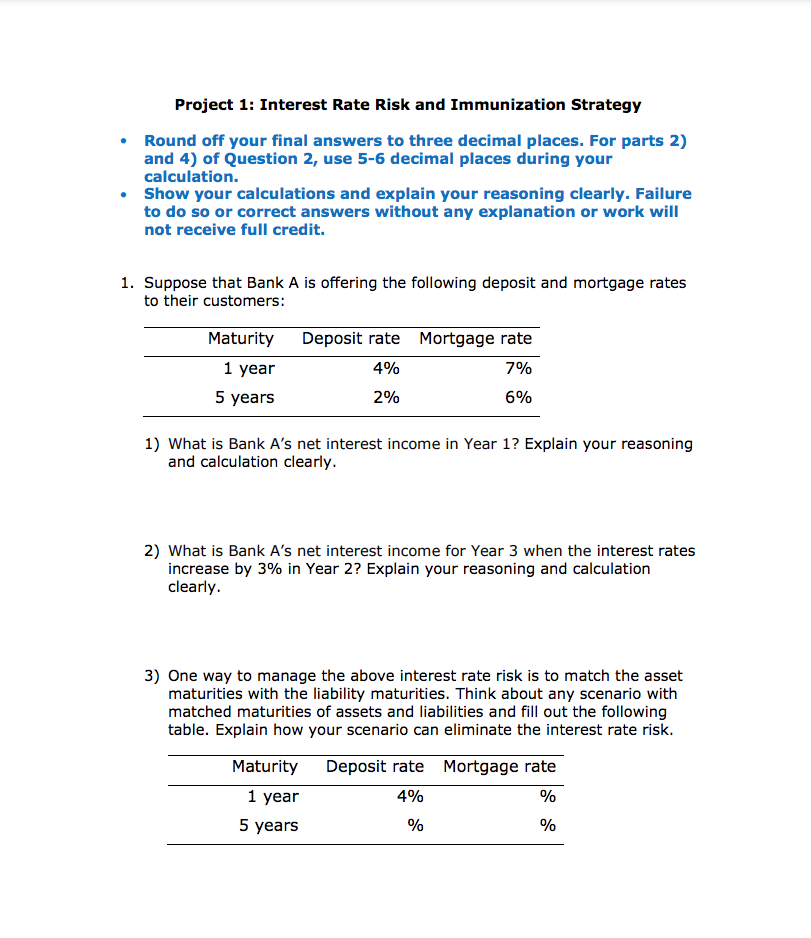

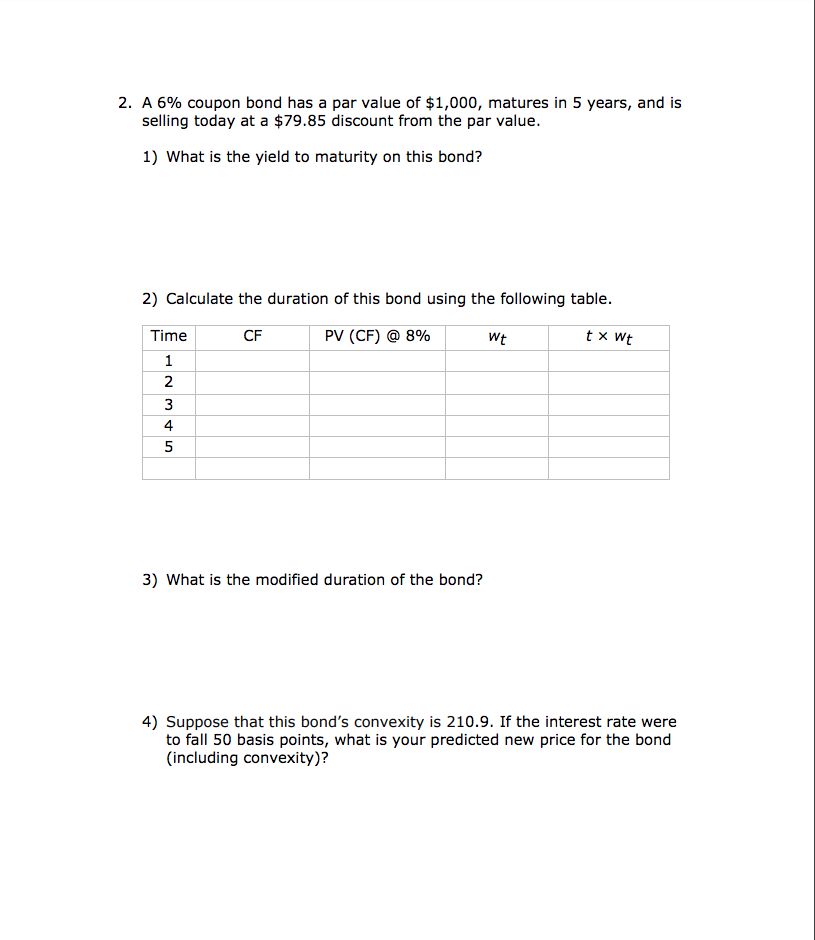

Project 1: Interest Rate Risk and Immunization Strategy - Round off your final answers to three decimal places. For parts 2) and 4) of Question 2, use 5-6 decimal places during your calculation. - Show your calculations and explain your reasoning clearly. Failure to do so or correct answers without any explanation or work will not receive full credit. 1. Suppose that Bank A is offering the following deposit and mortgage rates to their customers: 1) What is Bank A's net interest income in Year 1? Explain your reasoning and calculation clearly. 2) What is Bank A's net interest income for Year 3 when the interest rates increase by 3% in Year 2? Explain your reasoning and calculation clearly. 3) One way to manage the above interest rate risk is to match the asset maturities with the liability maturities. Think about any scenario with matched maturities of assets and liabilities and fill out the following table. Explain how your scenario can eliminate the interest rate risk. 2. A 6% coupon bond has a par value of $1,000, matures in 5 years, and is selling today at a $79.85 discount from the par value. 1) What is the yield to maturity on this bond? 2) Calculate the duration of this bond using the following table. 3) What is the modified duration of the bond? 4) Suppose that this bond's convexity is 210.9. If the interest rate were to fall 50 basis points, what is your predicted new price for the bond (including convexity)

Project 1: Interest Rate Risk and Immunization Strategy - Round off your final answers to three decimal places. For parts 2) and 4) of Question 2, use 5-6 decimal places during your calculation. - Show your calculations and explain your reasoning clearly. Failure to do so or correct answers without any explanation or work will not receive full credit. 1. Suppose that Bank A is offering the following deposit and mortgage rates to their customers: 1) What is Bank A's net interest income in Year 1? Explain your reasoning and calculation clearly. 2) What is Bank A's net interest income for Year 3 when the interest rates increase by 3% in Year 2? Explain your reasoning and calculation clearly. 3) One way to manage the above interest rate risk is to match the asset maturities with the liability maturities. Think about any scenario with matched maturities of assets and liabilities and fill out the following table. Explain how your scenario can eliminate the interest rate risk. 2. A 6% coupon bond has a par value of $1,000, matures in 5 years, and is selling today at a $79.85 discount from the par value. 1) What is the yield to maturity on this bond? 2) Calculate the duration of this bond using the following table. 3) What is the modified duration of the bond? 4) Suppose that this bond's convexity is 210.9. If the interest rate were to fall 50 basis points, what is your predicted new price for the bond (including convexity) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started