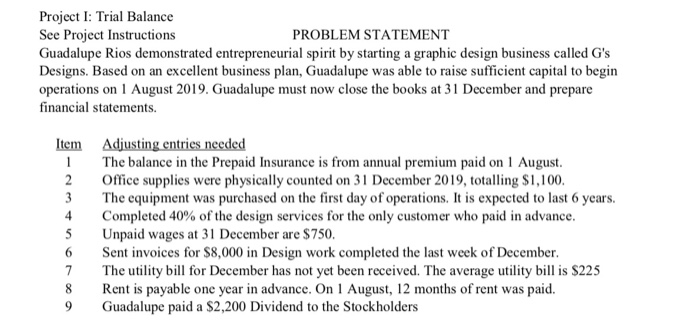

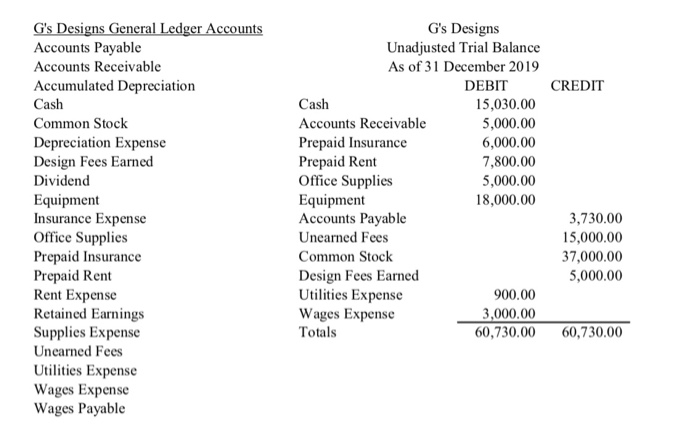

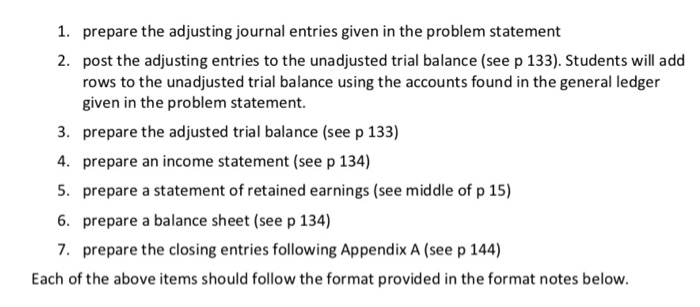

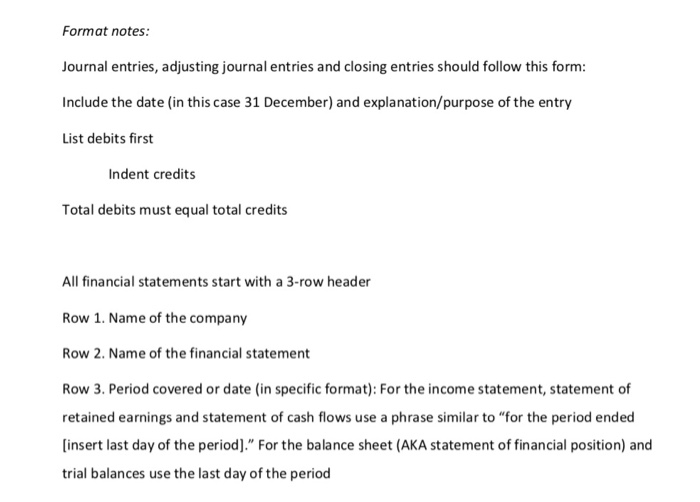

Project I: Trial Balance See Project Instructions PROBLEM STATEMENT Guadalupe Rios demonstrated entrepreneurial spirit by starting a graphic design business called G's Designs. Based on an excellent business plan, Guadalupe was able to raise sufficient capital to begin operations on 1 August 2019. Guadalupe must now close the books at 31 December and prepare financial statements. 4 Item Adjusting entries needed The balance in the Prepaid Insurance is from annual premium paid on 1 August 2 Office supplies were physically counted on 31 December 2019, totalling $1,100. 3 The equipment was purchased on the first day of operations. It is expected to last 6 years. Completed 40% of the design services for the only customer who paid in advance. 5 Unpaid wages at 31 December are $750. 6 Sent invoices for $8,000 in Design work completed the last week of December 7 The utility bill for December has not yet been received. The average utility bill is $225 Rent is payable one year in advance. On 1 August, 12 months of rent was paid. 9 Guadalupe paid a $2,200 Dividend to the Stockholders 8 CREDIT G's Designs General Ledger Accounts Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Depreciation Expense Design Fees Earned Dividend Equipment Insurance Expense Office Supplies Prepaid Insurance Prepaid Rent Rent Expense Retained Earnings Supplies Expense Unearned Fees Utilities Expense Wages Expense Wages Payable G's Designs Unadjusted Trial Balance As of 31 December 2019 DEBIT Cash 15,030.00 Accounts Receivable 5,000.00 Prepaid Insurance 6,000.00 Prepaid Rent 7,800.00 Office Supplies 5,000.00 Equipment 18,000.00 Accounts Payable Unearned Fees Common Stock Design Fees Earned Utilities Expense 900.00 Wages Expense 3,000.00 Totals 60,730.00 3,730.00 15,000.00 37,000.00 5,000.00 60,730.00 1. prepare the adjusting journal entries given in the problem statement 2. post the adjusting entries to the unadjusted trial balance (see p 133). Students will add rows to the unadjusted trial balance using the accounts found in the general ledger given in the problem statement 3. prepare the adjusted trial balance (see p 133) 4. prepare an income statement (see p 134) 5. prepare a statement of retained earnings (see middle of p 15) 6. prepare a balance sheet (see p 134) 7. prepare the closing entries following Appendix A (see p 144) Each of the above items should follow the format provided in the format notes below. Format notes: Journal entries, adjusting journal entries and closing entries should follow this form: Include the date (in this case 31 December) and explanation/purpose of the entry List debits first Indent credits Total debits must equal total credits All financial statements start with a 3-row header Row 1. Name of the company Row 2. Name of the financial statement Row 3. Period covered or date (in specific format): For the income statement, statement of retained earnings and statement of cash flows use a phrase similar to "for the period ended [insert last day of the period)." For the balance sheet (AKA statement of financial position) and trial balances use the last day of the period