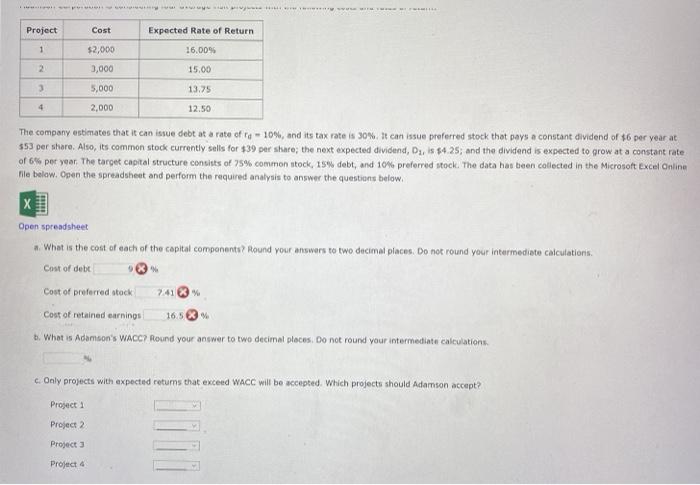

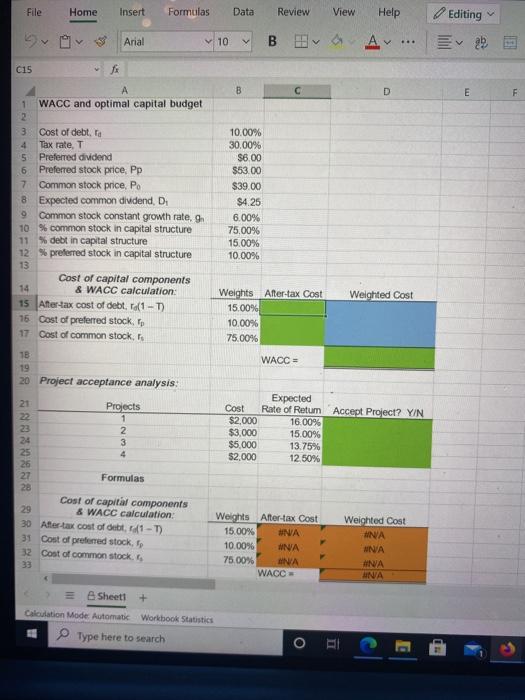

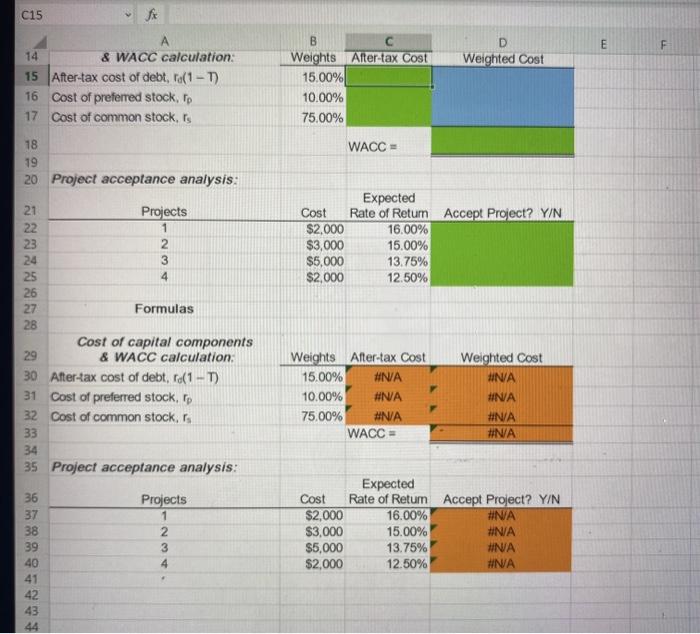

Project Cost Expected Rate of Return 1 16.00% $2,000 3,000 2 15.00 5,000 4 3 13.75 2,000 12.50 The company estimates that it can issue debt at a rate ofre -10%, and its tax rate is 30%. It can issue preferred stock that pays a constant dividend of $6 per year at $53 per store. Also, its common stock currently sells for $39 per share the next expected dividend, Da, is $4.25; and the dividend is expected to grow at a constant rate of 6% per year. The target capital structure conults of 75% common stock, 15% debt, and 10% preferred stock. The data has been collected in the Microsoft Excel Online Mile below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet * What is the cost of each of the capital components? Round your answers to two decimal places. Do not round your intermediate calculations Cost of debt Cost of preferred stock Cost of retained earnings 16.5 b. What is Adamson's WACCP Round your answer to two decimal places. Do not round your intermediate calculations Only projects with expected returns that exceed wacc will be accepted. Which projects should Adamson accept? Project 1 Project 2 Project 3 Project File Home Insert Formulas Data Review View Help Editing 25 V Aria! v 10 V B V . C15 fi B D E F A WACC and optimal capital budget 2 3 Cost of debt, la 4 Tax rate, T 5 Prefemed dividend 6 Preferred stock price, Pp 7 Common stock price. Po 8 Expected common diudend, D Common stock constant growth rate, 10 % common stock in capital structure 11 % debt in capital structure 12 % preferred stock in capital structure 13 Cost of capital components 14 & WACC calculation: 15 After-tax cost of debt, T.(1-T) 16 Cost of preferred stock to 17 Cost of common stock, 10.00% 30.00% $6.00 $53.00 $39.00 $4.25 6.00% 75.00% 15.00% 10.00% Weighted Cost Weights After-tax Cost 15.00% 10.00% 75.00% WACC 18 19 20 Project acceptance analysis EBE BEHE9% a x aaa Expected Cost Rate of Retum Accept Project? YIN $2,000 16.00% $3.000 15.00% $5,000 13.75% $2,000 12.50% 21 Projects 1 2 24 3 25 4 26 27 Formulas 28 Cost of capital components 29 & WACC calculation: 30 After-tax cost of debt, 1-T) 31 Cost of preferred stock, 32 Cost of common stock. Weights After-tax Cost 15.00% UNA 10.0096 WNA 75.00% INA WACC Weighted Cost NA WNA NA UNA Sheet1 + Calculation Mode: Automatic Workbook Statistics Type here to search O EL C15 E F D Weighted Cost 14 & WACC calculation: 15 After-tax cost of debt, Ta(1-T) 16 Cost of preferred stock, Tp 17 Cost of common stock, Ts 18 19 20 Project acceptance analysis: B Weights After-tax Cost 15.00% 10.00% 75.00% WACC = Expected Cost Rate of Return Accept Project? Y/N $2,000 16.00% $3,000 15.00% $5,000 13.75% $2,000 12.50% 21 Projects 22 23 2 24 3 25 4 26 27 Formulas 28 Cost of capital components 29 & WACC calculation, 30 After-tax cost of debt, ro(1-T) 31 Cost of preferred stock, Tp 32 Cost of common stock, 33 34 35 Project acceptance analysis: Weights After-tax Cost 15.00% #NA 10.00% #NA 75.00% #NA WACC = Weighted Cost #NA HINA #NA #N/A Projects 36 37 38 39 40 41 42 43 44 2 3 4 Expected Cost Rate of Return Accept Project? Y/N $2,000 16.00% #NA $3,000 15.00% #N/A $5,000 13.75% #NA $2,000 12.50% #NA