Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROJECT ANALYSIS FOR FINANCING (Case Study) Latifa Printing Limited was established ten years ago. The company, which has been banking with your institution since inception,

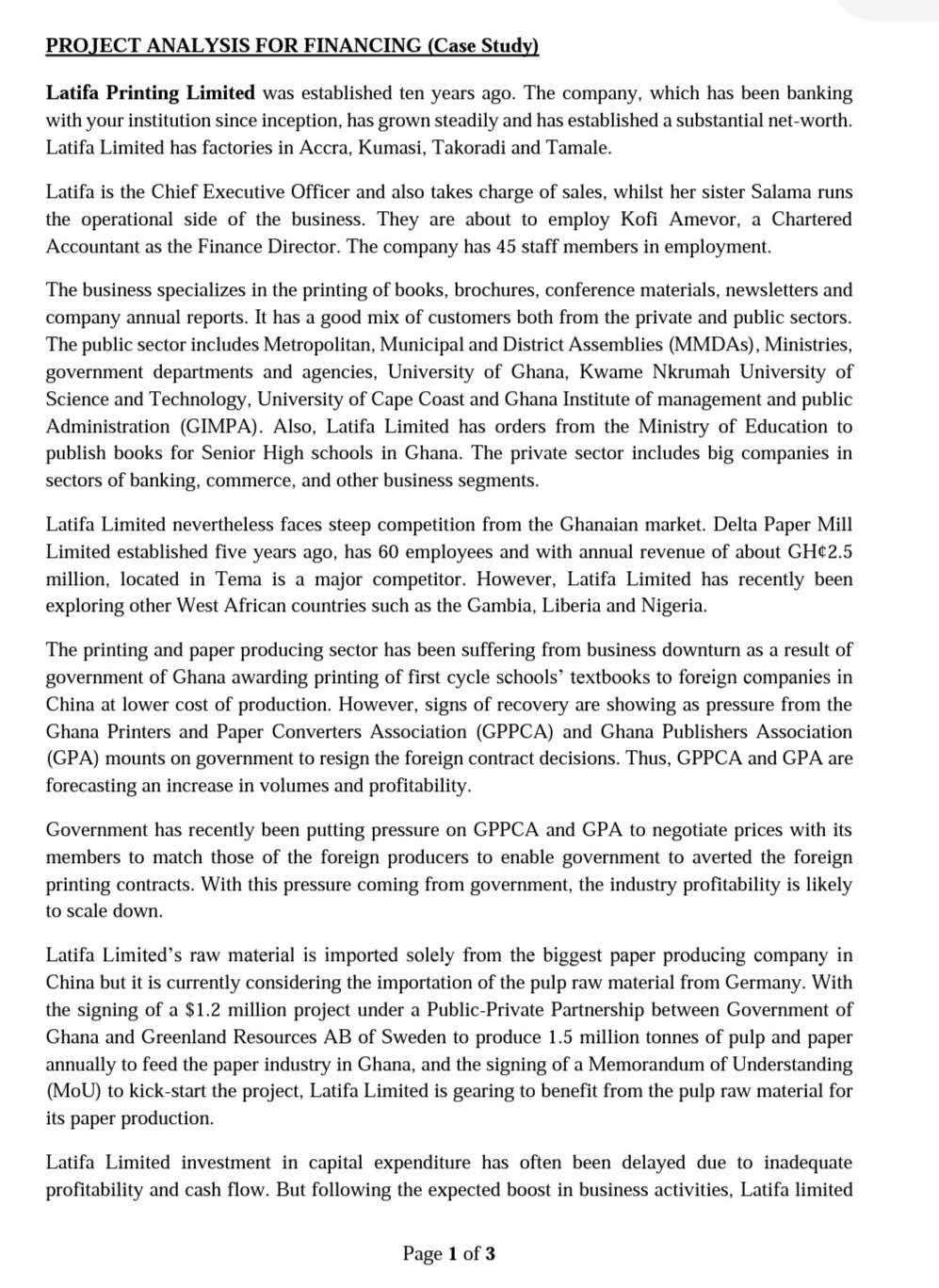

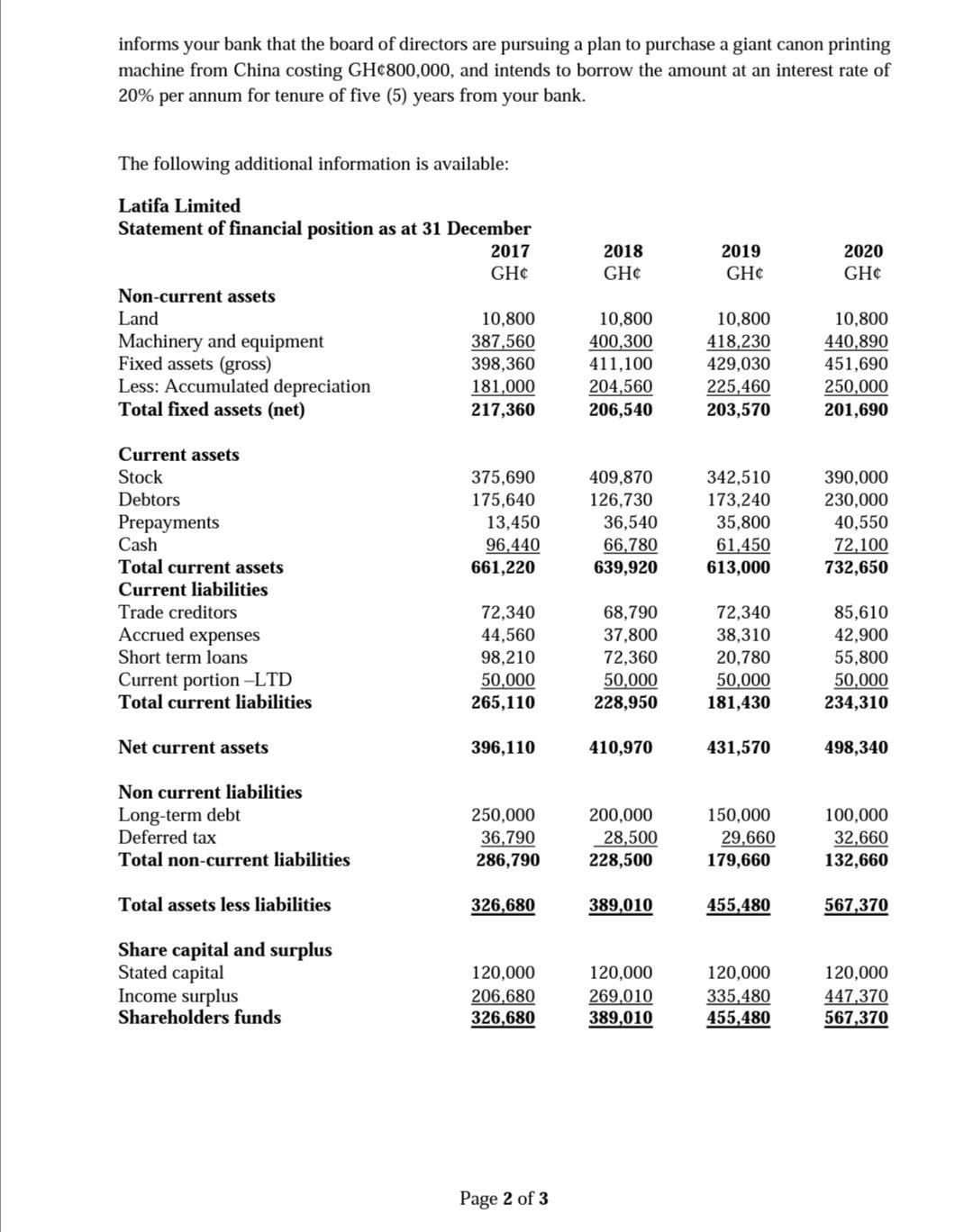

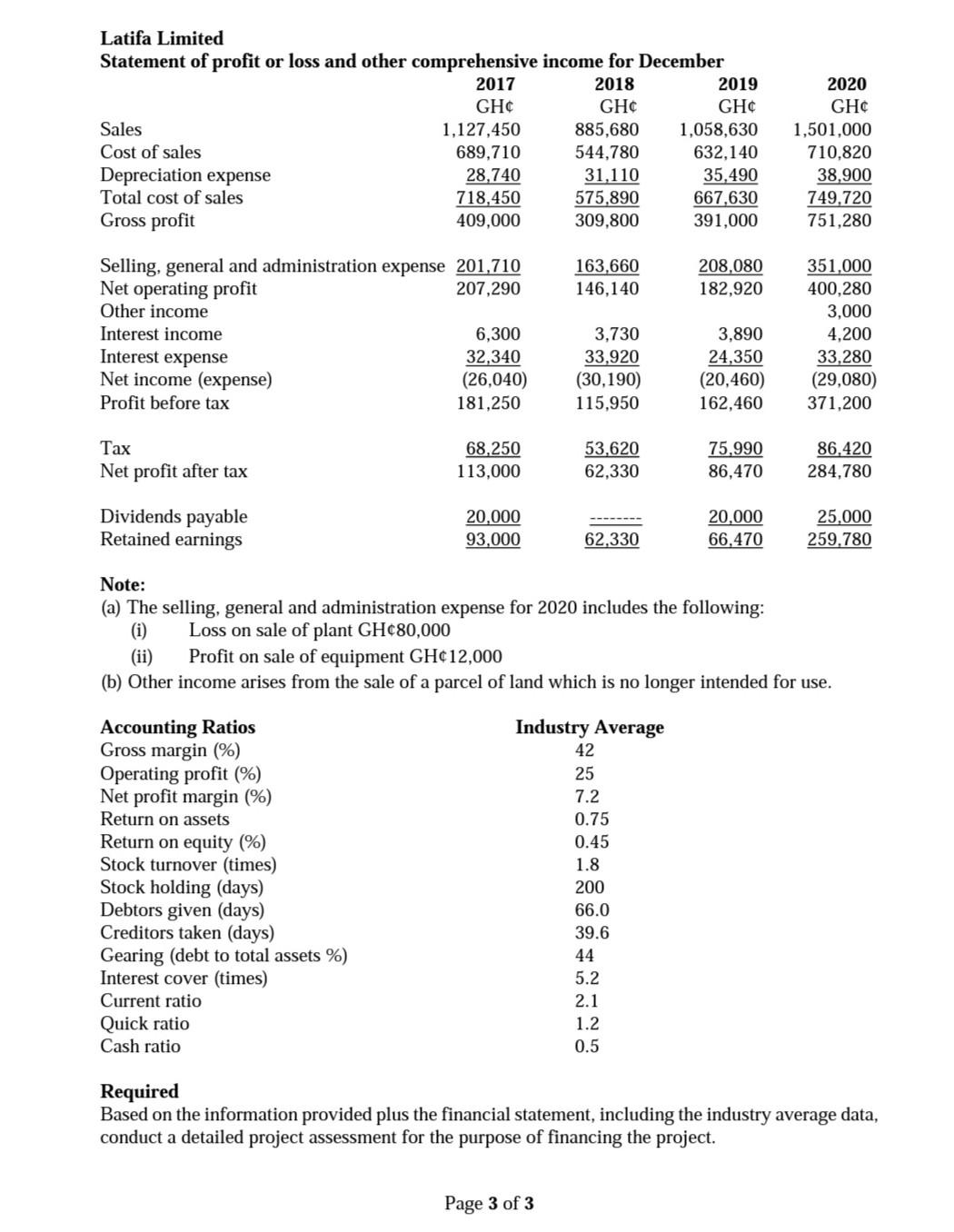

PROJECT ANALYSIS FOR FINANCING (Case Study) Latifa Printing Limited was established ten years ago. The company, which has been banking with your institution since inception, has grown steadily and has established a substantial net-worth. Latifa Limited has factories in Accra, Kumasi, Takoradi and Tamale. Latifa is the Chief Executive Officer and also takes charge of sales, whilst her sister Salama runs the operational side of the business. They are about to employ Kofi Amevor, a Chartered Accountant as the Finance Director. The company has 45 staff members in employment. The business specializes in the printing of books, brochures, conference materials, newsletters and company annual reports. It has a good mix of customers both from the private and public sectors. The public sector includes Metropolitan, Municipal and District Assemblies (MMDAs), Ministries, government departments and agencies, University of Ghana, Kwame Nkrumah University of Science and Technology, University of Cape Coast and Ghana Institute of management and public Administration (GIMPA). Also, Latifa Limited has orders from the Ministry of Education to publish books for Senior High schools in Ghana. The private sector includes big companies in sectors of banking, commerce, and other business segments. Latifa Limited nevertheless faces steep competition from the Ghanaian market. Delta Paper Mill Limited established five years ago, has 60 employees and with annual revenue of about GH2.5 million, located in Tema is a major competitor. However, Latifa Limited has recently been exploring other West African countries such as the Gambia, Liberia and Nigeria. The printing and paper producing sector has been suffering from business downturn as a result of government of Ghana awarding printing of first cycle schools' textbooks to foreign companies in China at lower cost of production. However, signs of recovery are showing as pressure from the Ghana Printers and Paper Converters Association (GPPCA) and Ghana Publishers Association (GPA) mounts on government to resign the foreign contract decisions. Thus, GPPCA and GPA are forecasting an increase in volumes and profitability. Government has recently been putting pressure on GPPCA and GPA to negotiate prices with its members to match those of the foreign producers to enable government to averted the foreign printing contracts. With this pressure coming from government, the industry profitability is likely to scale down. Latifa Limited's raw material is imported solely from the biggest paper producing company in China but it is currently considering the importation of the pulp raw material from Germany. With the signing of a $1.2 million project under a Public-Private Partnership between Government of Ghana and Greenland Resources AB of Sweden to produce 1.5 million tonnes of pulp and paper annually to feed the paper industry in Ghana, and the signing of a Memorandum of Understanding (MoU) to kick-start the project, Latifa Limited is gearing to benefit from the pulp raw material for its paper production. Latifa Limited investment in capital expenditure has often been delayed due to inadequate profitability and cash flow. But following the expected boost in business activities, Latifa limited Page 1 of 3 informs your bank that the board of directors are pursuing a plan to purchase a giant canon printing machine from China costing GH800,000, and intends to borrow the amount at an interest rate of 20% per annum for tenure of five (5) years from your bank. The following additional information is available: 2018 GHC 2019 GHC 2020 GHC Latifa Limited Statement of financial position as at 31 December 2017 GHC Non-current assets Land 10.800 Machinery and equipment 387,560 Fixed assets (gross) 398,360 Less: Accumulated depreciation 181,000 Total fixed assets (net) 217,360 10,800 400,300 411,100 204,560 206,540 10,800 418,230 429,030 225,460 203,570 10,800 440,890 451,690 250,000 201,690 375,690 175,640 13,450 96.440 661,220 409,870 126,730 36,540 66,780 639,920 342,510 173,240 35,800 61,450 613,000 390,000 230,000 40,550 72,100 732,650 Current assets Stock Debtors Prepayments Cash Total current assets Current liabilities Trade creditors Accrued expenses Short term loans Current portion -LTD Total current liabilities 72,340 44,560 98,210 50,000 265,110 68,790 37,800 72,360 50.000 228,950 72,340 38,310 20,780 50,000 181,430 85,610 42.900 55,800 50,000 234,310 Net current assets 396,110 410,970 431,570 498,340 Non current liabilities Long-term debt Deferred tax Total non-current liabilities 250,000 36,790 286,790 200,000 28,500 228,500 150,000 29,660 179,660 100,000 32,660 132,660 Total assets less liabilities 326,680 389,010 455,480 567,370 Share capital and surplus Stated capital Income surplus Shareholders funds 120,000 206.680 326,680 120,000 269,010 389,010 120,000 335.480 455,480 120,000 447,370 567,370 Page 2 of 3 Latifa Limited Statement of profit or loss and other comprehensive income for December 2017 2018 2019 GHC GHC GHC Sales 1,127,450 885,680 1,058,630 Cost of sales 689,710 544,780 632,140 Depreciation expense 28,740 31,110 35,490 Total cost of sales 718,450 575,890 667,630 Gross profit 409,000 309,800 391,000 2020 GHC 1,501,000 710,820 38,900 749,720 751,280 163,660 146,140 208,080 182,920 Selling, general and administration expense 201,710 Net operating profit 207,290 Other income Interest income 6,300 Interest expense 32,340 Net income (expense) (26,040) Profit before tax 181,250 3,730 33,920 (30,190) 115,950 3,890 24,350 (20,460) 162,460 351,000 400,280 3,000 4,200 33,280 (29,080) 371,200 Tax Net profit after tax 68,250 113,000 53,620 62,330 75,990 86,470 86,420 284,780 Dividends payable Retained earnings 20,000 93,000 20,000 66,470 25,000 259.780 62,330 Note: (a) The selling, general and administration expense for 2020 includes the following: (i) Loss on sale of plant GH80,000 (ii) Profit on sale of equipment GH12,000 (b) Other income arises from the sale of a parcel of land which is no longer intended for use. Accounting Ratios Gross margin (%) Operating profit (%) Net profit margin (%) Return on assets Return on equity (%) Stock turnover (times) Stock holding (days) Debtors given (days) Creditors taken (days) Gearing (debt to total assets %) Interest cover (times) Current ratio Quick ratio Cash ratio Industry Average 42 25 7.2 0.75 0.45 1.8 200 66.0 39.6 44 5.2 2.1 1.2 0.5 Required Based on the information provided plus the financial statement, including the industry average data, conduct a detailed project assessment for the purpose of financing the project. Page 3 of 3 PROJECT ANALYSIS FOR FINANCING (Case Study) Latifa Printing Limited was established ten years ago. The company, which has been banking with your institution since inception, has grown steadily and has established a substantial net-worth. Latifa Limited has factories in Accra, Kumasi, Takoradi and Tamale. Latifa is the Chief Executive Officer and also takes charge of sales, whilst her sister Salama runs the operational side of the business. They are about to employ Kofi Amevor, a Chartered Accountant as the Finance Director. The company has 45 staff members in employment. The business specializes in the printing of books, brochures, conference materials, newsletters and company annual reports. It has a good mix of customers both from the private and public sectors. The public sector includes Metropolitan, Municipal and District Assemblies (MMDAs), Ministries, government departments and agencies, University of Ghana, Kwame Nkrumah University of Science and Technology, University of Cape Coast and Ghana Institute of management and public Administration (GIMPA). Also, Latifa Limited has orders from the Ministry of Education to publish books for Senior High schools in Ghana. The private sector includes big companies in sectors of banking, commerce, and other business segments. Latifa Limited nevertheless faces steep competition from the Ghanaian market. Delta Paper Mill Limited established five years ago, has 60 employees and with annual revenue of about GH2.5 million, located in Tema is a major competitor. However, Latifa Limited has recently been exploring other West African countries such as the Gambia, Liberia and Nigeria. The printing and paper producing sector has been suffering from business downturn as a result of government of Ghana awarding printing of first cycle schools' textbooks to foreign companies in China at lower cost of production. However, signs of recovery are showing as pressure from the Ghana Printers and Paper Converters Association (GPPCA) and Ghana Publishers Association (GPA) mounts on government to resign the foreign contract decisions. Thus, GPPCA and GPA are forecasting an increase in volumes and profitability. Government has recently been putting pressure on GPPCA and GPA to negotiate prices with its members to match those of the foreign producers to enable government to averted the foreign printing contracts. With this pressure coming from government, the industry profitability is likely to scale down. Latifa Limited's raw material is imported solely from the biggest paper producing company in China but it is currently considering the importation of the pulp raw material from Germany. With the signing of a $1.2 million project under a Public-Private Partnership between Government of Ghana and Greenland Resources AB of Sweden to produce 1.5 million tonnes of pulp and paper annually to feed the paper industry in Ghana, and the signing of a Memorandum of Understanding (MoU) to kick-start the project, Latifa Limited is gearing to benefit from the pulp raw material for its paper production. Latifa Limited investment in capital expenditure has often been delayed due to inadequate profitability and cash flow. But following the expected boost in business activities, Latifa limited Page 1 of 3 informs your bank that the board of directors are pursuing a plan to purchase a giant canon printing machine from China costing GH800,000, and intends to borrow the amount at an interest rate of 20% per annum for tenure of five (5) years from your bank. The following additional information is available: 2018 GHC 2019 GHC 2020 GHC Latifa Limited Statement of financial position as at 31 December 2017 GHC Non-current assets Land 10.800 Machinery and equipment 387,560 Fixed assets (gross) 398,360 Less: Accumulated depreciation 181,000 Total fixed assets (net) 217,360 10,800 400,300 411,100 204,560 206,540 10,800 418,230 429,030 225,460 203,570 10,800 440,890 451,690 250,000 201,690 375,690 175,640 13,450 96.440 661,220 409,870 126,730 36,540 66,780 639,920 342,510 173,240 35,800 61,450 613,000 390,000 230,000 40,550 72,100 732,650 Current assets Stock Debtors Prepayments Cash Total current assets Current liabilities Trade creditors Accrued expenses Short term loans Current portion -LTD Total current liabilities 72,340 44,560 98,210 50,000 265,110 68,790 37,800 72,360 50.000 228,950 72,340 38,310 20,780 50,000 181,430 85,610 42.900 55,800 50,000 234,310 Net current assets 396,110 410,970 431,570 498,340 Non current liabilities Long-term debt Deferred tax Total non-current liabilities 250,000 36,790 286,790 200,000 28,500 228,500 150,000 29,660 179,660 100,000 32,660 132,660 Total assets less liabilities 326,680 389,010 455,480 567,370 Share capital and surplus Stated capital Income surplus Shareholders funds 120,000 206.680 326,680 120,000 269,010 389,010 120,000 335.480 455,480 120,000 447,370 567,370 Page 2 of 3 Latifa Limited Statement of profit or loss and other comprehensive income for December 2017 2018 2019 GHC GHC GHC Sales 1,127,450 885,680 1,058,630 Cost of sales 689,710 544,780 632,140 Depreciation expense 28,740 31,110 35,490 Total cost of sales 718,450 575,890 667,630 Gross profit 409,000 309,800 391,000 2020 GHC 1,501,000 710,820 38,900 749,720 751,280 163,660 146,140 208,080 182,920 Selling, general and administration expense 201,710 Net operating profit 207,290 Other income Interest income 6,300 Interest expense 32,340 Net income (expense) (26,040) Profit before tax 181,250 3,730 33,920 (30,190) 115,950 3,890 24,350 (20,460) 162,460 351,000 400,280 3,000 4,200 33,280 (29,080) 371,200 Tax Net profit after tax 68,250 113,000 53,620 62,330 75,990 86,470 86,420 284,780 Dividends payable Retained earnings 20,000 93,000 20,000 66,470 25,000 259.780 62,330 Note: (a) The selling, general and administration expense for 2020 includes the following: (i) Loss on sale of plant GH80,000 (ii) Profit on sale of equipment GH12,000 (b) Other income arises from the sale of a parcel of land which is no longer intended for use. Accounting Ratios Gross margin (%) Operating profit (%) Net profit margin (%) Return on assets Return on equity (%) Stock turnover (times) Stock holding (days) Debtors given (days) Creditors taken (days) Gearing (debt to total assets %) Interest cover (times) Current ratio Quick ratio Cash ratio Industry Average 42 25 7.2 0.75 0.45 1.8 200 66.0 39.6 44 5.2 2.1 1.2 0.5 Required Based on the information provided plus the financial statement, including the industry average data, conduct a detailed project assessment for the purpose of financing the project. Page 3 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started