Answered step by step

Verified Expert Solution

Question

1 Approved Answer

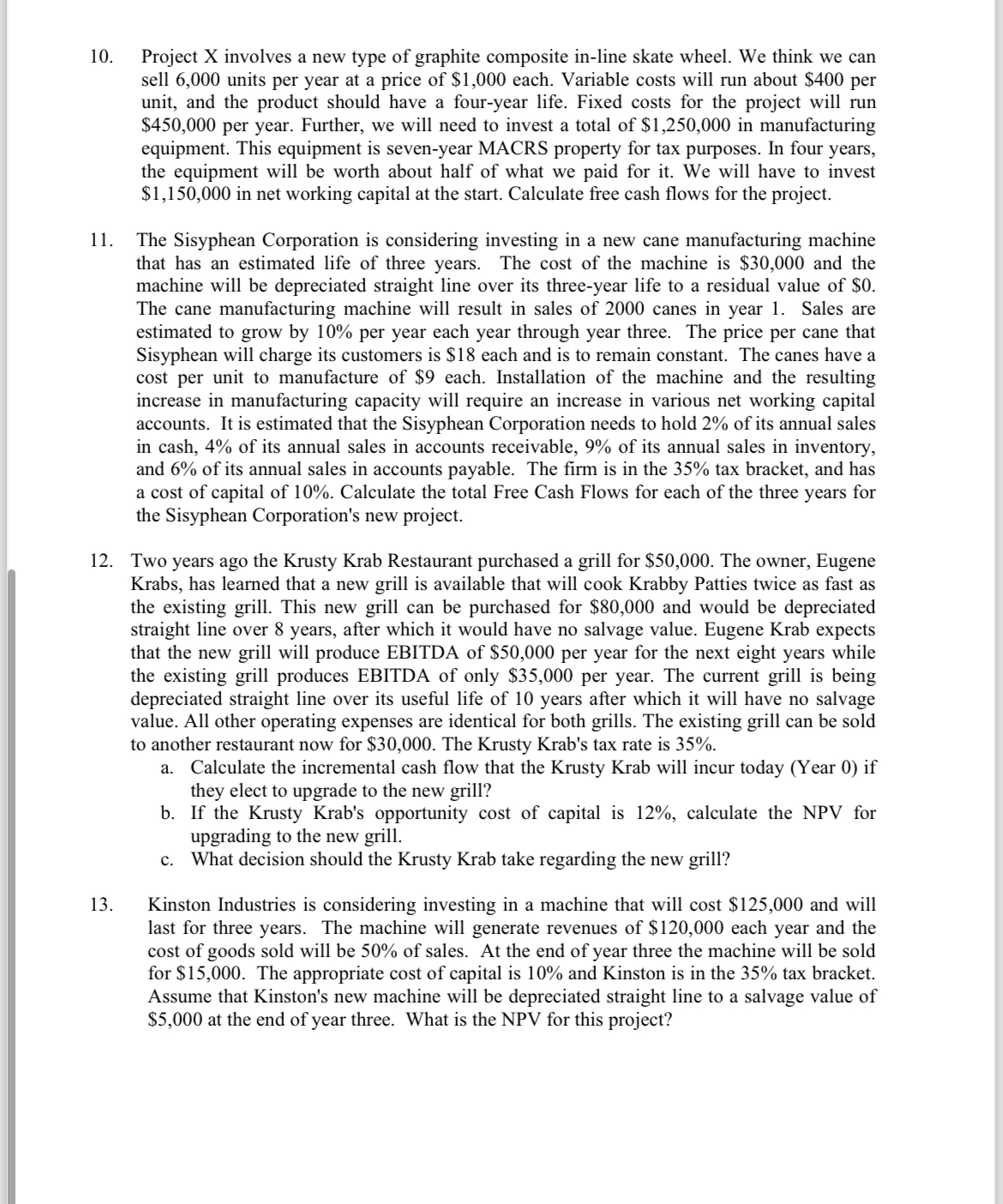

Project X involves a new type of graphite composite in - line skate wheel. We think we can sell 6 , 0 0 0 units

Project X involves a new type of graphite composite inline skate wheel. We think we can

sell units per year at a price of $ each. Variable costs will run about $ per

unit, and the product should have a fouryear life. Fixed costs for the project will run

$ per year. Further, we will need to invest a total of $ in manufacturing

equipment. This equipment is sevenyear MACRS property for tax purposes. In four years,

the equipment will be worth about half of what we paid for it We will have to invest

$ in net working capital at the start. Calculate free cash flows for the project.

The Sisyphean Corporation is considering investing in a new cane manufacturing machine

that has an estimated life of three years. The cost of the machine is $ and the

machine will be depreciated straight line over its threeyear life to a residual value of $

The cane manufacturing machine will result in sales of canes in year Sales are

estimated to grow by per year each year through year three. The price per cane that

Sisyphean will charge its customers is $ each and is to remain constant. The canes have a

cost per unit to manufacture of $ each. Installation of the machine and the resulting

increase in manufacturing capacity will require an increase in various net working capital

accounts. It is estimated that the Sisyphean Corporation needs to hold of its annual sales

in cash, of its annual sales in accounts receivable, of its annual sales in inventory,

and of its annual sales in accounts payable. The firm is in the tax bracket, and has

a cost of capital of Calculate the total Free Cash Flows for each of the three years for

the Sisyphean Corporation's new project.

Two years ago the Krusty Krab Restaurant purchased a grill for $ The owner, Eugene

Krabs, has learned that a new grill is available that will cook Krabby Patties twice as fast as

the existing grill. This new grill can be purchased for $ and would be depreciated

straight line over years, after which it would have no salvage value. Eugene Krab expects

that the new grill will produce EBITDA of $ per year for the next eight years while

the existing grill produces EBITDA of only $ per year. The current grill is being

depreciated straight line over its useful life of years after which it will have no salvage

value. All other operating expenses are identical for both grills. The existing grill can be sold

to another restaurant now for $ The Krusty Krab's tax rate is

a Calculate the incremental cash flow that the Krusty Krab will incur today Year if

they elect to upgrade to the new grill?

b If the Krusty Krab's opportunity cost of capital is calculate the NPV for

upgrading to the new grill.

c What decision should the Krusty Krab take regarding the new grill?

Kinston Industries is considering investing in a machine that will cost $ and will

last for three years. The machine will generate revenues of $ each year and the

cost of goods sold will be of sales. At the end of year three the machine will be sold

for $ The appropriate cost of capital is and Kinston is in the tax bracket.

Assume that Kinston's new machine will be depreciated straight line to a salvage value of

$ at the end of year three. What is the NPV for this project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started