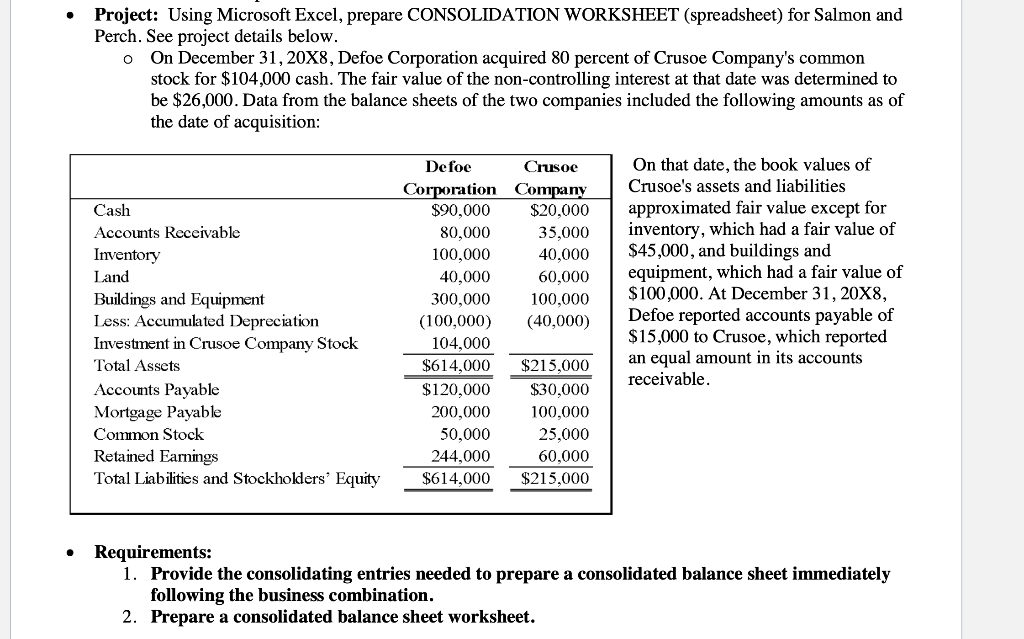

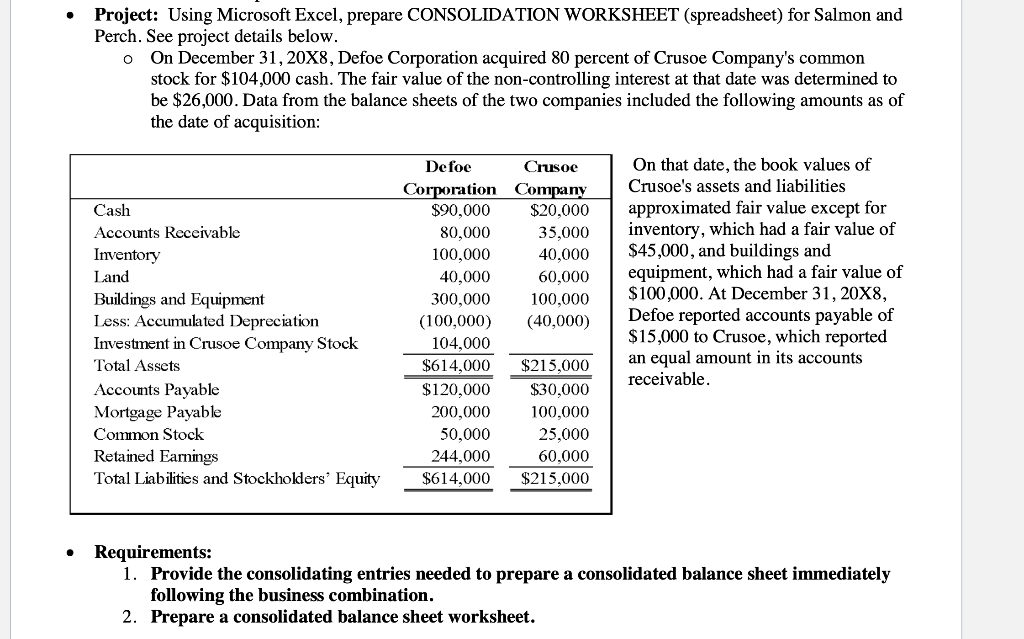

Project: Using Microsoft Excel, prepare CONSOLIDATION WORKSHEET (spreadsheet) for Salmon and Perch. See project details below. o On December 31,20X8, Defoe Corporation acquired 80 percent of Crusoe Company's common stock for $104,000 cash. The fair value of the non-controlling interest at that date was determined to be $26,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: On that date, the book values of Defoc Crusoe Crusoe's assets and liabilities Corporation Company $90,000 approximated fair value except for inventory, which had a fair value of $45,000, and buildings and equipment, which had a fair value of $100,000. At December 31,20X8, Defoe reported accounts payable of $15,000 to Crusoe, which reported an equal amount in its accounts receivable Cash $20,000 80,000 100,000 35,000 40,000 Accounts Receivable Inventory Land 40,000 60,000 Buildings and Equipment Less: Accumulated Depreciation Investment in Crusoe Company Stock 300,000 100,000 (100,000) (40,000) 104,000 Total Assets $614,000 $215,000 Accounts Payable Mortgage Payable $120,000 $30,000 200,000 100,000 Common Stock 50,000 25,000 Retained Eamings Total Liabilities and Stockholders' Equity 244,000 60,000 $614,000 $215,000 Requirements: 1. Provide the consolidating entries needed to prepare a consolidated balance sheet immediately following the business combination. 2. Prepare a consolidated balance sheet worksheet Project: Using Microsoft Excel, prepare CONSOLIDATION WORKSHEET (spreadsheet) for Salmon and Perch. See project details below. o On December 31,20X8, Defoe Corporation acquired 80 percent of Crusoe Company's common stock for $104,000 cash. The fair value of the non-controlling interest at that date was determined to be $26,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: On that date, the book values of Defoc Crusoe Crusoe's assets and liabilities Corporation Company $90,000 approximated fair value except for inventory, which had a fair value of $45,000, and buildings and equipment, which had a fair value of $100,000. At December 31,20X8, Defoe reported accounts payable of $15,000 to Crusoe, which reported an equal amount in its accounts receivable Cash $20,000 80,000 100,000 35,000 40,000 Accounts Receivable Inventory Land 40,000 60,000 Buildings and Equipment Less: Accumulated Depreciation Investment in Crusoe Company Stock 300,000 100,000 (100,000) (40,000) 104,000 Total Assets $614,000 $215,000 Accounts Payable Mortgage Payable $120,000 $30,000 200,000 100,000 Common Stock 50,000 25,000 Retained Eamings Total Liabilities and Stockholders' Equity 244,000 60,000 $614,000 $215,000 Requirements: 1. Provide the consolidating entries needed to prepare a consolidated balance sheet immediately following the business combination. 2. Prepare a consolidated balance sheet worksheet