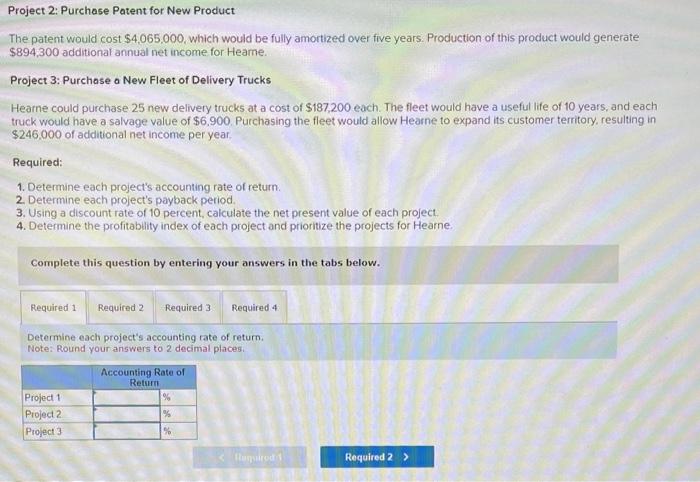

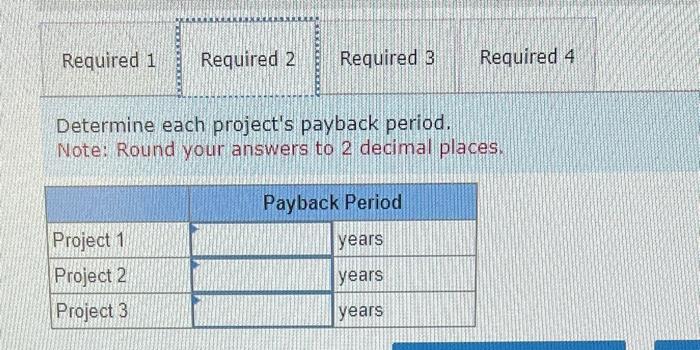

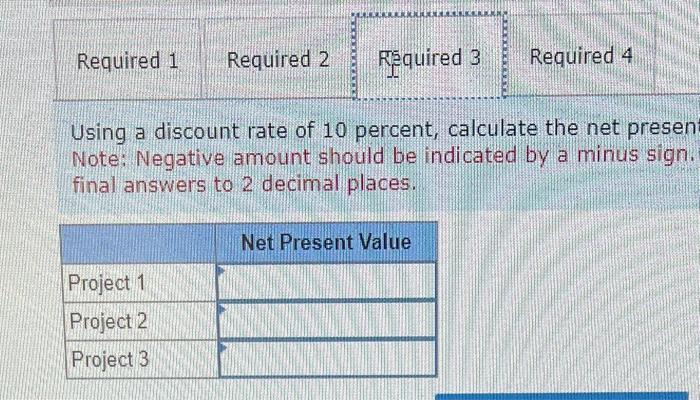

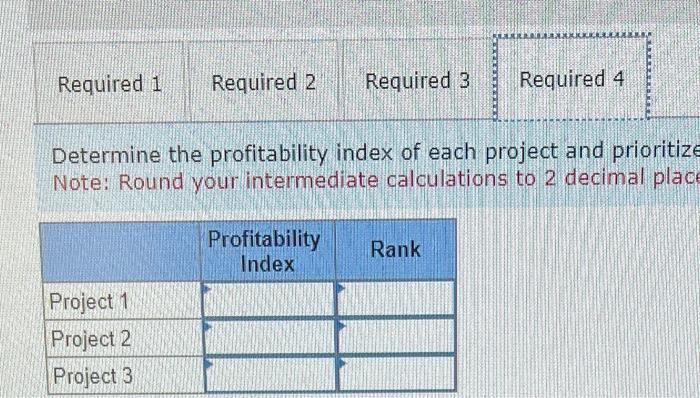

Project 2: Purchase Patent for New Product The patent would cost $4,065,000, which would be fully amortized over five years. Production of this product would generate $894,300 additional annual net income for Heame. Project 3: Purchase o New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $187,200 each. The fleet would have a useful life of 10 years, and each truck would have a salvage value of $6,900. Purchasing the fleet would allow Hearne to expand its customer territory, resulting in $246.000 of additional net income per year. Required: 1. Determine each project's accounting rate of return. 2. Determine each project's payback period. 3. Using a discount rate of 10 percent, caiculate the net present value of each project. 4. Determine the profitablity index of each project and prioritize the projects for Hearne. Complete this question by entering your answers in the tabs below. Determine each project's accounting rate of return. Note: Round your answers to 2 decimal places. Determine each project's payback period. Note: Round your answers to 2 decimal places. Using a discount rate of 10 percent, calculate the net presen Note: Negative amount should be indicated by a minus sign. final answers to 2 decimal places. Determine the profitability index of each project and prioritiz Note: Round your intermediate calculations to 2 decimal plac Project 2: Purchase Patent for New Product The patent would cost $4,065,000, which would be fully amortized over five years. Production of this product would generate $894,300 additional annual net income for Heame. Project 3: Purchase o New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $187,200 each. The fleet would have a useful life of 10 years, and each truck would have a salvage value of $6,900. Purchasing the fleet would allow Hearne to expand its customer territory, resulting in $246.000 of additional net income per year. Required: 1. Determine each project's accounting rate of return. 2. Determine each project's payback period. 3. Using a discount rate of 10 percent, caiculate the net present value of each project. 4. Determine the profitablity index of each project and prioritize the projects for Hearne. Complete this question by entering your answers in the tabs below. Determine each project's accounting rate of return. Note: Round your answers to 2 decimal places. Determine each project's payback period. Note: Round your answers to 2 decimal places. Using a discount rate of 10 percent, calculate the net presen Note: Negative amount should be indicated by a minus sign. final answers to 2 decimal places. Determine the profitability index of each project and prioritiz Note: Round your intermediate calculations to 2 decimal plac