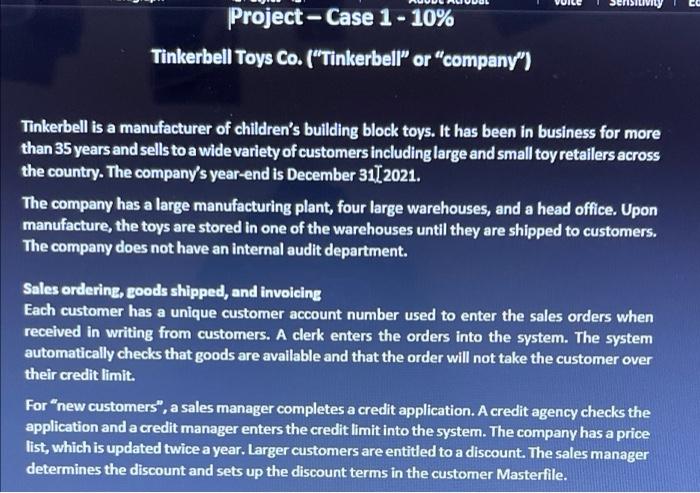

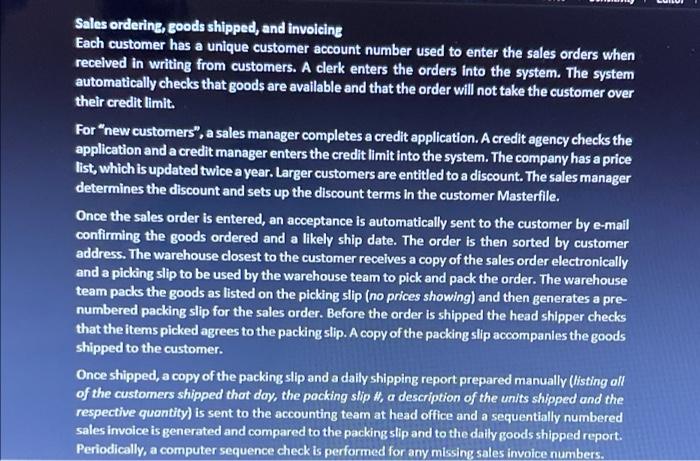

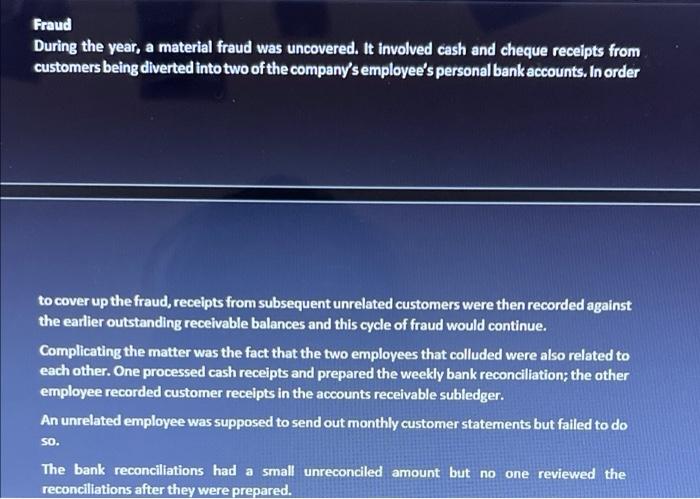

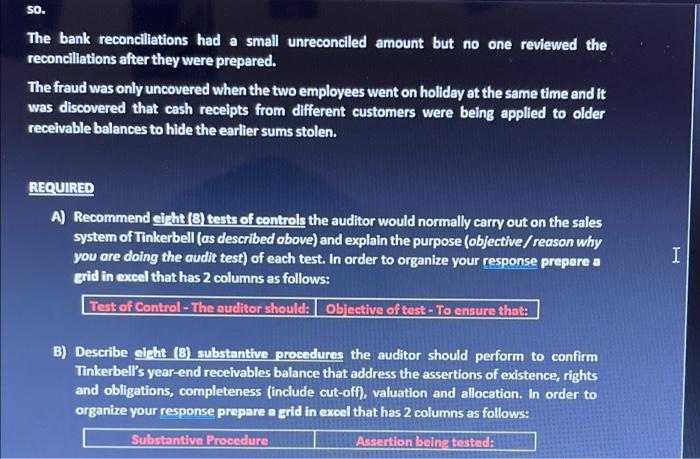

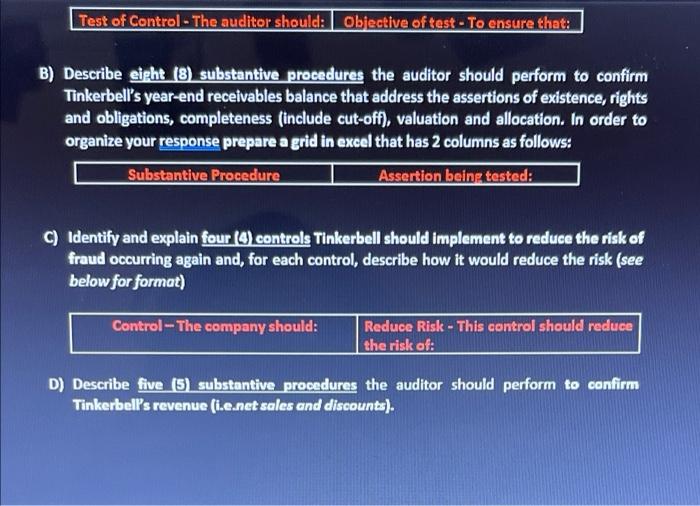

Project - Case 1 - 10% Tinkerbell Toys Co. ("Tinkerbell" or "company") Tinkerbell is a manufacturer of children's building block toys. It has been in business for more than 35 years and sells to a wide variety of customers including large and small toy retailers across the country. The company's year-end is December 31, 2021. The company has a large manufacturing plant, four large warehouses, and a head office. Upon manufacture, the toys are stored in one of the warehouses until they are shipped to customers. The company does not have an internal audit department. Sales ordering, goods shipped, and invoicing Each customer has a unique customer account number used to enter the sales orders when received in writing from customers. A clerk enters the orders into the system. The system automatically checks that goods are available and that the order will not take the customer over their credit limit. For "new customers", a sales manager completes a credit application. A credit agency checks the application and a credit manager enters the credit limit into the system. The company has a price list, which is updated twice a year. Larger customers are entitled to a discount. The sales manager determines the discount and sets up the discount terms in the customer Masterfile. Sales ordering, goods shipped, and invoicing Each customer has a unique customer account number used to enter the sales orders when received in writing from customers. A clerk enters the orders into the system. The system automatically checks that goods are available and that the order will not take the customer over their credit limit. For "new customers", a sales manager completes a credit application. A credit agency checks the application and a credit manager enters the credit limit into the system. The company has a price list, which is updated twice a year. Larger customers are entitled to a discount. The sales manager determines the discount and sets up the discount terms in the customer Masterfile. Once the sales order is entered, an acceptance is automatically sent to the customer by e-mail confirming the goods ordered and a likely ship date. The order is then sorted by customer address. The warehouse closest to the customer receives a copy of the sales order electronically and a picking slip to be used by the warehouse team to pick and pack the order. The warehouse team packs the goods as listed on the picking slip (no prices showing) and then generates a pre- numbered packing slip for the sales order. Before the order is shipped the head shipper checks that the items picked agrees to the packing slip. A copy of the packing slip accompanies the goods shipped to the customer. Once shipped, a copy of the packing slip and a daily shipping report prepared manually (listing all of the customers shipped that day, the packing slip #, a description of the units shipped and the respective quantity) is sent to the accounting team at head office and a sequentially numbered sales invoice is generated and compared to the packing slip and to the daily goods shipped report. Periodically, a computer sequence check is performed for any missing sales invoice numbers. Fraud During the year, a material fraud was uncovered. It involved cash and cheque receipts from customers being diverted into two of the company's employee's personal bank accounts. In order to cover up the fraud, receipts from subsequent unrelated customers were then recorded against the earlier outstanding receivable balances and this cycle of fraud would continue. Complicating the matter was the fact that the two employees that colluded were also related to each other. One processed cash receipts and prepared the weekly bank reconciliation; the other employee recorded customer receipts in the accounts receivable subledger. An unrelated employee was supposed to send out monthly customer statements but failed to do SO. The bank reconciliations had a small unreconciled amount but no one reviewed the reconciliations after they were prepared. so. The bank reconciliations had a small unreconciled amount but no one reviewed the reconciliations after they were prepared. The fraud was only uncovered when the two employees went on holiday at the same time and it was discovered that cash receipts from different customers were being applied to older receivable balances to hide the earlier sums stolen. REQUIRED A) Recommend eight (8) tests of controls the auditor would normally carry out on the sales system of Tinkerbell (as described above) and explain the purpose (objective/reason why you are doing the audit test) of each test. In order to organize your response prepare a grid in excel that has 2 columns as follows: Test of Control - The auditor should: Objective of test-To ensure that: B) Describe eight (8) substantive procedures the auditor should perform to confirm Tinkerbell's year-end receivables balance that address the assertions of existence, rights and obligations, completeness (include cut-off), valuation and allocation. In order to organize your response prepare a grid in excel that has 2 columns as follows: Substantive Procedure Assertion being tested: I Test of Control - The auditor should: Objective of test - To ensure that: B) Describe eight (8) substantive procedures the auditor should perform to confirm Tinkerbell's year-end receivables balance that address the assertions of existence, rights and obligations, completeness (include cut-off), valuation and allocation. In order to organize your response prepare a grid in excel that has 2 columns as follows: Substantive Procedure Assertion being tested: C) Identify and explain four (4) controls Tinkerbell should implement to reduce the risk of fraud occurring again and, for each control, describe how it would reduce the risk (see below for format) Control-The company should: Reduce Risk - This control should reduce the risk of: D) Describe five (5) substantive procedures the auditor should perform to confirm Tinkerbell's revenue (i.e.net sales and discounts)