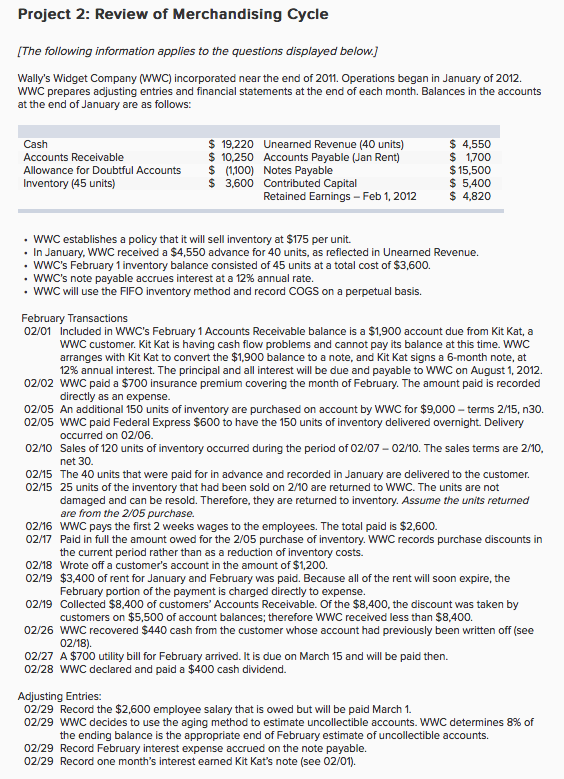

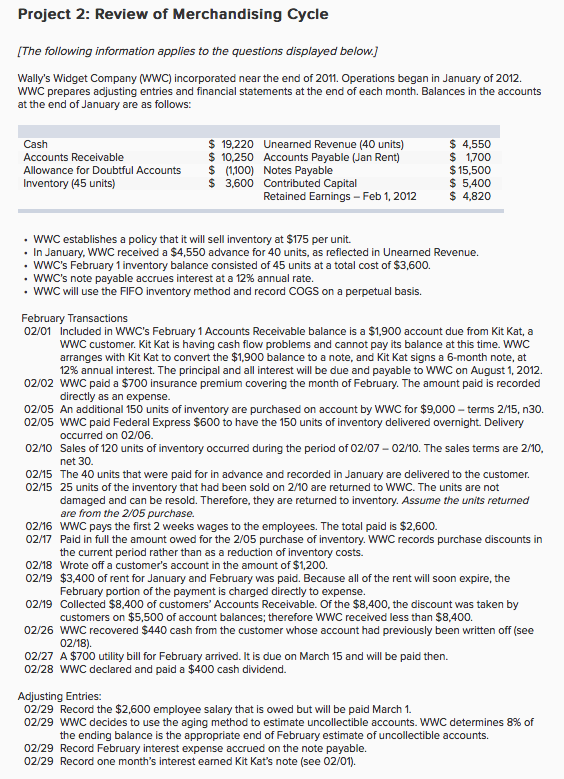

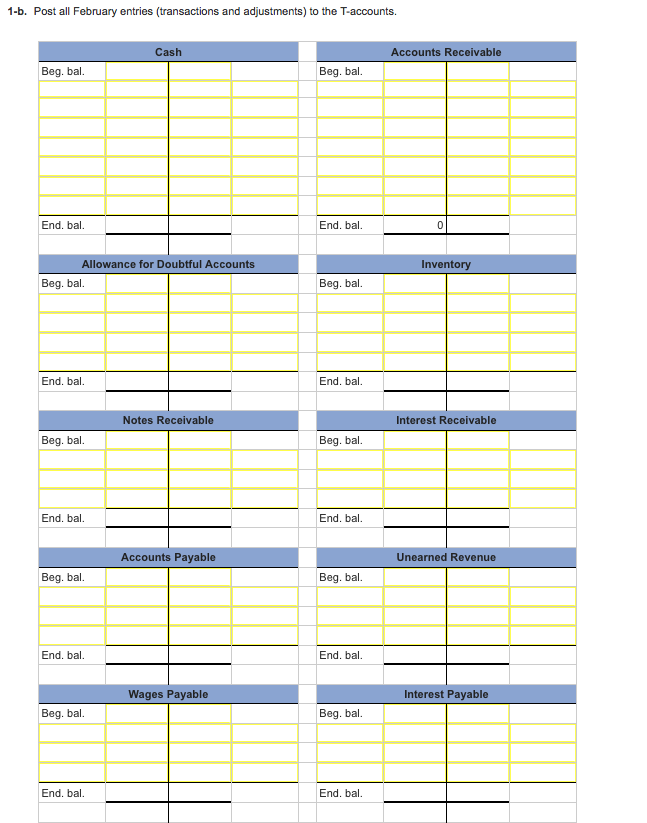

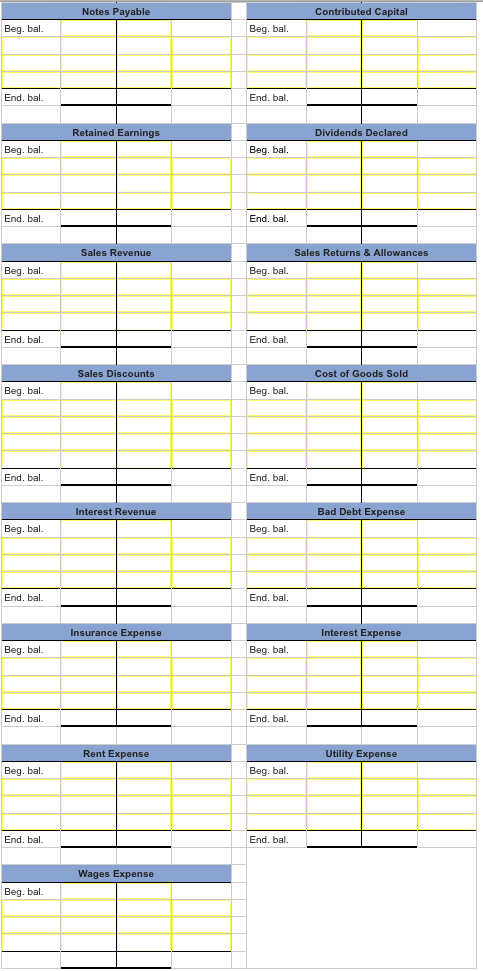

Project 2: Review of Merchandising Cycle

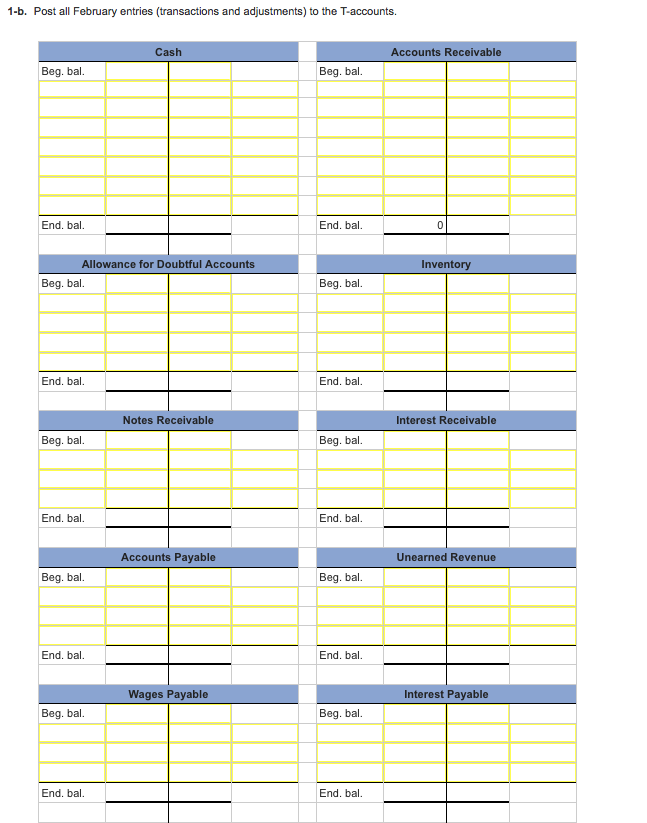

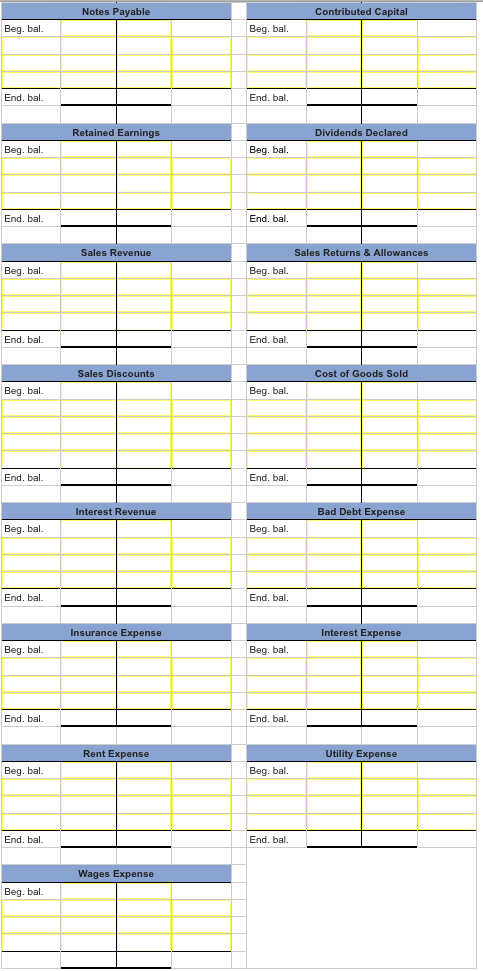

Project 2: Review of Merchandising Cycle [The following information applies to the questions displayed belo ally's Widget Company WWC) incorporated near the end of 2011. Operations began in January of 2012. WWC prepares adjusting entries and financial ents at the end of each month. Balances in the accounts t the end of January are as follows 19,220 Unearned Revenue (40 units) 4,550 Cash Accounts Receivable 10,250 Accounts Payable Jan Rent) 1.700 $1 Allowance for Doubtful Accounts (1100) Notes Payable 15.500 5.400 Inventory (45 units) 3,600 Contributed Capital Retained Earnings Feb 1, 2012 820 WWC establishes a policy that it will sell inventory at $175 per un In January, WWC received a $4,550 advance for 40 units, as reflected in Unearned Revenue WWC's February 1 inventory balance consisted of 45 units at a total cost of $3,600 s note payable accrues interest at a 12% annual rate WWC will use the FlFO inventory method and record COGS on a perpetual basis February Transaction 02/01 Included in WWC's February 1 Accounts Receivable balance is a 1.900 account due from Kit Kat, a WWC customer. Kat is having cash flow problems and cannot pay its balance at this time. WWC arranges with Kit Kat to convert the $1,900 balance to a note, and Kit Kat signs a 6-month note, at 12% annual interest. The principal and all interest will be due and payable to WWC on August 1, 2012. 02/02 WWC paid a $700 insurance premium covering the month of February. The amount paid is recorded directly as an expense 02/05 An additional 150 units of inventory are purchased on account by WWC for $9,000-terms 2/15, n30 02/05 WWC paid Federal Express $600 to have the 150 units of inventory delivered overnight. Delivery occurred on 02/06. 02210 Sales of 120 units of inventory occurred during the period of 02/07-02/10. The sales terms are 2M0, net 30. 02/15 The 40 units that were paid for in advance and recorded in January are delivered to the customer 02/15 25 units of the inventory that had been sold on 2/10 are returned to WWC. The units are not damaged and can be resold. Therefore, they are returned to inventory. Assume the units returned are from the 2/05 purchase. 02/16 WWC pays the first 2 weeks wages to the employees. The total paid is $2,600. 02/17 Paid in full the amount owed for the 2/05 purchase of inventory. WWC records purchase discounts in the current period rather than as a reduction of inventory costs 02/18 Wrote off a customer's account in the amount of $1,200 02/19 $3,400 of rent for January and February was paid. Because all of the rent wi soon expire, the February portion of the payment is charged directly to expens 02/19 Collected $8.400 of customers' Accounts Receivable. Of the $8,400, the discount was taken by customers on $5.500 of account balances: therefore WWC received less than $8.400 02/26 WWC recovered $440 cash from the customer whose account had previously been written off (se 02/18) 02/27 A $700 utility bill for February arrived. It is due on March 15 and will be paid then 02/28 WWC declared and paid a $400 cash dividend. Adjusting Entrie 02/29 Record the $2,600 employee salary that is owed but will be paid March 1 02/29 WWC decides to use the aging method to estimate uncollectible accounts. WWC determines 8% of the ending balance is the appropriate end of February estimate of uncollectible accounts 02/29 Record February interest expense accrued on the note payable 02/29 Record one month's interest earned Kit Kat's note (see 02/01)