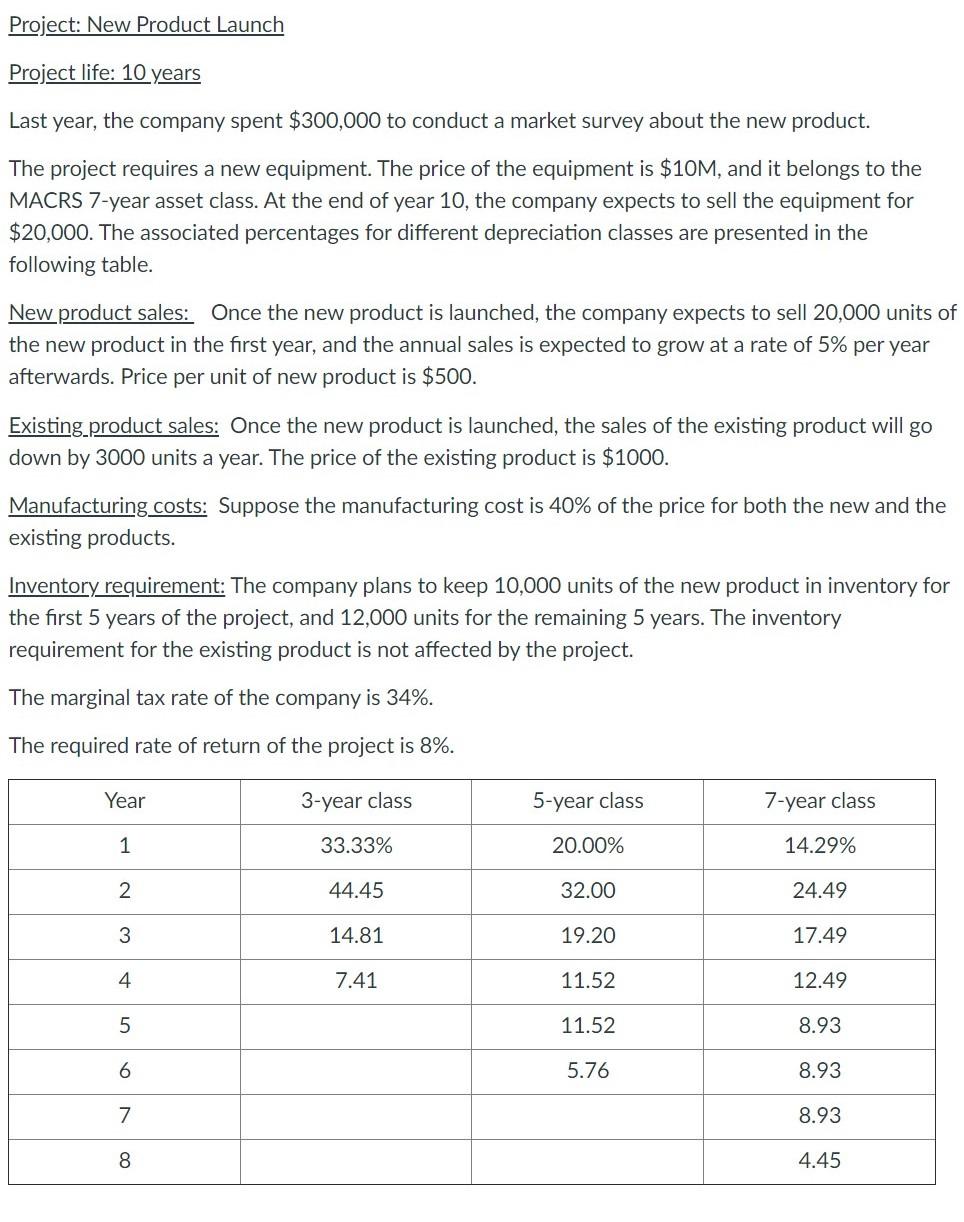

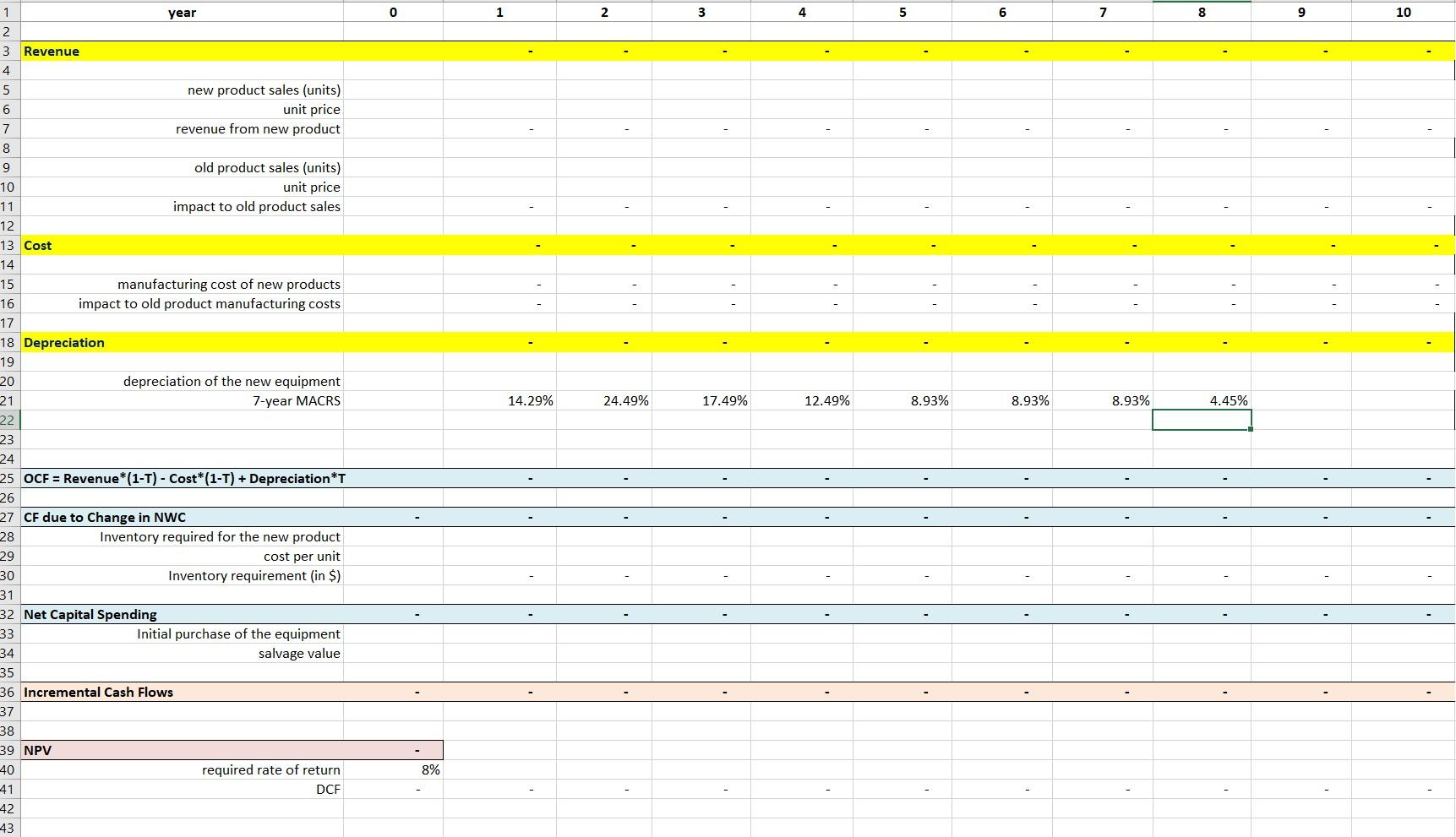

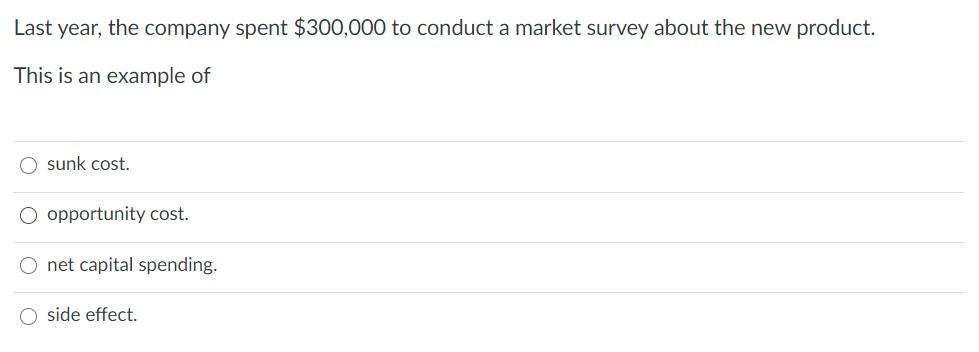

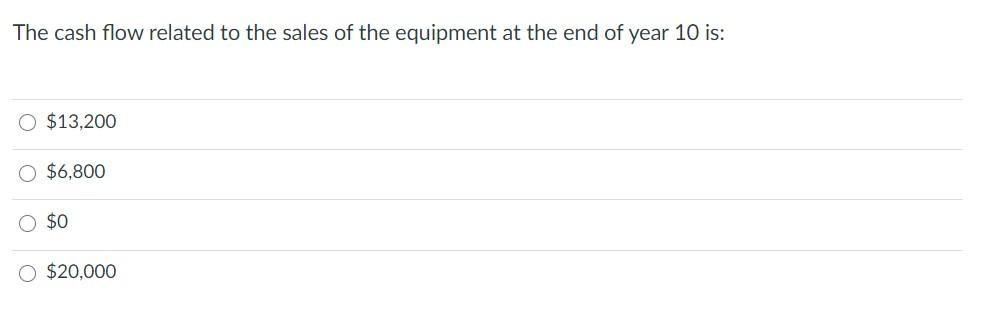

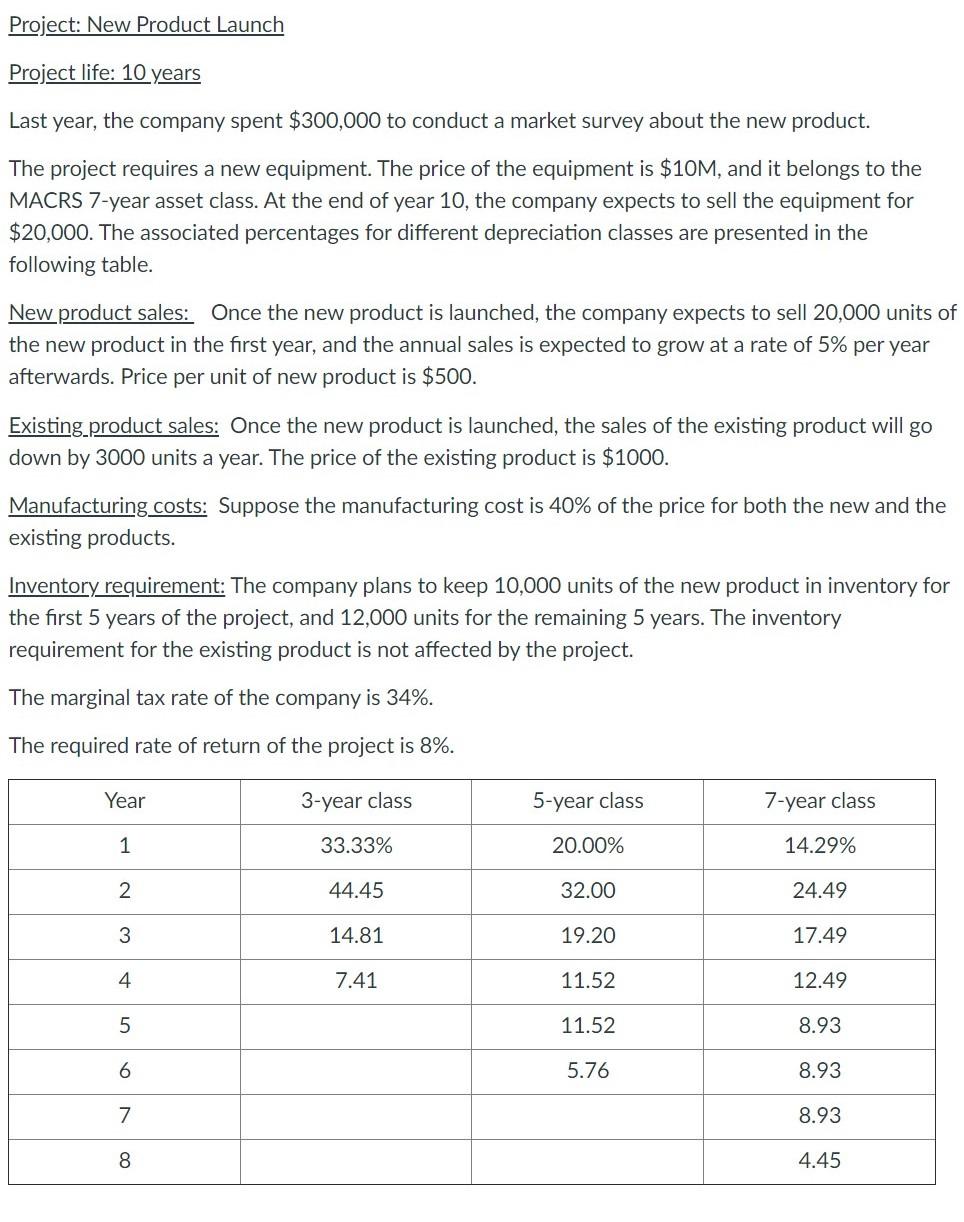

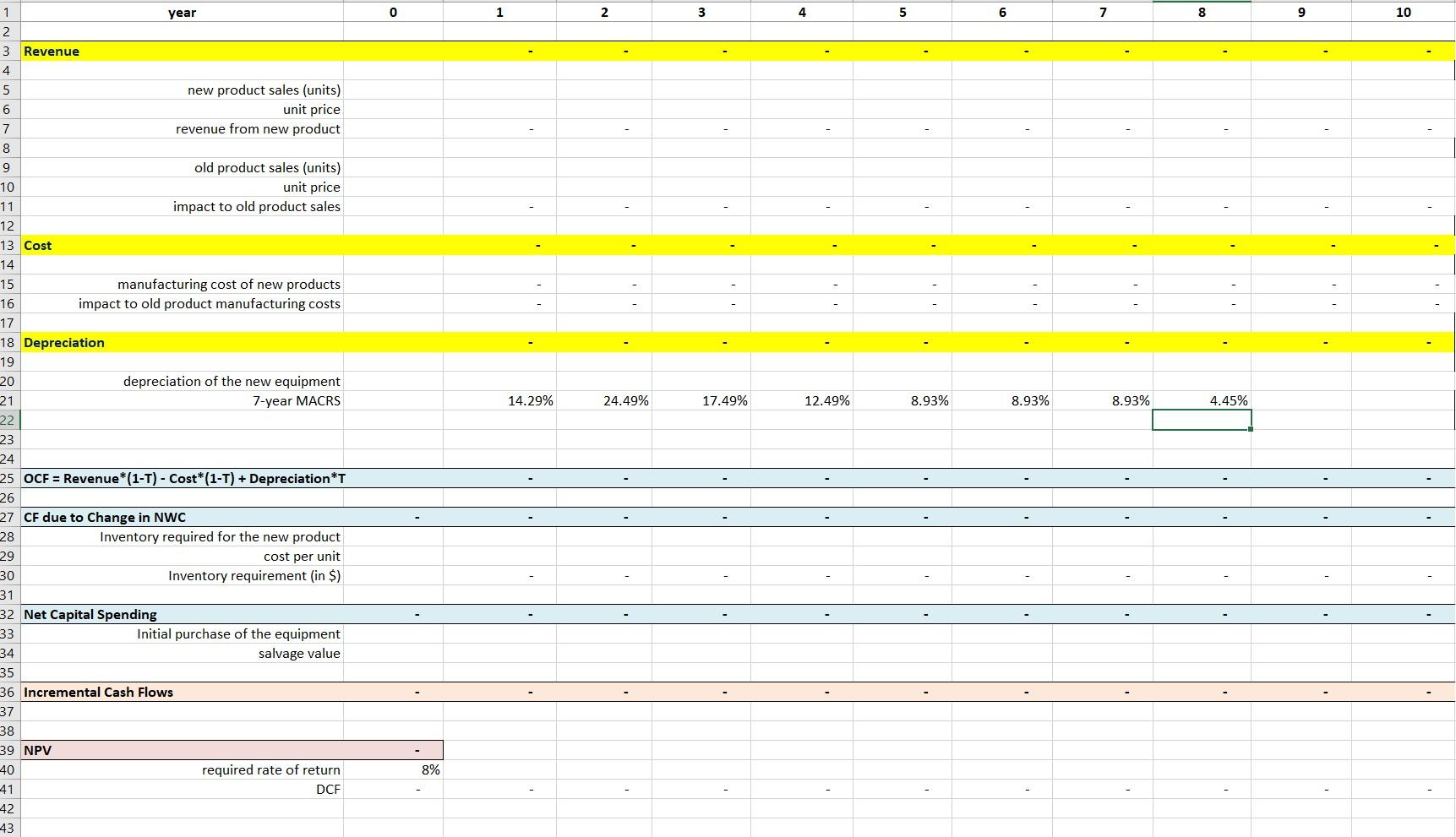

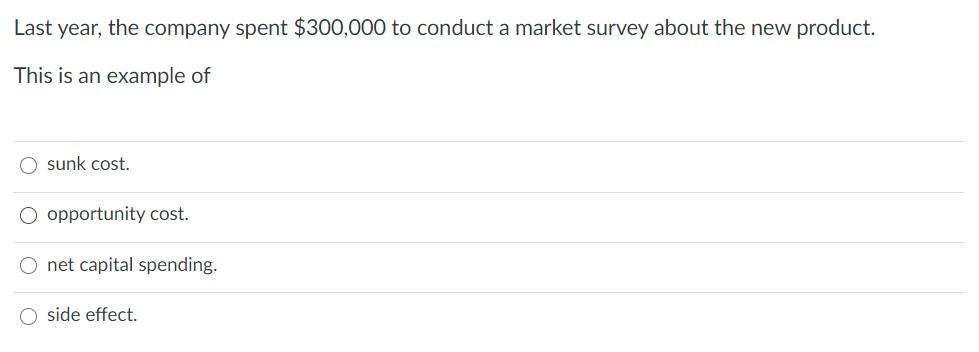

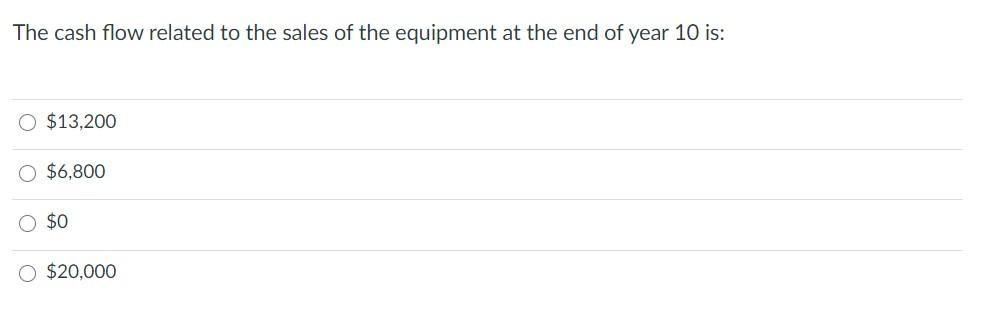

Project: New Product Launch Project life: 10 years Last year, the company spent $300,000 to conduct a market survey about the new product. The project requires a new equipment. The price of the equipment is $10M, and it belongs to the MACRS 7-year asset class. At the end of year 10, the company expects to sell the equipment for $20,000. The associated percentages for different depreciation classes are presented in the following table. New product sales: Once the new product is launched, the company expects to sell 20,000 units of the new product in the first year, and the annual sales is expected to grow at a rate of 5% per year afterwards. Price per unit of new product is $500. Existing product sales: Once the new product is launched, the sales of the existing product will go down by 3000 units a year. The price of the existing product is $1000. Manufacturing costs: Suppose the manufacturing cost is 40% of the price for both the new and the existing products. Inventory requirement: The company plans to keep 10,000 units of the new product in inventory for the first 5 years of the project, and 12,000 units for the remaining 5 years. The inventory requirement for the existing product is not affected by the project. The marginal tax rate of the company is 34%. The required rate of return of the project is 8%. Year 3-year class 5-year class 7-year class 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 3 14.81 19.20 17.49 4. 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.93 7 8.93 8 8 4.45 year 0 1 2 3 4 5 6 7 8 9 10 1 2 3 Revenue 4 . . - - - 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 5 new product sales (units) 6 unit price 7 revenue from new product 8 9 old product sales (units) 10 unit price 11 impact to old product sales 12 13 Cost 14 15 manufacturing cost of new products 16 impact to old product manufacturing costs 17 18 Depreciation 19 20 depreciation of the new equipment 21 7-year MACRS 22 23 24 25 OCF = Revenue*(1-T) - Cost*(1-T) + Depreciation *T 26 27 CF due to Change in NWC 28 Inventory required for the new product 29 cost per unit 30 Inventory requirement (in $) 31 32 Net Capital Spending 33 Initial purchase of the equipment 34 salvage value 35 36 Incremental Cash Flows 37 38 39 NPV 40 required rate of return 41 DCF 42 43 8% Last year, the company spent $300,000 to conduct a market survey about the new product. This is an example of Osunk cost. O opportunity cost. O net capital spending. side effect. The cash flow related to the sales of the equipment at the end of year 10 is: O $13,200 O $6,800 0 $0 $20,000 Project: New Product Launch Project life: 10 years Last year, the company spent $300,000 to conduct a market survey about the new product. The project requires a new equipment. The price of the equipment is $10M, and it belongs to the MACRS 7-year asset class. At the end of year 10, the company expects to sell the equipment for $20,000. The associated percentages for different depreciation classes are presented in the following table. New product sales: Once the new product is launched, the company expects to sell 20,000 units of the new product in the first year, and the annual sales is expected to grow at a rate of 5% per year afterwards. Price per unit of new product is $500. Existing product sales: Once the new product is launched, the sales of the existing product will go down by 3000 units a year. The price of the existing product is $1000. Manufacturing costs: Suppose the manufacturing cost is 40% of the price for both the new and the existing products. Inventory requirement: The company plans to keep 10,000 units of the new product in inventory for the first 5 years of the project, and 12,000 units for the remaining 5 years. The inventory requirement for the existing product is not affected by the project. The marginal tax rate of the company is 34%. The required rate of return of the project is 8%. Year 3-year class 5-year class 7-year class 1 33.33% 20.00% 14.29% 2 44.45 32.00 24.49 3 14.81 19.20 17.49 4. 7.41 11.52 12.49 5 11.52 8.93 6 5.76 8.93 7 8.93 8 8 4.45 year 0 1 2 3 4 5 6 7 8 9 10 1 2 3 Revenue 4 . . - - - 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 5 new product sales (units) 6 unit price 7 revenue from new product 8 9 old product sales (units) 10 unit price 11 impact to old product sales 12 13 Cost 14 15 manufacturing cost of new products 16 impact to old product manufacturing costs 17 18 Depreciation 19 20 depreciation of the new equipment 21 7-year MACRS 22 23 24 25 OCF = Revenue*(1-T) - Cost*(1-T) + Depreciation *T 26 27 CF due to Change in NWC 28 Inventory required for the new product 29 cost per unit 30 Inventory requirement (in $) 31 32 Net Capital Spending 33 Initial purchase of the equipment 34 salvage value 35 36 Incremental Cash Flows 37 38 39 NPV 40 required rate of return 41 DCF 42 43 8% Last year, the company spent $300,000 to conduct a market survey about the new product. This is an example of Osunk cost. O opportunity cost. O net capital spending. side effect. The cash flow related to the sales of the equipment at the end of year 10 is: O $13,200 O $6,800 0 $0 $20,000