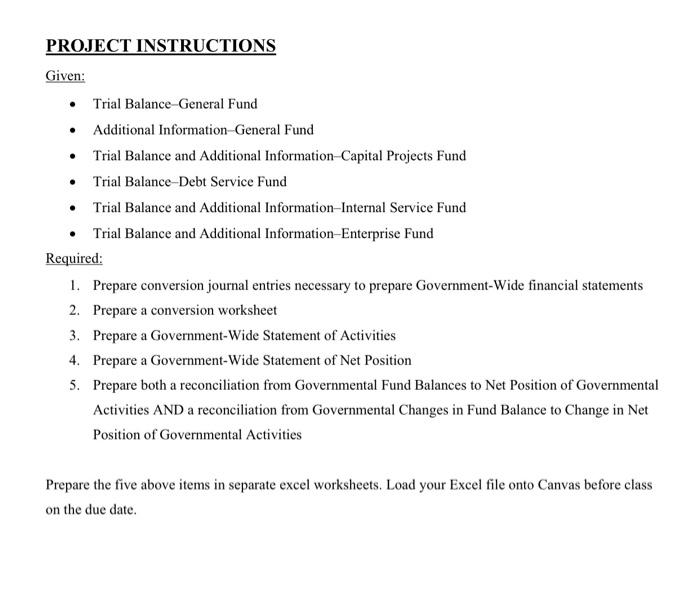

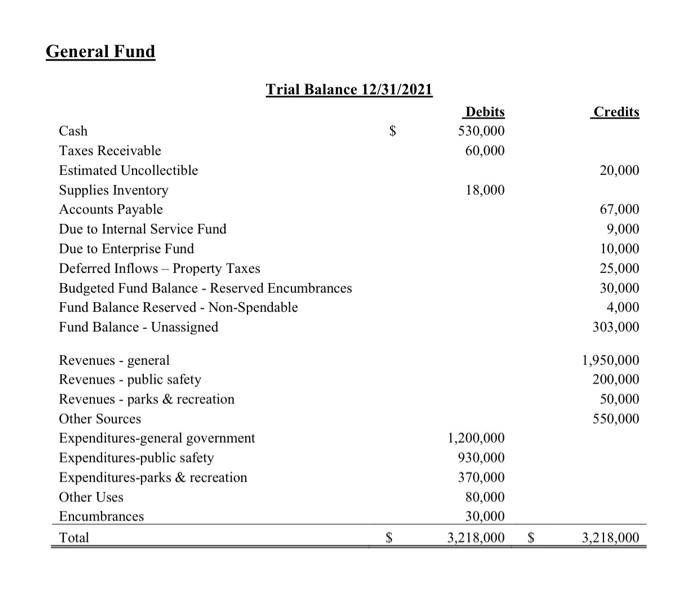

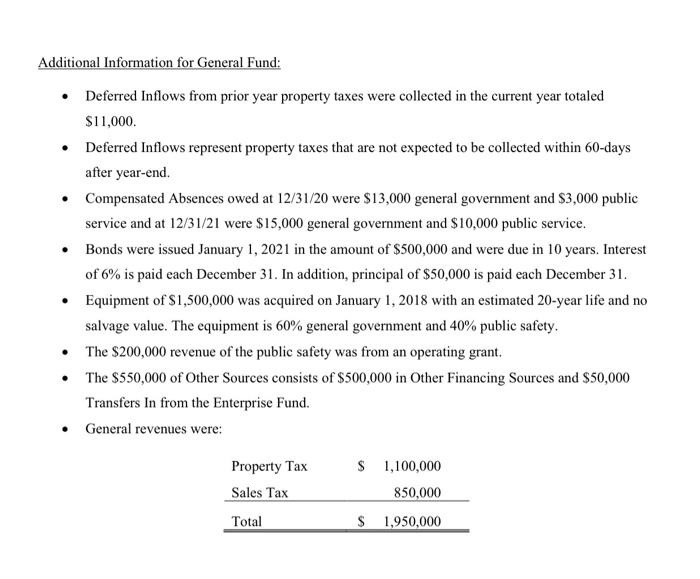

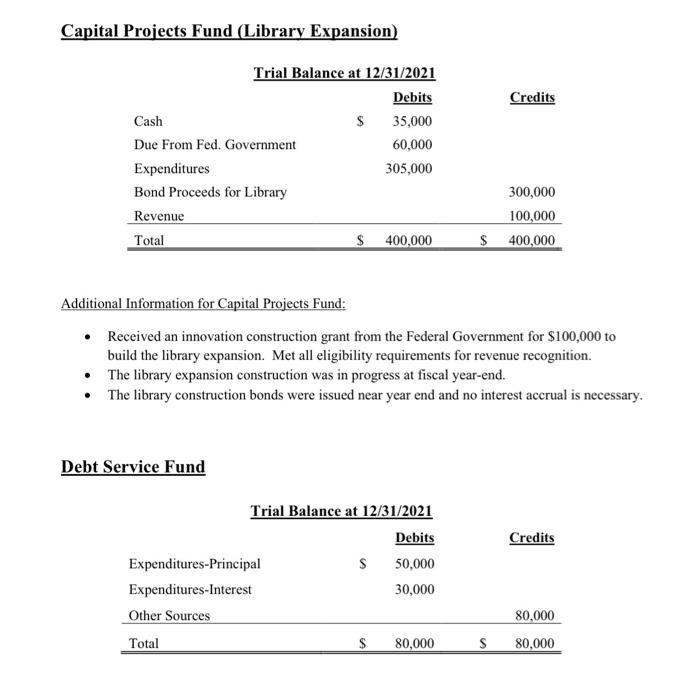

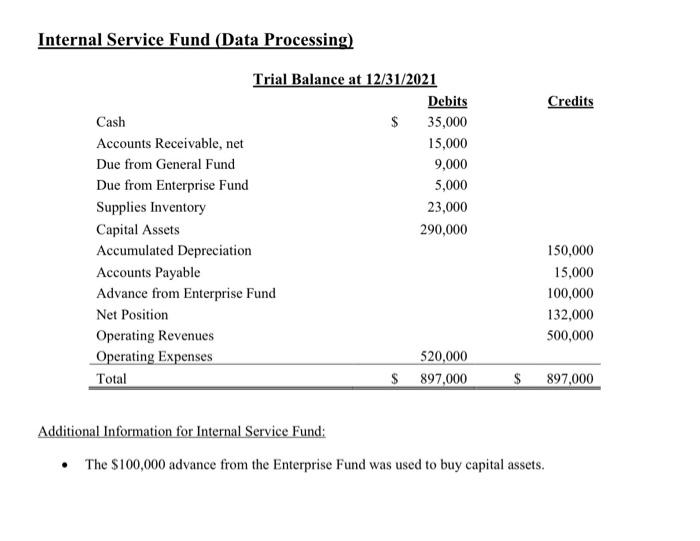

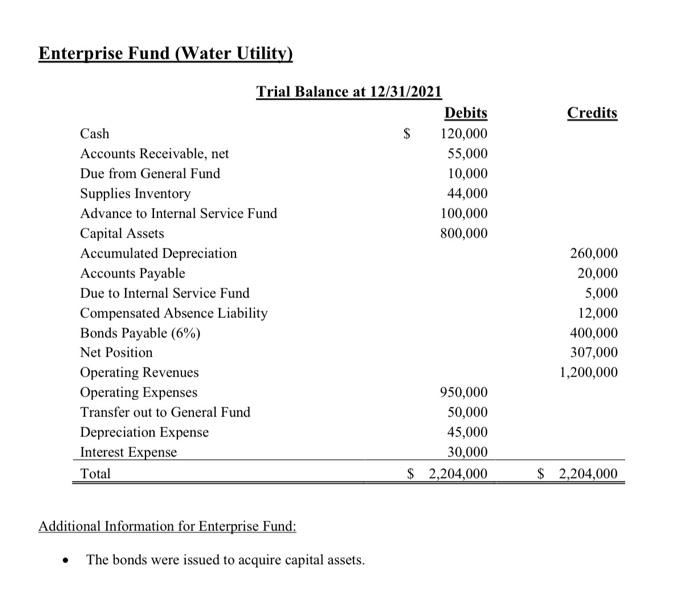

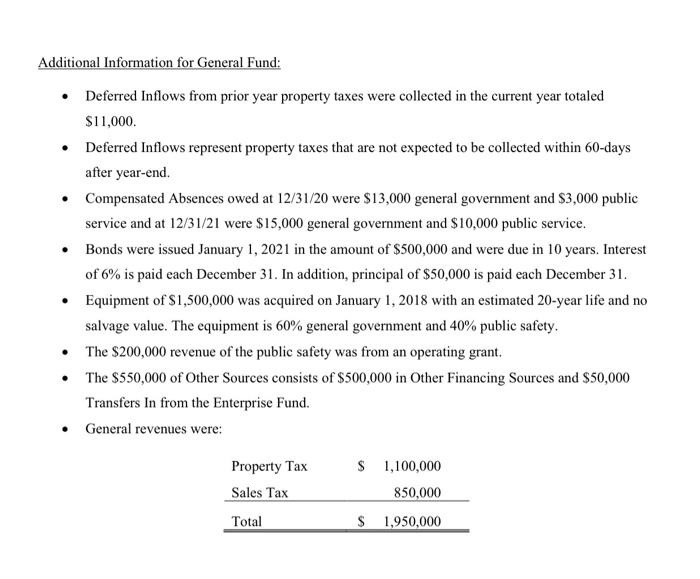

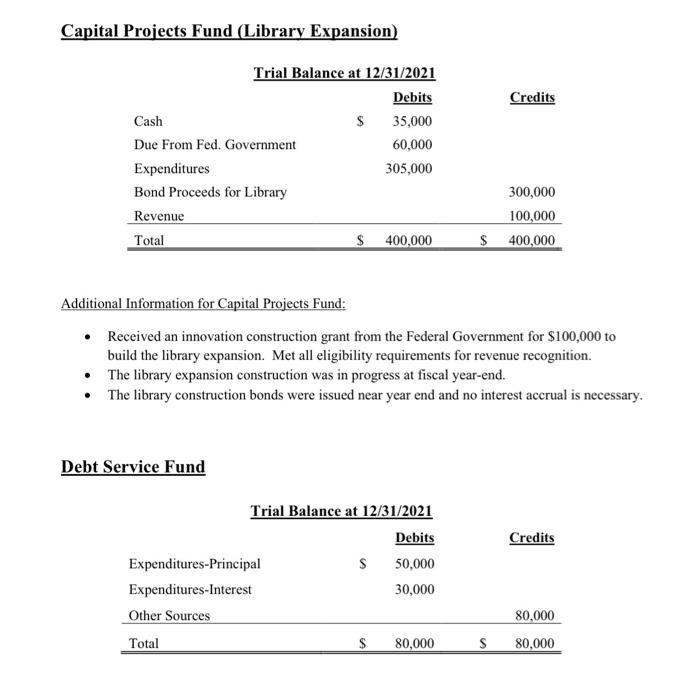

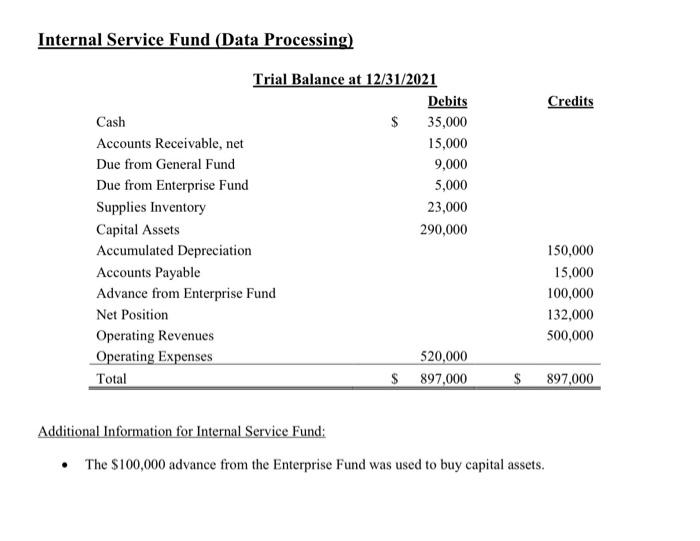

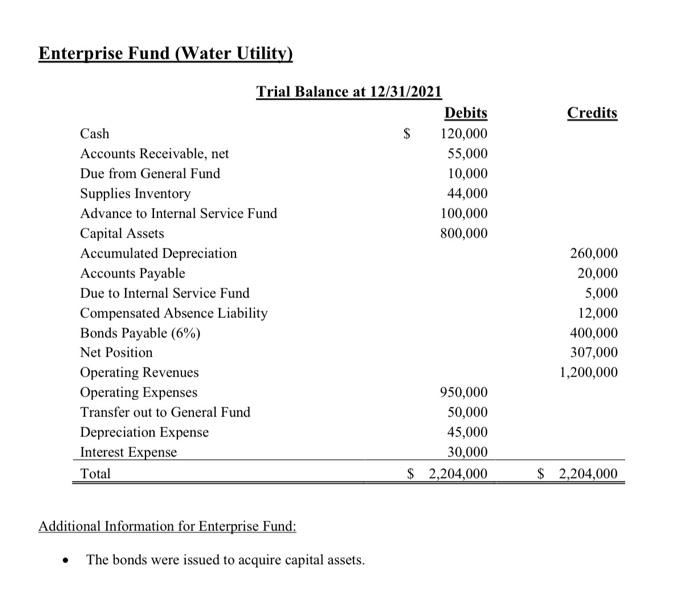

PROJECT INSTRUCTIONS Given: Trial Balance General Fund Additional Information-General Fund Trial Balance and Additional Information-Capital Projects Fund Trial Balance-Debt Service Fund Trial Balance and Additional Information Internal Service Fund Trial Balance and Additional Information-Enterprise Fund Required: 1. Prepare conversion journal entries necessary to prepare Government-Wide financial statements 2. Prepare a conversion worksheet 3. Prepare a Government-Wide Statement of Activities 4. Prepare a Government-Wide Statement of Net Position 5. Prepare both a reconciliation from Governmental Fund Balances to Net Position of Governmental Activities AND a reconciliation from Governmental Changes in Fund Balance to Change in Net Position of Governmental Activities Prepare the five above items in separate excel worksheets. Load your Excel file onto Canvas before class on the due date. General Fund Trial Balance 12/31/2021 Credits $ Debits 530,000 60,000 20,000 18,000 Cash Taxes Receivable Estimated Uncollectible Supplies Inventory Accounts Payable Due to Internal Service Fund Due to Enterprise Fund Deferred Inflows - Property Taxes Budgeted Fund Balance - Reserved Encumbrances Fund Balance Reserved - Non-Spendable Fund Balance - Unassigned 67,000 9,000 10,000 25,000 30,000 4,000 303,000 1,950,000 200,000 50,000 550,000 Revenues - general Revenues - public safety Revenues - parks & recreation Other Sources Expenditures-general government Expenditures-public safety Expenditures-parks & recreation Other Uses Encumbrances Total 1,200,000 930,000 370,000 80,000 30,000 3,218,000 $ 3,218,000 Additional Information for General Fund: Deferred Inflows from prior year property taxes were collected in the current year totaled $11,000. Deferred Inflows represent property taxes that are not expected to be collected within 60-days after year-end. Compensated Absences owed at 12/31/20 were $13,000 general government and $3,000 public service and at 12/31/21 were $15,000 general government and $10,000 public service. Bonds were issued January 1, 2021 in the amount of $500,000 and were due in 10 years. Interest of 6% is paid each December 31. In addition, principal of $50,000 is paid each December 31. Equipment of $1,500,000 was acquired on January 1, 2018 with an estimated 20-year life and no salvage value. The equipment is 60% general government and 40% public safety. The $200,000 revenue of the public safety was from an operating grant. The $550,000 of Other Sources consists of $500,000 in Other Financing Sources and $50,000 Transfers In from the Enterprise Fund. General revenues were: Property Tax Sales Tax $ 1,100,000 850,000 Total $ 1,950,000 Capital Projects Fund (Library Expansion) Credits Trial Balance at 12/31/2021 Debits Cash $ 35,000 Due From Fed. Government 60,000 Expenditures 305,000 Bond Proceeds for Library Revenue Total $ 400,000 300,000 100,000 $ 400,000 Additional Information for Capital Projects Fund: Received an innovation construction grant from the Federal Government for $100,000 to build the library expansion. Met all eligibility requirements for revenue recognition. The library expansion construction was in progress at fiscal year-end. The library construction bonds were issued near year end and no interest accrual is necessary. Debt Service Fund Credits Trial Balance at 12/31/2021 Debits Expenditures-Principal $ 50,000 Expenditures-Interest 30,000 Other Sources Total $ 80,000 80,000 80,000 S Internal Service Fund (Data Processing) Credits Trial Balance at 12/31/2021 Debits Cash $ 35,000 Accounts Receivable, net 15,000 Due from General Fund 9,000 Due from Enterprise Fund 5,000 Supplies Inventory 23,000 Capital Assets 290,000 Accumulated Depreciation Accounts Payable Advance from Enterprise Fund Net Position Operating Revenues Operating Expenses 520,000 Total $ 897,000 150,000 15,000 100,000 132,000 500,000 $ 897,000 Additional Information for Internal Service Fund: The $100,000 advance from the Enterprise Fund was used to buy capital assets. Enterprise Fund (Water Utility) Credits Trial Balance at 12/31/2021 Debits Cash $ 120,000 Accounts Receivable, net 55,000 Due from General Fund 10,000 Supplies Inventory 44,000 Advance to Internal Service Fund 100,000 Capital Assets 800,000 Accumulated Depreciation Accounts Payable Due to Internal Service Fund Compensated Absence Liability Bonds Payable (6%) Net Position Operating Revenues Operating Expenses 950,000 Transfer out to General Fund 50,000 Depreciation Expense 45,000 Interest Expense 30,000 Total $ 2,204,000 260,000 20,000 5,000 12,000 400,000 307,000 1,200,000 $ 2,204,000 Additional Information for Enterprise Fund: The bonds were issued to acquire capital assets. PROJECT INSTRUCTIONS Given: Trial Balance General Fund Additional Information-General Fund Trial Balance and Additional Information-Capital Projects Fund Trial Balance-Debt Service Fund Trial Balance and Additional Information Internal Service Fund Trial Balance and Additional Information-Enterprise Fund Required: 1. Prepare conversion journal entries necessary to prepare Government-Wide financial statements 2. Prepare a conversion worksheet 3. Prepare a Government-Wide Statement of Activities 4. Prepare a Government-Wide Statement of Net Position 5. Prepare both a reconciliation from Governmental Fund Balances to Net Position of Governmental Activities AND a reconciliation from Governmental Changes in Fund Balance to Change in Net Position of Governmental Activities Prepare the five above items in separate excel worksheets. Load your Excel file onto Canvas before class on the due date. General Fund Trial Balance 12/31/2021 Credits $ Debits 530,000 60,000 20,000 18,000 Cash Taxes Receivable Estimated Uncollectible Supplies Inventory Accounts Payable Due to Internal Service Fund Due to Enterprise Fund Deferred Inflows - Property Taxes Budgeted Fund Balance - Reserved Encumbrances Fund Balance Reserved - Non-Spendable Fund Balance - Unassigned 67,000 9,000 10,000 25,000 30,000 4,000 303,000 1,950,000 200,000 50,000 550,000 Revenues - general Revenues - public safety Revenues - parks & recreation Other Sources Expenditures-general government Expenditures-public safety Expenditures-parks & recreation Other Uses Encumbrances Total 1,200,000 930,000 370,000 80,000 30,000 3,218,000 $ 3,218,000 Additional Information for General Fund: Deferred Inflows from prior year property taxes were collected in the current year totaled $11,000. Deferred Inflows represent property taxes that are not expected to be collected within 60-days after year-end. Compensated Absences owed at 12/31/20 were $13,000 general government and $3,000 public service and at 12/31/21 were $15,000 general government and $10,000 public service. Bonds were issued January 1, 2021 in the amount of $500,000 and were due in 10 years. Interest of 6% is paid each December 31. In addition, principal of $50,000 is paid each December 31. Equipment of $1,500,000 was acquired on January 1, 2018 with an estimated 20-year life and no salvage value. The equipment is 60% general government and 40% public safety. The $200,000 revenue of the public safety was from an operating grant. The $550,000 of Other Sources consists of $500,000 in Other Financing Sources and $50,000 Transfers In from the Enterprise Fund. General revenues were: Property Tax Sales Tax $ 1,100,000 850,000 Total $ 1,950,000 Capital Projects Fund (Library Expansion) Credits Trial Balance at 12/31/2021 Debits Cash $ 35,000 Due From Fed. Government 60,000 Expenditures 305,000 Bond Proceeds for Library Revenue Total $ 400,000 300,000 100,000 $ 400,000 Additional Information for Capital Projects Fund: Received an innovation construction grant from the Federal Government for $100,000 to build the library expansion. Met all eligibility requirements for revenue recognition. The library expansion construction was in progress at fiscal year-end. The library construction bonds were issued near year end and no interest accrual is necessary. Debt Service Fund Credits Trial Balance at 12/31/2021 Debits Expenditures-Principal $ 50,000 Expenditures-Interest 30,000 Other Sources Total $ 80,000 80,000 80,000 S Internal Service Fund (Data Processing) Credits Trial Balance at 12/31/2021 Debits Cash $ 35,000 Accounts Receivable, net 15,000 Due from General Fund 9,000 Due from Enterprise Fund 5,000 Supplies Inventory 23,000 Capital Assets 290,000 Accumulated Depreciation Accounts Payable Advance from Enterprise Fund Net Position Operating Revenues Operating Expenses 520,000 Total $ 897,000 150,000 15,000 100,000 132,000 500,000 $ 897,000 Additional Information for Internal Service Fund: The $100,000 advance from the Enterprise Fund was used to buy capital assets. Enterprise Fund (Water Utility) Credits Trial Balance at 12/31/2021 Debits Cash $ 120,000 Accounts Receivable, net 55,000 Due from General Fund 10,000 Supplies Inventory 44,000 Advance to Internal Service Fund 100,000 Capital Assets 800,000 Accumulated Depreciation Accounts Payable Due to Internal Service Fund Compensated Absence Liability Bonds Payable (6%) Net Position Operating Revenues Operating Expenses 950,000 Transfer out to General Fund 50,000 Depreciation Expense 45,000 Interest Expense 30,000 Total $ 2,204,000 260,000 20,000 5,000 12,000 400,000 307,000 1,200,000 $ 2,204,000 Additional Information for Enterprise Fund: The bonds were issued to acquire capital assets