Answered step by step

Verified Expert Solution

Question

1 Approved Answer

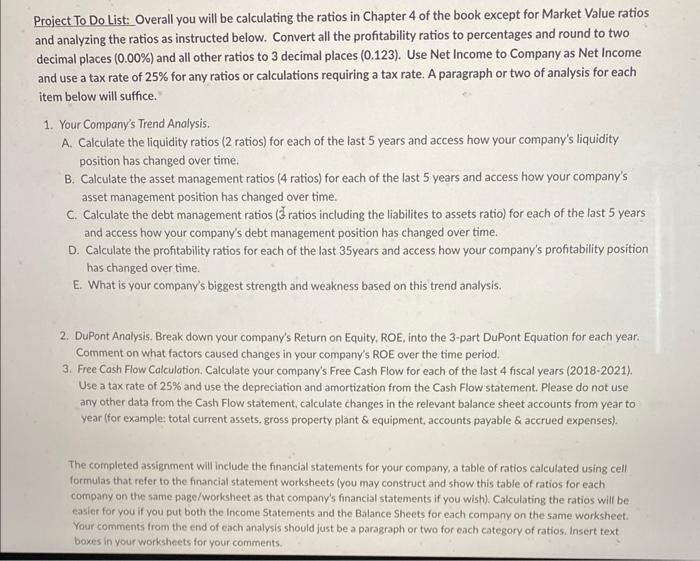

Project To Do List: Overall you will be calculating the ratios in Chapter 4 of the book except for Market Value ratios and analyzing

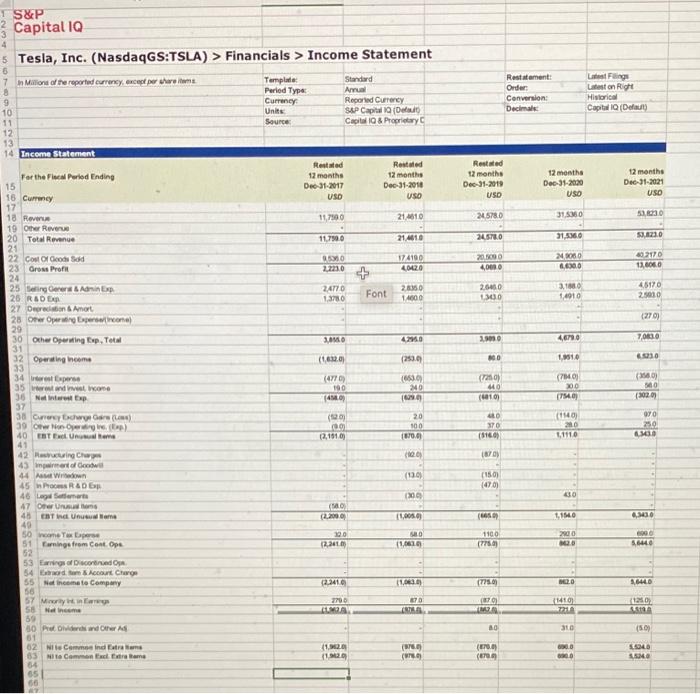

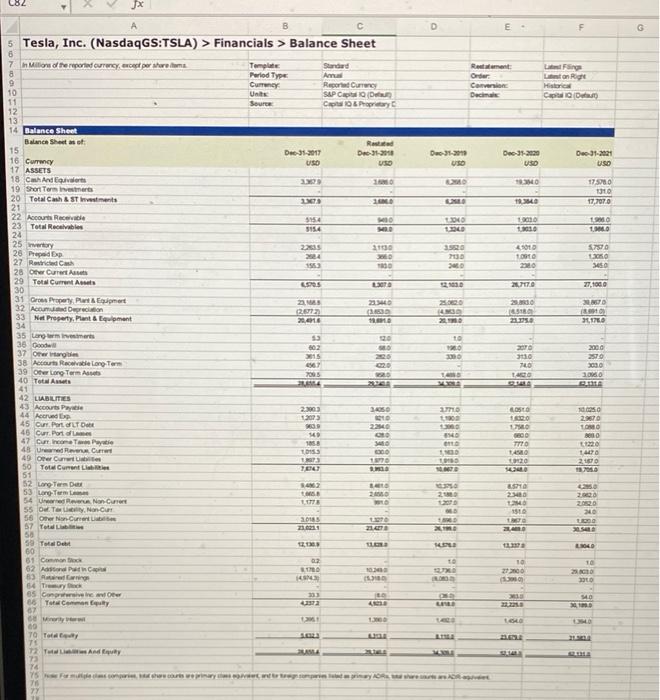

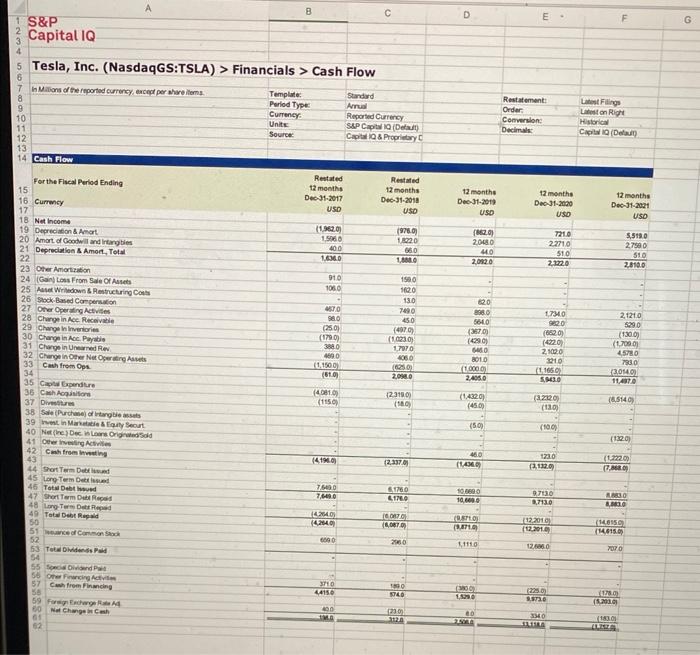

Project To Do List: Overall you will be calculating the ratios in Chapter 4 of the book except for Market Value ratios and analyzing the ratios as instructed below. Convert all the profitability ratios to percentages and round to two decimal places (0.00%) and all other ratios to 3 decimal places (0.123). Use Net Income to Company as Net Income and use a tax rate of 25% for any ratios or calculations requiring a tax rate. A paragraph or two of analysis for each item below will suffice. 1. Your Company's Trend Analysis. A. Calculate the liquidity ratios (2 ratios) for each of the last 5 years and access how your company's liquidity position has changed over time. B. Calculate the asset management ratios (4 ratios) for each of the last 5 years and access how your company's asset management position has changed over time. C. Calculate the debt management ratios (3 ratios including the liabilites to assets ratio) for each of the last 5 years and access how your company's debt management position has changed over time. D. Calculate the profitability ratios for each of the last 35years and access how your company's profitability position has changed over time. E. What is your company's biggest strength and weakness based on this trend analysis. 2. DuPont Analysis. Break down your company's Return on Equity, ROE, into the 3-part DuPont Equation for each year. Comment on what factors caused changes in your company's ROE over the time period. 3. Free Cash Flow Calculation. Calculate your company's Free Cash Flow for each of the last 4 fiscal years (2018-2021). Use a tax rate of 25% and use the depreciation and amortization from the Cash Flow statement. Please do not use any other data from the Cash Flow statement, calculate changes in the relevant balance sheet accounts from year to year (for example: total current assets, gross property plant & equipment, accounts payable & accrued expenses). The completed assignment will include the financial statements for your company, a table of ratios calculated using cell formulas that refer to the financial statement worksheets (you may construct and show this table of ratios for each company on the same page/worksheet as that company's financial statements if you wish). Calculating the ratios will be easier for you if you put both the Income Statements and the Balance Sheets for each company on the same worksheet. Your comments from the end of each analysis should just be a paragraph or two for each category of ratios. Insert text boxes in your worksheets for your comments.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started