Answered step by step

Verified Expert Solution

Question

1 Approved Answer

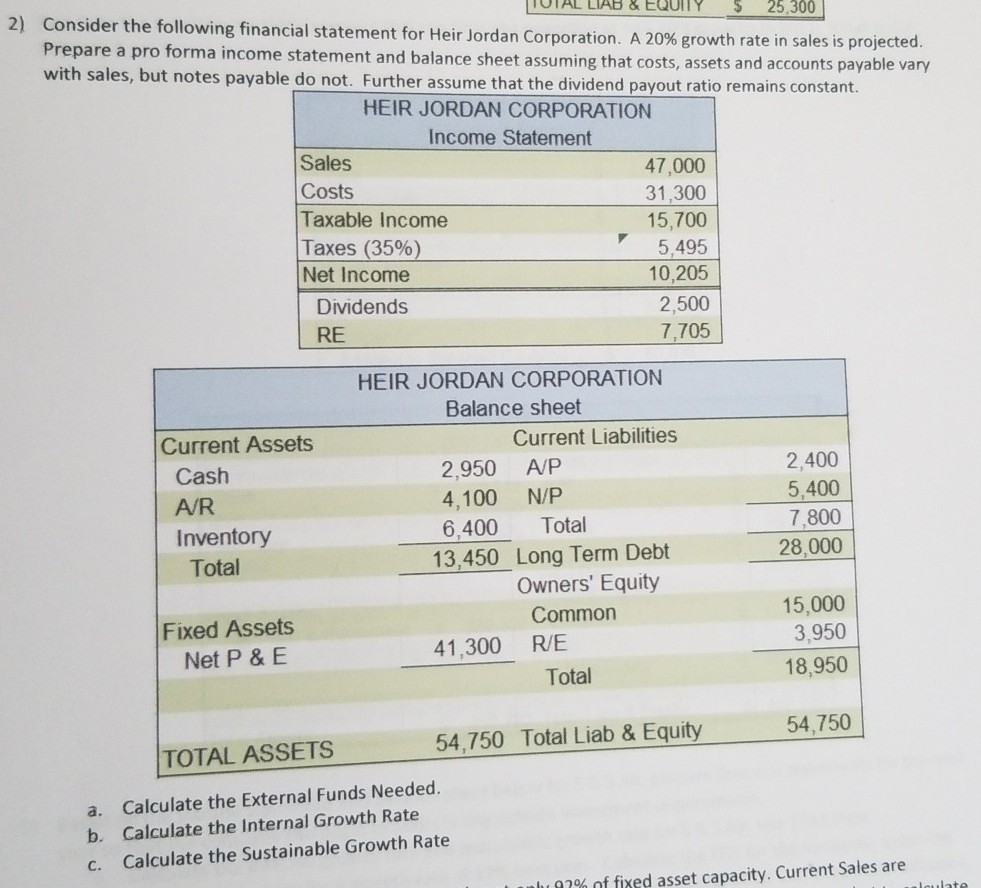

project growth. 20% dividend payout 24% taxes. 35% TIUTAL LIAD OCWUIT $ 25,JUU 2) Consider the following financial statement for Heir Jordan Corporation. A 20%

project growth. 20% dividend payout 24% taxes. 35%

TIUTAL LIAD OCWUIT $ 25,JUU 2) Consider the following financial statement for Heir Jordan Corporation. A 20% growth rate in sales is projected. Prepare a pro forma income statement and balance sheet assuming that costs, assets and accounts payable vary with sales, but notes payable do not. Further assume that the dividend payout ratio remains constant. HEIR JORDAN CORPORATION Income Statement Sales 47,000 Costs 31.300 Taxable income 15,700 Taxes (35%) 5.495 Net Income 10,205 Dividends 2,500 RE 7,705 Current Assets Cash A/R Inventory Total HEIR JORDAN CORPORATION Balance sheet Current Liabilities 2.950 A/P 4,100 N/P 6.400 Total 13,450 Long Term Debt Owners' Equity Common 41.300 RE Total 2,400 5.400 7,800 28.000 Fixed Assets Net P & E 15.000 3.950 18,950 54.750 54.750 Total Liab & Equity TOTAL ASSETS a. Calculate the External Funds Needed. b. Calculate the Internal Growth Rate C. Calculate the Sustainable Growth Rate h.02% of fixed asset capacity. Current Sales are 1-..lateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started